Market deep-dive: Spain as an emerging hub of app marketing

Since the 2008 economic crisis, Spain’s gradual recovery has helped fuel a rebirth of Spain’s hi-tech scene. The country is building its reputation as fertile ground for startups.

Both VC investment and the availability of government funds have risen sharply in recent years.

Barcelona and Madrid are leading other Spanish cities as tech hubs, but the entrepreneurial ecosystem is expanding to include Valencia, Basque Country and Andalucia.

Spain as a Tech Hub

According to Pagan Research, in 2017, Spain’s tech startups investment grew by 45%. Venture capital investments exploded from about €150M in 2013 to almost €800M in 2017, marking an all time high in both investment amounts and number of deals.

A number of notable Spanish tech startups include Letgo, Ticketbis, Privalia, Social Point, and Cabify.

- Letgo, an AppsFlyer customer, is a free, person-to-person mobile classifieds app named among the “Hottest Startups” by Wired and “Best Apps” by Google. It has raised $475M to date.

- Ticketbis, an online platform for buying and selling tickets to events, was acquired by eBay for €160M.

- Privalia, an online e-commerce platform for top fashion brands, was sold for €500M.

- Social Point, one of the top global developers of social games, was acquired by Take-Two Interactive for more than $250M.

- Cabify, a mobile app startup that has raised $407M, offers a car service with personal vehicles driven by their owners.

And of course there’s Telefonica, Spain’s largest telecommunications and broadband operator and the 7th largest telecom multinational in the world. Telefonica recorded revenues of 52 billion euros in 2017.

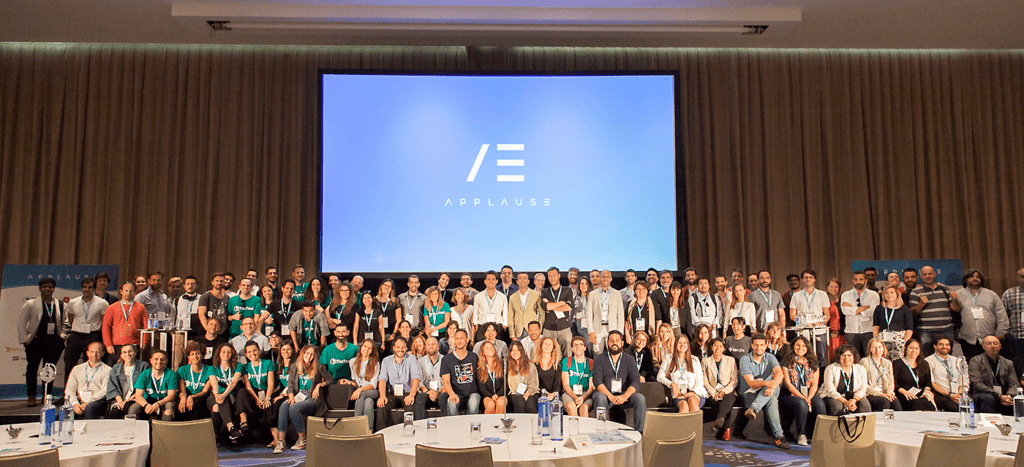

As a sign of Barcelona’s status as Spain’s leading tech hub, the city hosts the only conference for app marketing & mobile growth professionals in Spain. Applause welcomed almost 300 app marketers to Barcelona in the beginning of June. The event, organized by TheTool, PickASO and AppsFlyer, celebrated its third and most successful year to date.

Topics discussed included app store optimization, user acquisition (UA), engagement / retention, and mobile analytics.

According to a Mobile World Capital Report, in terms of “the most attractive city for founders” Barcelona is on the 3rd place behind Dublin and Berlin.

Another sign of Barcelona’s attractiveness is the increasing presence of top international app publishers such as Ubisoft, King, Booking.com and the Norwegian marketplace powerhouse Schibsted who opened offices in the city in the last few years (in Schibsted’s case, one of their biggest hubs worldwide).

During 2016, Spanish private equity and venture capital firms raised €2.3bn in new funds, 49 per cent more than in 2015; they raised another €1.3bn over the first nine months of 2017. There were 449 venture capital investments in start-ups during the first nine months of 2017, up from 361 deals over the same period in 2016.

Mobile is by far the leading sector in terms of share of capital investments, with 49% of all investments in 2017.

Spanish market insights

In our analysis of the market, we compared data from Q1 2017 and Q1 2018. This included more than 100 million non-organic installs of 1,100 apps. Overall, we measured $80 million worth of in-app purchases.

