Finance and OTT led retention as festive loyalty dips post-Eid

Fraud exposure held at 27% as detection improves

Countries showed distinct non-organic mixes during Ramadan

Ramadan anchors one of the region’s most active mobile periods

Across Southeast Asia and Pakistan, Ramadan remains a powerful convergence of culture, connection, and commerce, one that is increasingly unfolding through mobile. The holy month reshapes daily rhythms and digital habits alike, creating peak moments of activity across shopping, streaming, finance, and travel apps. Consumers browse, buy, and give through their screens, blending tradition and technology in their shopping, streaming, and spending habits.

In 2025, Ramadan began earlier in the year, overlapping with Q1 retail and travel campaigns. This timing pushed marketers to accelerate user acquisition and remarketing efforts to capture intent sooner, sustaining engagement through Eid. In Indonesia, over half of consumers planned to increase their Ramadan shopping budgets, reflecting stronger purchase confidence. In Malaysia, online spending during Ramadan reached an estimated $680 million across nearly 100,000 festive stalls, underscoring the season’s broad commercial impact.

In Pakistan, household spending typically rises by around 40% above routine levels during the holy month, as festive demand boosts retail and online activity. In Singapore, mobile commerce continues to accelerate, with 65% of consumers using a smartphone for their most recent retail transaction, reflecting a deeply mobile-first shopping culture.

This report analyzes aggregated AppsFlyer data across Indonesia, Malaysia, Singapore, and Pakistan, encompassing the E-commerce, Finance, OTT & Livestreaming, and Travel verticals. It examines how installs, engagement, retention, and fraud shifted through the 2025 Ramadan period and how early-season peaks translated into sustained user intent.

*All results are based on fully anonymous and aggregated data. To ensure statistical validity, we follow strict volume thresholds and methodologies and only present data when these conditions are met.

