The Travel App Playbook is Changing. Here’s What the Data Shows

Travel app marketing in 2025 looks very different from the days when user acquisition dominated strategy. Those days are officially over.

New data from AppsFlyer, analyzing 293 travel apps across Europe and the US, reveals a fundamental shift in how the smartest travel marketers are approaching growth in 2025. And honestly, it’s about time.

The headline? Retargeting now drives more than 75% of all conversions in travel apps. Let that sink in for a moment. A significant proportion is coming from users who already have your app installed, not from shiny new downloads.

The gradual shift away from UA-first marketing

For years, travel app marketing heavily emphasized user acquisition. Better install numbers carried significant weight. CPIs were closely watched metrics. Marketing teams often measured success primarily by how many new users they could bring into their apps each month.

But the industry has been gradually shifting away from this approach, and the 2025 data shows just how far this evolution has progressed.

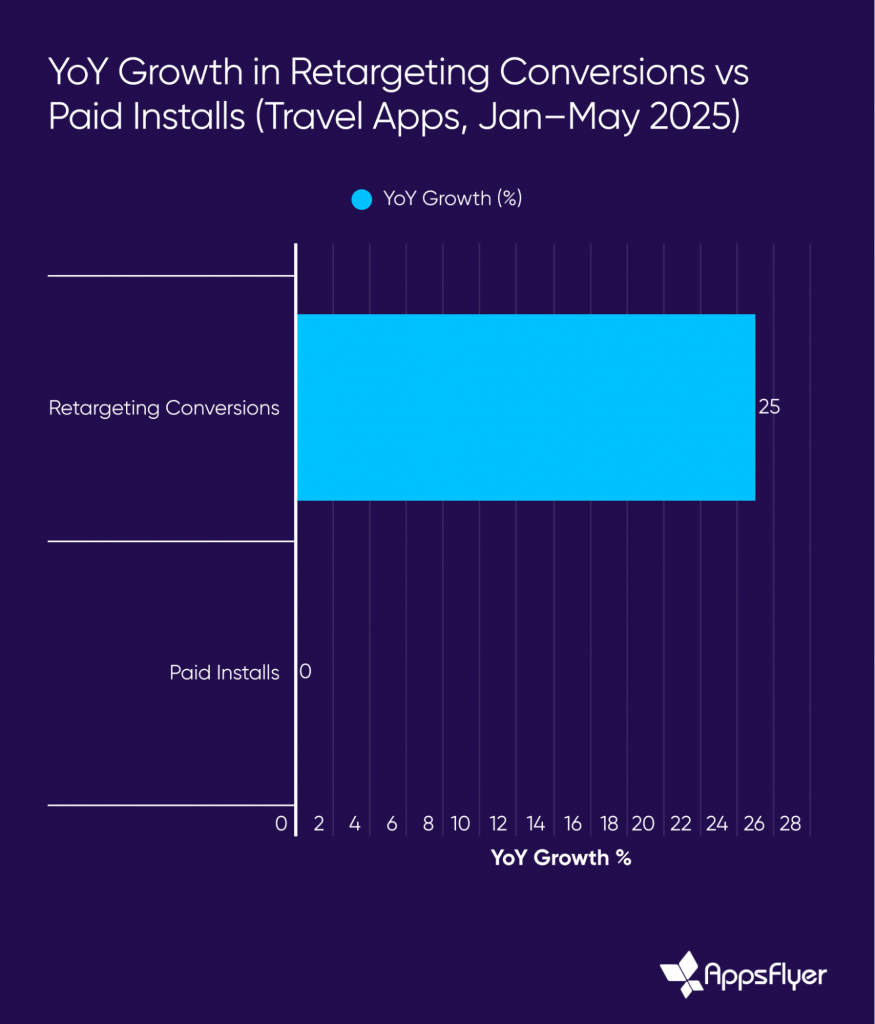

Paid user acquisition across major European markets showed zero growth from January to May 2025 compared to the previous year.

Meanwhile, just 20% of the largest travel companies are capturing more than 80% of all installs. Translation: if you’re not Booking.com, Airbnb, or one of the other giants, competing purely on volume is a losing game.

The winners are playing a different game

So what are successful travel apps doing differently? They’re focusing on the users they already have.

Between January and May 2025, remarketing volumes grew by 20 to 30% year over year for most apps in the dataset. That’s not a small uptick, it’s a fundamental strategic shift that we have seen progressing over the last three years.

And it’s working. Apps that doubled down on lifecycle marketing and AI-powered personalization saw measurable results with purchases per paying user jumping from 1.89 to 2.13 (a 13% boost).

Those might not look like incremental gains, but in an industry where market share is increasingly consolidated, and where numbers were down until this year, even small improvements in retention and monetization translate to serious revenue.

AI Is finally earning its keep

Here’s where things get interesting. AI isn’t transforming travel apps through flashy integrations or virtual assistants. It’s winning through the practical, often invisible improvements that matter most to users.

Think smarter search filters that actually understand what you’re looking for. Booking flows that are fast and intuitive. Real-time language translation that works. Personalized recommendations that feel timely and relevant.