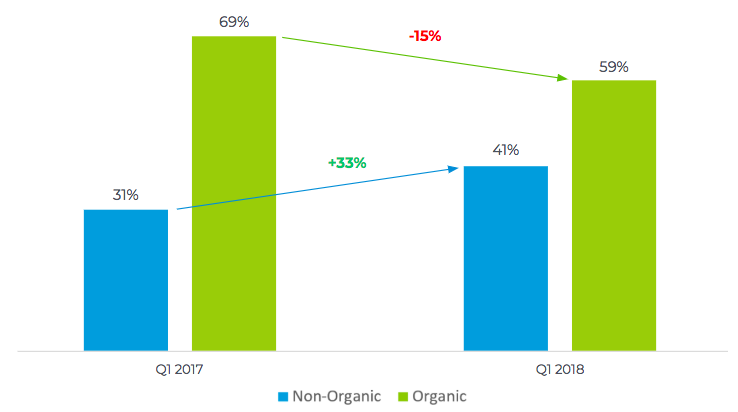

Install trends: The rise of non-organic

Like in the rest of the world, Spanish app marketers are also experiencing the challenge of organic app discovery. The two main reasons are an ever increasing number of apps in the major app stores (over 2 million each in the App Store and Google Play) and fierce competition. As a result, apps increased their investment in marketing to drive new users.

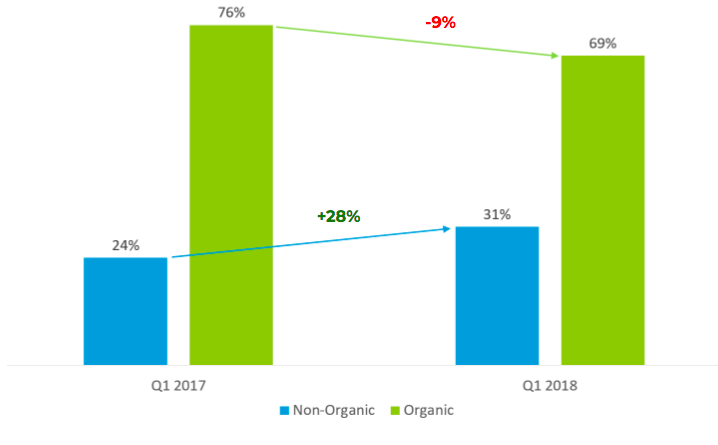

The numbers in Spain clearly illustrate this: from Q1 2017 to Q1 2018, there was a 33% increase in the share of non-organic installs in contrast with a 15% decrease in the share of installs from organic traffic.

Year-over-Year Change in the Share of the App Install Pie (Spain)

In Spain, the ratio of non-organic to organic is 40/60, which is considerably higher than in the rest of Western Europe — Germany, UK, France, Italy, Ireland, Switzerland, Denmark, Sweden, Portugal, and the Netherlands.

Western Europe: Lower Share of Non-Organic Installs

Retention

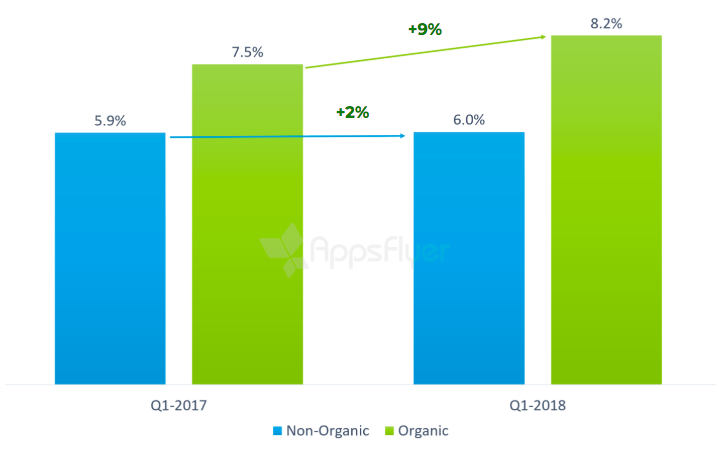

Retention numbers for Spain paint a bleak picture of app loyalty in the market with only 6-8% of users opening the apps they downloaded after 30 days. But this is common across the globe as engagement, or rather a lack of, is a significant pain for apps.

We can see that non-organic retention is stagnate with only a 2% increase from 2017 to 2018. It appears marketers, overall, can do better as far as retention-driven optimization is concerned. For example, by using retention and cohort reports, in addition to more aggressive re-engagement activities like paid retargeting, push and email. We can see that there is potential with an organic uptick.

Day 30 Retention Rate

Media cost

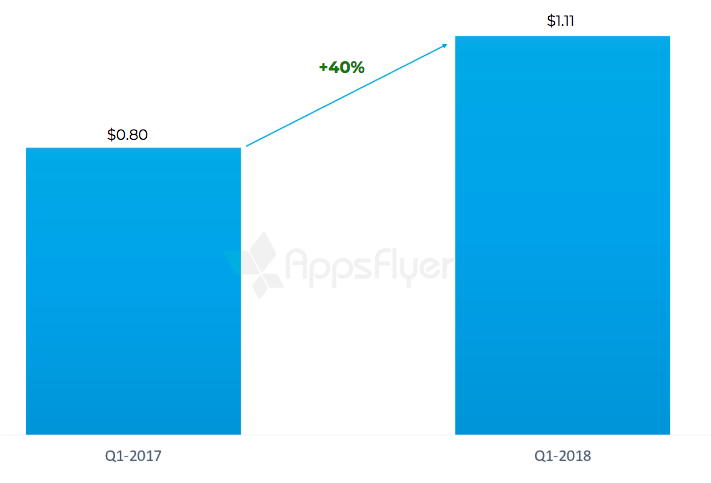

The Cost Per Install in Spain increased from $0.80 in Q1 2017 to $1.11 in Q1 2018, a significant 40% jump. But this cost is still significantly cheaper than other Western European countries like Germany and the UK, which could explain why the share of non-organic traffic in the app install pie in Spain is so high.

