Winning Ramadan 2026: A Data-Backed Playbook for Gulf Decision Makers

TL;DR

- Remarketing beats acquisition during the holy month. Reactivating warm users delivers higher ROI, especially around Iftar, Suhoor, and late-night moments.

- Start earlier than the market. The highest LTV users are acquired before Ramadan. Early February is critical for building intent and future value.

- Plan by phase, not by hype. Early Ramadan builds intent, mid-month reinforces habits, Eid converts, post-Ramadan is about stabilizing.

- Protect retention after Eid. Expect sharp drop-offs. Focus on loyalty mechanics and delayed rewards instead of scaling low-quality acquisition.

- Use Ramadan as a stress test for the rest of the year. AI-driven discovery and better measurement matter beyond the season. Brands win by understanding, not reacting.

Why Ramadan belongs on every brand calendar

For millions, Ramadan is a sacred pillar of the Islamic calendar. It’s a time of spiritual reflection, prayer, and community. As daily rhythms slow and shift, media habits change too. Mobile becomes a quiet companion, a way to connect with loved ones, find inspiration, or unwind after prayer.

For brands, relevance during Ramadan comes from understanding these moments and showing up in a way that fits the pace, emotions, and intent of the season.

Ramadan 2026 is expected to begin on the evening of February 17 and conclude around March 19, ending with Eid al-Fitr. It is a period when spending, gifting, and travel peak across the region.

To understand how brands can win this moment, we analyzed data from 370 apps across the United Arab Emirates, Saudi Arabia, and Qatar, each with at least 3,000 installs, spanning February 17 to April 13, 2025. We looked at Ramadan and the two weeks before and after to see how user behavior builds, peaks, and normalizes. In this post, we cover:

- How Ramadan reshapes mobile engagement across the Gulf

- What 2025 data tells us about timing and value across key verticals

- How broader digital and AI-driven shifts extend beyond the season

Ramadan shifts mobile momentum across the Gulf

This holiday is a major growth window for brands, with mobile usage, engagement, and purchase activity surging. In 2026, Ramadan will overlap with Spring Break in several Gulf markets, bringing together two high-intent periods and raising the stakes for brands to get both timing and relevance right.

eCommerce activity rises as people prepare for iftars, gatherings, and Eid gifting. Finance apps, especially digital payments and buy now, pay later (BNPL), move to the foreground as consumers manage higher spending and short-term credit. In Saudi Arabia alone, the Saudi Central Bank reported USD 4.6 billion in consumer spending in the week before Ramadan 2025, driven mainly by food and retail. That’s more than a third higher than the previous week.

Travel also plays a role. Some people travel for leisure, others return home to be with family. Apps that support flight bookings, accommodation, and ground transportation often see increased demand.

For marketers, Ramadan should be a core pillar of 2026 planning. Strong creative and media strategies during this Q1 surge can drive short-term results and, just as importantly, set up long-term growth.

Pre-Ramadan planning and remarketing: where LTV is built

The season shapes marketing performance across the Gulf, but the real opportunity starts earlier. In the weeks leading up to Ramadan, people begin browsing and planning ahead.

eCommerce apps attract first-time shoppers, travel apps capture early intent, and finance and payment apps see increased demand as spending patterns shift. While a major influx of users arrives when the holy month begins on February 17, 2026, our data shows that customers acquired in the two weeks before Ramadan often deliver higher lifetime value (LTV).

During Ramadan itself, remarketing becomes the main growth driver, boosting both volume and LTV. In 2025, remarketing conversions rose across the Gulf, with more mature markets like Saudi Arabia and the UAE delivering higher and more stable conversions than in the pre-Ramadan period.

eCommerce reactivations peaked early. Finance apps built momentum toward Eid, and travel apps activated later in the month. Different rhythms, same outcome: more efficient conversion.

During Ramadan, relevance, smart timing, and contextual moments like Iftar or Suhoor often outperformed aggressive acquisition.

Vertical deep dives: What 2025 data reveals

We’ve already covered the big-picture trends leading into Ramadan. Now it’s time to look at what actually happened in 2025.

We’re zooming in on three key app verticals. eCommerce, finance, and travel, across the UAE, Saudi Arabia, and Qatar. We’ll examine acquisition, engagement, and revenue, giving brands in the region a head start on winning Ramadan 2026.

1. eCommerce

Ramadan is a key eCommerce moment in the Gulf, but a single seasonal spike hides very different demand curves. All markets grow. What changes is when value is created and how long it lasts. One thing stays consistent. As Eid approaches, attention shifts away from screens, and while eCommerce continues, the window to influence performance closes quickly.