Observation window: 17 February – 13 April 2025

Ramadan: 1-30 March 2025

Eid al-Fitr: 30–31 March 2025

Front-loaded campaigns fuel early wins as marketers chase high-intent users

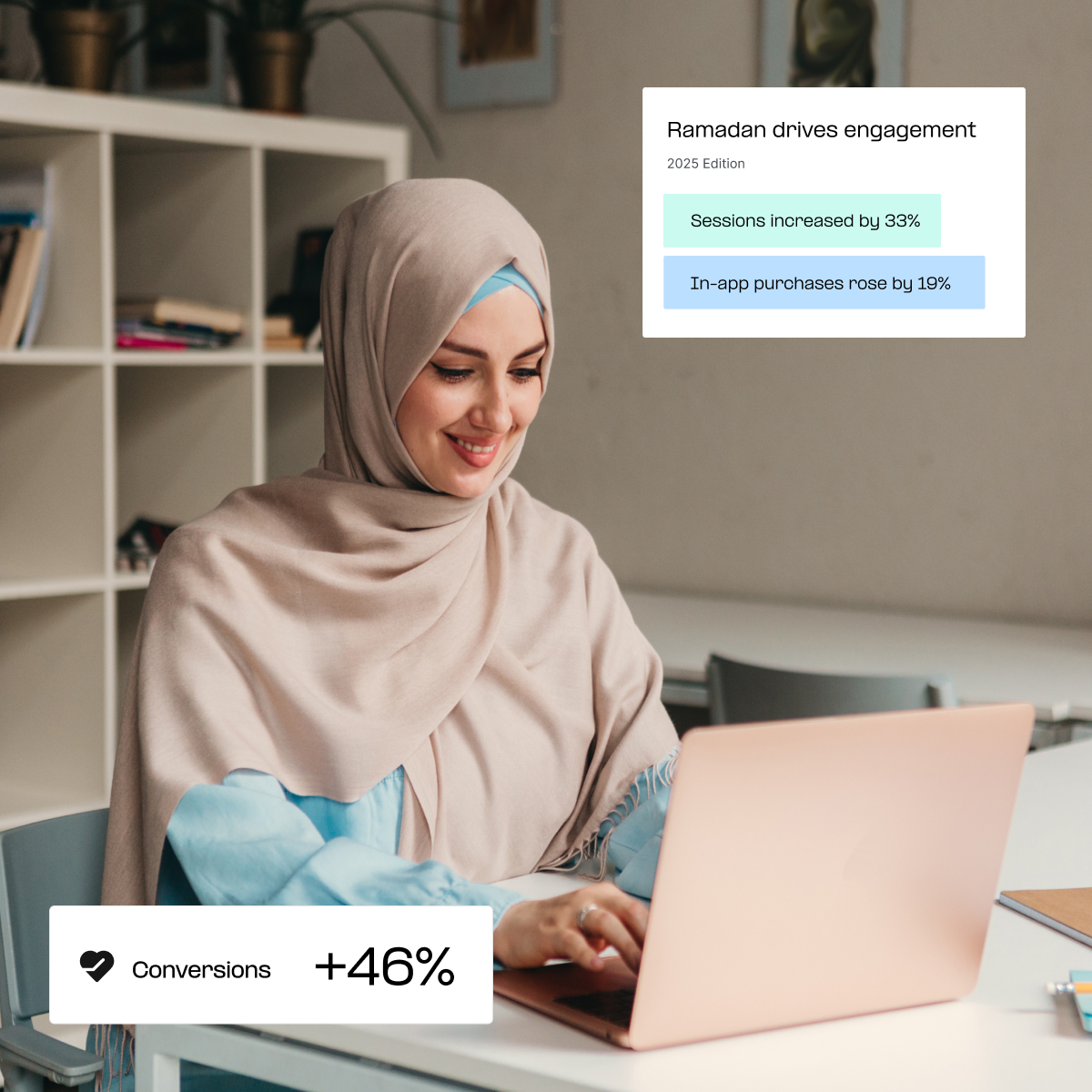

Ramadan’s earlier start in 2025 pulled performance forward. Across Southeast Asia and Pakistan, total conversions increased by 46% compared to the pre-Ramadan period, as marketers brought campaigns forward and concentrated their spending around high-intent weeks. Paid channels led the season, accounting for 69% of all installs, and the share of conversions from remarketing increased from 11% before Ramadan to 16% during the month, showing a clear shift toward efficiency and re-engagement.

Indonesia accounted for roughly one-third of total conversions, with a non-organic share of 71% throughout the season and a steady performance week over week. Malaysia followed with a 77% non-organic share and weekly conversion rates close to 14%, supported by disciplined Q1 budgets and more mature user acquisition planning.

Pakistan delivered the strongest conversion lift in the region. Total conversions increased by 97% compared to the pre-Ramadan period, driven by cost-efficient campaigns and higher spending on food and finance apps. As fraud filtering tightened later in the period, conversion quality stabilised while volumes remained elevated. Singapore contributed a smaller share of volume but posted a 47% increase in total conversions compared with pre-Ramadan, supported by regional travel and cross-border retail campaigns.

For marketers, the pattern is clear. Starting early secures attention, but disciplined execution sustains results. Markets that combined a strong week-one acquisition with consistent remarketing, particularly Indonesia and Malaysia, were best positioned to convert short-term festive intent into durable, long-term performance.

Engagement deepens across Ramadan’s peak weeks

Once acquired, users became significantly more active. Across Southeast Asia and Pakistan, overall sessions increased by 33% compared with the pre-Ramadan period, while in-app purchase (IAP) trends rose by 19%. The highest activity levels appeared during the Ramadan weeks and around Eid, reflecting heavier use of shopping, payments, and entertainment apps during key festive moments.

E-commerce apps captured the largest share of attention. Sessions increased by 37%, while IAP rose 20%, supported by ongoing browsing, deal discovery, and flash-sale campaigns throughout the season. Finance apps maintained steady use as users managed payments, transfers, and zakat through mobile channels, reinforcing the role of finance apps in everyday behaviour.

OTT & Livestreaming also gained, with sessions up roughly 25–30% and IAP up 39%. Longer watch time and more in-app activity contributed to this uplift through the middle of Ramadan. Travel apps showed their strongest gains closer to Eid, with sessions 15% above pre-Ramadan as users planned trips and family visits.

For marketers, the implication is straightforward. Ramadan and the surrounding weeks focus on intent, not just reaching. Campaigns that align timing, creatives, and offers with these peaks in browsing, viewing, and transaction behaviour are best placed to convert seasonal interest into concrete actions and repeat engagement.