Booking.com’s Smart Filtering and conversational property Q&A features are helping users find what they need faster, with fewer abandoned searches. Trip.com’s TripGenie offers real-time menu translations in 12 languages. These aren’t revolutionary features, they’re just really good at solving real problems and removing friction from the user journey.

Seasonality still matters (but not how you think it should)

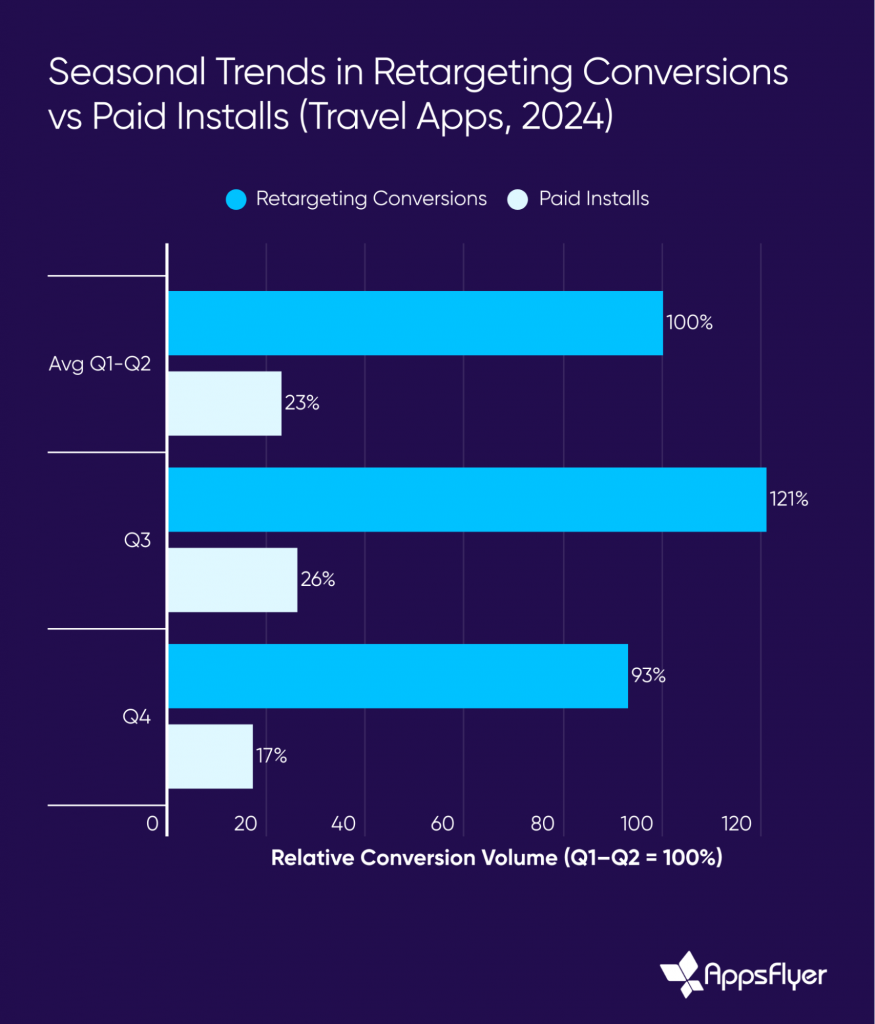

Travel apps still see predictable spikes in July, August, and January that align with peak planning periods. But the data shows that most seasonal growth comes from organic installs, not paid campaigns.

Paid UA only increased by 10 to 15% during Q3, while organic installs surged even higher. Paid acquisition stays relatively steady throughout the year, while organic traffic drives the sharpest seasonal peaks.

Europe Is leading the charge

When we break down the data by region, Western Europe shows 5% year-over-year growth in first-time installs across the UK, France, Germany, Spain, Italy, and the Netherlands. This positions travel as one of the strongest-performing mobile verticals in Europe, with most other app categories like ecommerce and gaming recording flat or near-zero growth.

European markets also demonstrated the clearest shift toward retargeting:

- Flat or declining paid UA volumes

- Double-digit growth in re-engagement conversions

The US market tells a different story. While it remains large and important, the data shows more mixed results, with nearly half of top apps seeing stagnation or decline in their retargeting efforts.

What this means for your strategy

If you’re a travel marketer reading this, the implications are clear:

Stop obsessing over install volume. You still need new users, but the apps that are winning are the ones that can turn their existing users into repeat customers.

AI should solve real problems, not create buzz. The travel apps seeing results from AI aren’t the ones with the most sophisticated tools, they’re the ones using it to eliminate actual pain points.

Treat remarketing like a core strategy, not a nice-to-have. When 75% of your conversions are coming from re-engaged users, lifecycle marketing isn’t optional — it’s essential.

The bottom line

The travel app marketing playbook of 2025 looks fundamentally different from what came before. It’s less about shouting louder and more about building deeper relationships. Less about acquiring at all costs and more about creating value that lasts.

For travel marketers, the path forward is clear, focus on depth, not just scale.