Why early acquisition still wins in 2026

In the UAE, eCommerce momentum ahead of and during the holy month is driven by paid media. Brands invest early to stay visible while shoppers browse, compare, and shortlist. This is when demand is shaped.

Once Eid starts, the dynamic shifts. Paid and remarketing impact declines, while organic installs rise. That post-Ramadan organic lift is the delayed payoff of early-funnel investment. It reflects users influenced by pre-Ramadan ads who waited for gifted cash or new devices to install.

Saudi Arabia shows a similar pattern, but with a shorter payoff window. Paid and remarketing peak early in Ramadan, while organic installs surge immediately after, nearly doubling before stabilizing.

Meanwhile, organic installs dominate throughout the season in Qatar, reaching roughly 96% after Eid. Here, remarketing builds gradually. Many shoppers wait for post-Eid offers, making Ramadan spend more selective and performance-driven.

As commerce becomes more omnichannel, brands that connect app, web, retail, and offline touchpoints early are better positioned to capture intent efficiently.

First week sets the revenue ceiling

Across the Gulf, eCommerce demand peaks fast. The first week of Ramadan concentrates the highest share of sessions and revenue, making it the moment when intent turns into decisions.

In the UAE, engagement extends beyond the initial surge. After week one, sessions and IAP revenue remain relatively stable throughout the holy month. This points to repeat visits and incremental purchases over time, rather than one-off buying. For 2026, the opportunity is not to save big launches for Eid, but to monetize early and mid-Ramadan, then use Eid to complete journeys, bundle products, or drive upsell.

Saudi Arabia is more compressed. Most value is captured upfront, with consumers acting decisively in the opening days. Here, sales pressure and promotional visibility need to peak early, not ramp gradually.

Qatar sits in between. Week one should anchor monetization, while the following four to six weeks offer room for retention and repeat purchases, especially as shoppers wait for post-Eid incentives.

Your most valuable customers are won before Ramadan

The highest-value eCommerce customers across the Gulf are acquired before Ramadan begins. Shoppers acquired in the weeks leading up to the holiday consistently deliver higher repeat purchase rates and higher LTV than those who join during or after the season.

In the UAE and Saudi Arabia, pre-Ramadan users deliver around 20% higher retention across Day 7, 14, and 30. Ramadan campaigns do generate volume and day-one spikes, but much of that traffic is highly transactional and short-lived, with limited impact on repeat orders or sustained revenue.

Qatar shows the same dynamic. Ramadan generates strong initial engagement, but shoppers acquired beforehand are the ones who return, spend again, and stay active in the weeks that follow.

For 2026, treat Ramadan as a capitalization phase, not a starting point. The two weeks before the holiday are where high-quality demand is shaped and long-term growth is secured.

2. Finance

During Ramadan, finance apps are used for specific tasks like payments, transfers, and top-ups. Demand is purposeful and time-bound. Unlike eCommerce, Eid does not disrupt this behavior. While social focus increases, financial needs continue, making Eid a continuation phase where remarketing and trust-led actions outperform acquisition-heavy pushes.

Growth during Ramadan is driven by market maturity

Ramadan rarely creates new financial needs. It speeds up decisions people are already ready to make. What separates winning finance apps from the rest is readiness.

In more mature markets, intent is activated quickly through paid acquisition and remarketing. In less mature ones, growth leans on organic discovery and habit formation. Ramadan rewards teams that know which lever to pull, and when.

In the UAE, finance app growth during the holy month is deliberate and driven primarily by paid acquisition. In 2025, organic installs briefly exceed 20% around Eid before normalizing. The real driver is timing. Remarketing performs especially well because audiences are already primed to act.

Saudi Arabia shows a slower build. Paid remains the main lever, but demand accumulates gradually. When trust, relevance, and timing align, users return.Qatar sits earlier in its maturity curve. Most growth comes organically, signaling that habits and long-term trust are still forming.

Financial activity peaks early and is purpose-driven

Across the Gulf, sessions and revenue rise sharply at the start of the month.

In the UAE, activity rises fast and remains elevated through Ramadan and Eid. Revenue follows the same pattern, peaking early and remaining strong until the holiday ends. The post-Ramadan decline is not fatigue, it’s the removal of a context that reinforces trust and financial discipline.

Saudi Arabia shows the strongest continuity. Engagement and revenue ramp up quickly and stay above pre-Ramadan levels, even during Eid. Qatar shows a more concentrated cycle. Activity tapers after week one but stays above baseline. The revenue opportunity is smaller, making early execution critical.

For finance apps, week one is where intent crystallizes. Eid is a continuation phase where remarketing and completion-focused journeys outperform acquisition-led pushes.