Session trend over time

IAP revenue trend over time

High intent delivers quick wins, but long-term loyalty remains elusive

Ramadan drove strong early engagement, but securing loyalty beyond the season was harder. Across Southeast Asia and Pakistan, short-term retention on Days 1–3 stayed broadly consistent with pre-Ramadan levels. The most notable shifts occurred in midterm behavior, where retention for the Ramadan and Eid cohorts declined by approximately 2–5% on Days 7 and 14.

Day 30 retention typically landed in the low single digits across markets and verticals, indicating that only a limited share of festive installs were still active one month later. High-intent users converted quickly, but activity tapered once Ramadan-related needs were fulfilled.

E-commerce apps saw the most visible post-Eid softening. Day 7 retention slipped from around 6% to 5% as users completed purchases and reduced app visits once core shopping tasks were done. Finance apps, by contrast, sustained the strongest continuity, maintaining a near 4% Day 30 retention rate as users returned regularly for payments, transfers, and savings.

OTT & Livestreaming maintained a steady profile across the Ramadan weeks, with only modest weakening after Eid as viewing habits normalised. Travel moved in the opposite direction, with a slight lift in Eid cohorts. Day 7 and Day 14 retention for these users improved by around 0.3%, boosted by trip planning and post-booking activity.

For marketers, the lesson is practical. Retention depends on ongoing relevance, not only on seasonal reach. Finance and entertainment apps that are embedded in daily behavior retain users more easily. Other verticals require structured retention plans, loyalty programs, personalized offers, and remarketing journeys that extend beyond Eid to convert festive installs into durable, high-value relationships.

As budgets rise, cleaner traffic becomes a competitive edge

Fraud exposure continued to be a constant pressure across Southeast Asia and Pakistan during the Ramadan period. Overall fraud rates were close to pre-season levels, moving from 21–25% before Ramadan to 24–27% during Ramadan weeks. The sharpest rise occurred after the holiday, when fraud increased to 33% and 30% in the two post-Ramadan weeks, as campaigns remained active and invalid traffic attempted to capitalise on the ongoing demand.

Ramadan week 2 was the most stressful week. Pakistan and Singapore recorded the most extreme spikes. In Pakistan, E-commerce fraud surged to 82% and Travel to 54%. In Singapore, overall fraud reached 78%, with Finance, E-commerce, OTT, and Travel all rising into the 59–83% range. These spikes eased quickly, indicating that systems and partners filtered out abnormal traffic rather than allowing consistently high exposure.

Indonesia and Malaysia showed more controlled patterns. In Indonesia, fraud across most verticals stayed between 17% and 24% during Ramadan, rising only after the holiday. Malaysia entered Ramadan with higher exposure, particularly in Finance, where fraud exceeded 50%, but levels declined across the season. E-commerce fraud fell from 18% at the start of Ramadan to 9% by Eid, while Finance moved from 57% to 42%

The vertical picture was consistent across markets. Finance remained the highest-risk category, often exceeding 25–30% and occasionally reaching higher levels in specific weeks. E-commerce stayed above regional averages during peak sale activity. OTT & Livestreaming remained the cleanest environment, typically with a usage rate of between 7–15%. Travel showed the widest swings, from very low levels to around 20% in some Eid-related weeks.

For marketers, fraud management has become a core part of their performance infrastructure. Always-on verification, partner audits, and post-install checks are essential to protect ROI as seasonal budgets rise and invalid traffic targets high-intent windows.

Fraud rate trend by country

Fraud rate trend by vertical

Decoding Ramadan Search Intent Beyond The Calendar

Ramadan and Eid represent a profound behavioral migration. Across the region, Google Search intent follows a precise choreography: building from R-3, peaking for Ramadan at R-1, and concluding by E+2. However, the “soul” of these searches varies significantly by geography.

In Indonesia and Malaysia, the narrative is one of escalating celebration. Search interest for Eid eclipses the fasting month. In Indonesia, the mandatory Festive Bonus (e.g., THR bonus in Indonesia) acts as a powerful economic ignition point; search intent spikes sharply at R3 when liquidity hits, driving an Eid peak at R4. Malaysia shows similar fervor, with Ramadan engagement matching the massive scale of the Chinese New Year, the nation’s other major festival.

Conversely, Pakistan and Singapore prioritize the observance of the holy month itself. In these markets, peak interest for Eid is lower than or equal to the Ramadan peak, reflecting a sustained engagement with spiritual practices and the daily logistics of fasting rather than a singular focus on the concluding festivities.