With rising cost, apps need to drive more revenue to remain profitable, which means smarter media buying and a focus on granular measurement of revenue events and other monetization streams for proper optimization.

CPI Trend (USD)

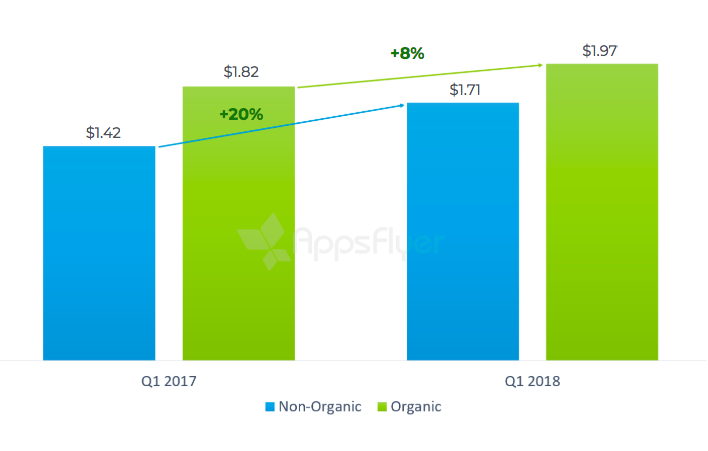

LTV

Indeed, we can see that Spanish marketers focused on revenue optimization, which grew 2.5x From Q1 2017 to Q1 2018. During this time, there was a 20% increase in the 90-day LTV of non-organic installs by Spanish users as compared to only an 8% increase for organic installs.

This translates into increased confidence among marketers as a result of their effective use of data for growth marketing.

Day 90 LTV

To demonstrate the innovation coming out of Spain, we recently published two case studies with leading companies: Telefonica and eCooltra.

Case studies

Telefonica

With $52B in revenues in 2017, Telefonica is Spain’s largest telecommunications and broadband operator. Their mobile app brands include Vibo in Brazil, O2 in Germany and UK and MoviStar in most Spanish speaking countries.

Their goal was to grow their app brands fast using growth marketing. To do this, they needed a clear picture of where users were coming from and what they were doing once they launched the app. In the past, one difficult challenge for them was to integrate additional SDKs anytime they needed to test a new media source. This impacted their product roadmap and app performance.

Telefonica is a company completely driven by data with a wealth of information sources. One common complaint they had was that sometimes data from one side was not the same as the other side and they spent a lot of effort syncing data.

As they decided to expand into more countries, it was critical for Telefonica to have complete control of what was going on with their apps.

When they decided to go with AppsFlyer for their growth marketing, they realized that with just one SDK, they could execute campaigns easily with any partner in the world. In addition to Facebook and Google, Telefonica is integrated dozens of other media partners around the globe.

AppsFlyer gave them one place to check all of their marketing efforts, optimize and glean valuable unbiased, accurate insights. With AppsFlyer, they measure the entire customer journey and optimize campaigns not based only on an install but also on generating active users. They also record their owned media activities such as short messaging, emailing and push notifications.

Read the full customer success story here

eCooltra

eCooltra, a leading scooter sharing platform, was well positioned for expansion beyond their launch cities in Spain, Portugal and Italy. As a seasonal business with aggressive growth targets, they needed an agile and accurate way to identify and optimize every available growth partner and strategy.

Recognizing the importance of growth data and user experience optimization, eCooltra selected AppsFlyer as their mobile measurement partner.

ECooltra’s plan was multi-faceted: Paid media optimization, data and reporting flexibility, Audiences, postbacks and targeting optimization, and eliminating user experience friction.

In just their first year of focusing on mobile app growth, eCooltra’s growth rate jumped by 5X. By emphasizing user quality and delivering a seamless customer journey, eCooltra’s improved their first-ride rate by 60% and doubled user loyalty.

Read the full customer success story here

Final note

As the numbers show, Spain is currently demonstrating steady and significant growth in its high-tech sector and specifically in mobile apps. Historically overlooked in this sector, Spain is now one of the most attractive tech ecosystems in Europe. In the past, Spain experienced a “brain drain,” with a lack of investment and job opportunities at home.

Today, smart, ambitious and well-educated Spaniards are staying at home, and are joined by a growing number of foreign talents who are attracted by the various opportunities and quality of life Spain’s cities have to offer.