Lifetime value powered by pre-Ramadan period

As with eCommerce, the most valuable finance app customers are not won during Ramadan, but before it. Across the three markets, users acquired in the two weeks prior to the holiday show materially higher retention and LTV.

In the UAE, pre-Ramadan users show significantly higher D3, D7, and D14 retention. Ramadan installs may spike day-one activity, but they skew transactional and short-lived. For LTV, early acquisition clearly wins.

Saudi Arabia shows the same pattern. While standout creatives during early Ramadan can drive strong day-one retention, the most durable users are still those acquired before the holiday begins. Qatar reinforces this further. The best retention rates come from users acquired in the week immediately before Ramadan.

In 2026, finance leaders should treat Ramadan less as a growth sprint and more as a conversion and activation phase. The real investment window is ahead of the season. That is where LTV is built, audiences are primed, and Ramadan demand can be efficiently captured rather than chased.

3. Travel

Travel apps in the Gulf behave differently from eCommerce and finance apps during Ramadan. It is not about impulsive acquisition or early monetization, but about intent formation, planning, and reactivation, with revenue peaking later as Eid becomes the main conversion trigger. Organic installs dominate, and growth comes less from new discovery and more from re-engaging existing users at the moments when they are ready to act.

Organic-led acquisition and reactivation at scale

As working hours shorten and evenings stretch, organic installs rise. Users have more time to browse destinations, compare prices, and revisit travel plans. Eid creates a second uplift, once family commitments ease and attention shifts toward travel, commuting, and short breaks.

Remarketing is what drives scale throughout Ramadan and Eid. Travel intent exists well ahead of the holiday, but it is often passive. Ramadan activates that intent by changing daily routines. The weeks before Ramadan are best for awareness and consideration. Ramadan itself is when reactivation and booking-focused journeys perform strongest.

Market behavior reinforces this. In the UAE, conversions rise as soon as Ramadan begins, then build toward Eid. In Saudi Arabia, reactivations nearly double around Eid, when plans turn into transactions. In Qatar, remarketing conversions grow gradually and peak around Eid, as travel plans and budgets are finalized. Across all three, existing users drive the majority of value.

For travel brands planning ahead to 2026, the opportunity is less about acquisition spikes and more about conversion timing. Organic demand signals intent, remarketing is how that intent becomes revenue.

Ramadan builds intent. Eid unlocks transactions

Travel follows a consistent seasonal rhythm across the Gulf, but winning during this period requires restraint, not pressure. Ramadan is a period of research, comparison, and soft planning. Eid is when decisions finally convert into bookings and revenue.

The weakest point remains the two weeks before Ramadan, when intent pauses and demand softens. Once Ramadan starts, momentum builds.

In the UAE, engagement and revenue rise in week one, dip slightly mid-month, then climb again toward Eid. Saudi Arabia shows the sharpest Eid-driven spike, with transaction intensity outpacing session growth. Qatar follows the same structure with smoother fluctuations, sustaining engagement through Ramadan before peaking at Eid.

This year, do not force conversions early. Use Ramadan to nurture intent through content, price alerts, and flexible offers. Shift budget and messaging toward remarketing as Eid approaches. The brands that win are the ones that stay visible while users decide, then act decisively when intent becomes commitment.

Retention and LTV depend on timing, not volume

Unlike eCommerce and finance, travel during Ramadan is defined by market-specific LTV dynamics. There is no single winning moment, only the right one for each market.

In the UAE, value is built early. Travelers acquired in the two weeks before Ramadan show about 16% higher Day 7, 14, and 30 retention than Ramadan cohorts, and roughly 20% higher than post-Ramadan users. Early acquisition builds habits, while Ramadan installs are more transactional. For 2026, this means prioritizing consideration and planning tools before the month starts, then using Ramadan to nurture rather than chase volume.

Saudi Arabia shows a weaker pre-Ramadan advantage. Success hinges on precise reactivation, especially around Eid, when intent finally converts. In 2026, remarketing quality and timing will matter more than expanding top-of-funnel reach.

Qatar breaks the pattern entirely. The strongest retention comes from users acquired during the first two weeks of Ramadan, as planning unfolds gradually. Sustained visibility during the month consistently outperforms front-loaded acquisition.

Across markets, the principle holds. Ramadan captures attention, while value is created by matching acquisition and reactivation timing to how travelers actually plan, decide, and commit.

Cool down, not scale up: the post-Ramadan normalization

While a post-holiday cooldown is inevitable, brands should watch how sharply things normalize after Eid. Sessions drop, churn accelerates, and fraud becomes a bigger risk.

In eCommerce and travel, fraud stays low during Ramadan, then briefly spikes after Eid as opportunistic actors exploit looser controls and leftover budgets. These attacks are usually short-lived and shut down quickly.