Category-specific data reveals the tactical window for brands. Finance intent exhibits a synchronized heartbeat across all markets, driven by festive allowances typically disbursed in weeks two or three of Ramadan. This is the pivotal moment where “preparation” transforms into “purchasing power.”

Digital entertainment usage also shifts, but the medium varies by geography. While Indonesia, Singapore, and Malaysia see a holistic surge in both online video and gaming as forms of communal entertainment, Pakistan experiences a singular, explosive peak in gaming.

For brands, winning requires mastering this tempo. Shopping and Travel require early-funnel momentum, while Finance and Media must pivot to capture the surge of liquidity and leisure. Success isn’t just about presence; it’s about timing your message to the precise moment the consumer moves from reflection to celebration.

R-n = n weeks before Ramadan first day

Rn = n weeks after Ramadan first day

En = n weeks after Eid first day

Google Search Trends on Ramadan and Eid-related topics, 2025

Consumer Intent Mapping: Category-Level Search Trends Across the 2025 Ramadan Lifecycle

- Search trends indicate that Ramadan intent begins as early as R-3 and continues beyond Eid. What do marketers most often underestimate about how early they need to start planning for the season?

-

R-3 marks the start of the “Discovery” phase, which means that marketers should focus early campaigns on addressing Ramadan and Eid-related needs, rather than waiting for the peak purchase period. Since Ramadan communications are typically highly saturated, establishing early brand presence is vital to secure top-of-mind status and influence purchase decisions before the peak season.

Marketers focused on user acquisition can use Google Trends to understand consumer trends to time their efforts during the discovery-to-purchase phase. These in combination with historical data from their analytics tools, including Appsflyer and Google Analytics, can be helpful in re-engaging customers even earlier by leveraging relevant loyalty messaging.

Moreover, these insights can also be utilized through features like Audience Signals to guide Google App Campaigns for Install (ACi) in acquiring new app users that may have similar traits to your existing customers. This can be helpful in driving more campaign efficiencies during Ramadan.

- Ramadan intent varies significantly across markets and categories. How should marketers adapt their creative and messaging strategies to align with these staggered intent windows?

-

Strategic success requires moving beyond a “one-size-fits-all” approach. Marketers who align their creative efforts with the distinct behavioral rhythms and consumption patterns can create an edge. Some key opportunities during the Ramadan season include:

Market-Specific Messaging: In Indonesia and Malaysia, messaging should follow an ‘Expansion Model’, starting with preparation at R-3 and pivoting to high-energy celebratory content as Eid interest overtakes Ramadan interest. Conversely, in Pakistan and Singapore, a ‘Sustained Engagement’ approach can be effective. Here creatives could focus on the spiritual journey and daily rituals, as Ramadan search volumes here are double those of Eid.

Vertical-Specific Execution

– Shopping & Travel: These are Early-Funnel categories. Brands should aim to build mental availability well before R-3 to secure consideration before the R-1 search peak.

– Finance: This vertical owns the liquidity window in R2-R3. Some potential creative tactics include focusing on ease of disbursement, digital gifting, and purchasing power exactly as allowances and festive bonus (e.g. the mandatory “THR” Eid bonus in Indonesia) hit bank accounts

– Entertainment (OTT/Online Gaming): Messaging could lean into shared gaming and video experiences in Malaysia/Singapore/Indonesia, while prioritizing interactive gaming formats in Pakistan to capture its unique market surge.

Beyond behavioral rhythms, marketers should explore diverse ways to tailor a unified message for different audience segments. Google App Campaigns offers a powerful means to navigate this complexity by allowing marketeers to simply upload diverse creative assets simultaneously and using Google’s AI autonomously to assemble, rigorously test, and optimize the highest-performing advertisements across major channels including Search, YouTube, and Play. This streamlined process ensures marketers can effortlessly scale and adapt their messaging, whether transitions are daily, weekly, or running concurrently, thereby maximizing reach and driving impact throughout Ramadan without the burden of heavy manual execution. - Managing multiple intent windows across markets and categories can get difficult. How do leading marketers use AI to scale and adapt execution during peak periods like Ramadan?

-

Managing the complex, shifting intent windows of Ramadan across multiple markets can be daunting, particularly when trying to determine the optimal bid in a rapidly fluctuating auction environment. To solve this, marketers can now leverage Max Conversions and Max Conversions Value bid strategies on App Campaign for Install (ACi). These allow Google’s AI to capture the highest possible volume within the set budget, helping the model learn your customers’ seasonal behavior patterns quickly without the constraint of a fixed target.