In finance, however, fraud is more about persistent exposure. Adaptive attacks tend to reappear, which demands continuous monitoring, tighter thresholds, and steady decision-making.

All of this makes the post-Ramadan window a weak moment to scale acquisition. A smarter move is protecting what you already built and focusing on retention. The goal is not to extend Ramadan hype, but to preserve the value it created. Eid-based loyalty mechanics, delayed rewards, or benefits that unlock after the holiday can help stabilize engagement among high-value users.

From Ramadan data to broader digital shifts

While our weekly performance data throughout Ramadan 2025 highlights clear patterns in installs, sessions, and remarketing uplift, it also reveals something bigger. Ramadan doesn’t just change when people engage with apps. It amplifies how they discover, decide, and convert, acting as a pressure test for broader digital behavior across the Gulf.

During the season, shifts that are gradual the rest of the year become highly visible. A young, digitally fluent population moves further away from linear customer journeys. Discovery increasingly starts with creators, communities, and AI-powered tools rather than ads alone, as people search for recommendations and inspiration that fit new daily rhythms. Nearly a third of consumers in the MENA region say AI search tools influence their purchase decisions, and Saudi Arabia and the UAE rank among global leaders in AI trust and optimism, supported by strong state-level investment.

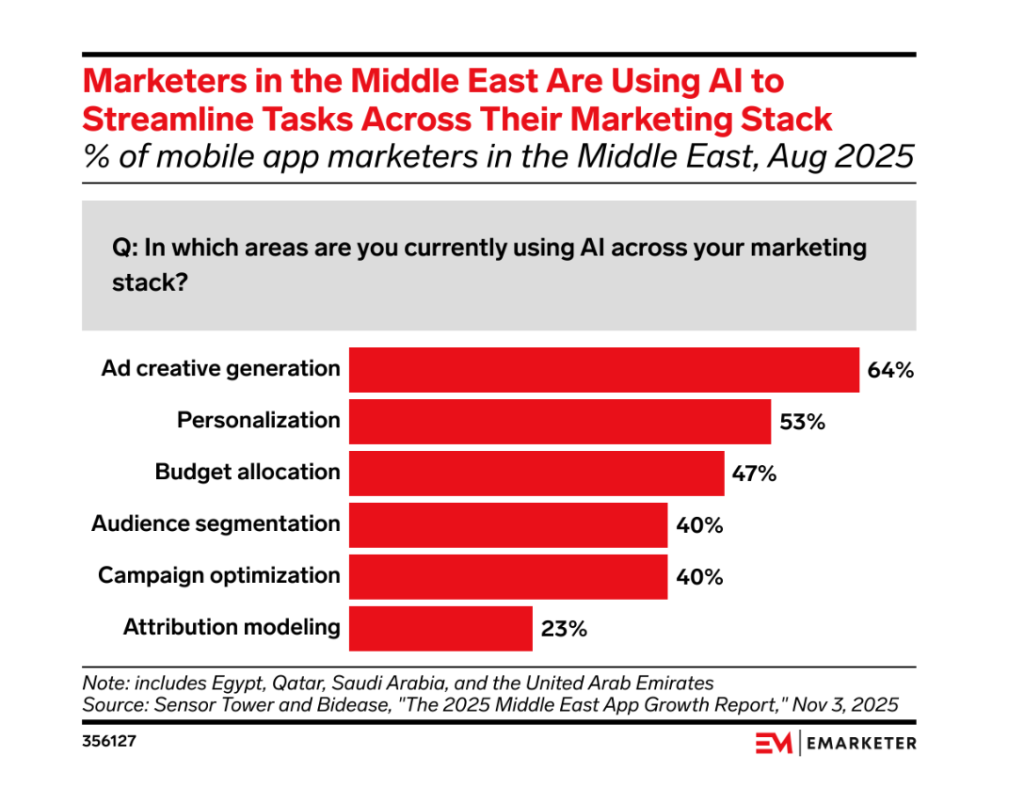

These changes are already reflected in how marketers operate. As reported by eMarketer, across the Middle East AI is actively used for creative generation, personalization, budget allocation, audience segmentation, and campaign optimization. AI is no longer experimental. It’s operational. Attribution modeling, however, still lags behind, creating risks as automation accelerates.

This is where solutions like the Modern Marketing Cloud become critical. As execution speeds up, measurement and clarity become the real differentiators. Connecting every touchpoint across AI-driven journeys allows brands to separate true uplift from seasonal noise.

Ultimately, Ramadan makes one thing clear. In an AI-shaped ecosystem, brands don’t win by reacting faster. They win by understanding better.