Once campaigns are scaled, marketers can refine cost-efficiency and LTV through tCPA (Target Cost-per-Action) or tROAS (Target Return-on-Ad-Spend). This shift introduces a cost-efficiency layer, maintaining performance even as user intent transitions from Ramadan rituals to Eid celebrations.

For short yet high-impact windows, such as the 3-day window following the Festive Bonus like “THR” disbursement, marketers can leverage Seasonality Adjustments for App Campaigns. This informs the AI of an expected spike in conversion rates, allowing the system to proactively scale bids before the spike occurs, ensuring no high-value intent is left on the table.

- Looking ahead to Ramadan 2026, what's one execution principle marketers should keep in mind to turn early intent into sustained engagement beyond the season?

-

Across our key categories like Finance, Travel, and Shopping, the data shows that search interest doesn’t just vanish after Eid. It often sustains or rebounds significantly in the months leading into the year-end. This highlights a critical opportunity: User acquisition during Ramadan shouldn’t be viewed as a one-off seasonal play.

In fact, leading marketers leverage these seasonal gains as part of their longer term strategy anchored on user Lifetime Value (LTV). To execute this, marketers can use Google tROAS bid strategy during Ramadan acquisition on App Campaigns for Install (ACi) for short-term ROAS returns, and on App Campaigns for Engagement (ACe) to re-engage high-value users, ensuring Ramadan investments drive sustained growth throughout the year.

For brands operating across both web and app platforms, implementing Web to App Connect or Deep Linking is key for driving marketing objectives across the full funnel. Web to App Connect allows to expand growth strategies to leverage the broader suite of Google Ads solutions, such as Demand Gen and Performance Max, to complement your App Campaigns to maximize ROAS directly across both platforms.

- Which insights from last year had the biggest influence on the way you approached this year’s Ramadan planning?

-

One of the most important learnings for us was how pre-Lebaran holidays in Q1 directly shape behavior during the Lebaran period itself. That insight led us to approach Ramadan and Lebaran not as a single peak, but as a sequence—where what happens before Ramadan strongly influences how Lebaran unfolds.

- Where did you see the earliest signals of festive intent this year, and how did that shape your pacing or prioritization?

-

We noticed early trends in users searching for Lebaran accommodations, so we shifted our budget toward upper-funnel channels to capture that demand. By launching our Lebaran campaigns early, we were able to communicate our value proposition to the market sooner and stay ahead of the festive rush.

- How did your Ramadan-acquired users behave once the peak period passed, and what differences stood out when compared with your regular user base?

- Ramadan is one of our most critical seasons, so our strategy focused on early demand capture through lifestyle-oriented communication and travel inspiration. A key differentiator this year was the launch of tiketDP (Down Payment), which allowed users to lock in prices for Mudik early.

- As the season unfolded, which parts of your funnel or performance landscape did you monitor most closely for impact or risk?

- We focused heavily on upper-funnel health—specifically, reach and search intent—to identify shifting market trends early. The biggest risk we monitored was a ‘drop-off’ between the inspiration phase and the actual booking spike. To mitigate this, we utilized customized mid-funnel retargeting to ensure that users who had shown early interest didn’t switch to competitors when the compressed booking window finally opened.

- Ramadan 2025 showed compressed booking windows and Eid-driven activity spikes. How will these patterns shape the way you plan demand forecasting, campaign pacing, or route prioritization for the next festive season?

- To address the compressed booking windows, we will shift to a front-loaded demand forecasting model, capturing early-bird intent before the pre-Ramadan surge. Our campaign pacing will be tiered, utilizing ‘inspiration-based’ content early on to drive route prioritization, followed by aggressive tactical promotions during the Eid spikes to capture the late-booking market. This ensures we remain agile enough to pivot resources as the booking window narrows.

Conversions climbed sharply in week one, so shift budgets and assets ahead of Ramadan to capitalize on that momentum.

Costs stay lower, and impact stays high during Ramadan, so run structured re-engagement flows through Eid to compensate for this year’s softer remarketing uplift.

Sessions and IAP peaked in clear windows, so time campaigns around these usage patterns to convert intent when it is strongest.