How to reactivate bank customers at 5x lower cost

TL;DR

- Reactivating dormant customers costs significantly less than acquiring new ones

- Behavioral segmentation outperforms demographic targeting in conversion rates

- Real-time audience syncing across media networks eliminates manual campaign management

- Banks using smart remarketing can reduce acquisition costs while improving customer lifetime value

- AppsFlyer maintains banking compliance while enabling sophisticated remarketing using first-party data with explicit user consent

The costly mistake most banks make

Customer acquisition costs in banking have risen significantly, with traditional retail banks averaging $561 per customer and commercial accounts reaching $760 in early 2025. Compounding this challenge, 34% of new checking accounts become inactive within a year, making their acquisition costs a sunk investment. Yet most financial institutions continue allocating the majority of their marketing budget toward new customer acquisition. This approach overlooks a significant opportunity: dormant high-value customers who already demonstrate trust and engagement history.

Consider this scenario: A customer completed three mobile transactions monthly for twelve months, then activity stopped completely for 90 days. This isn’t a lost customer. It’s a relationship with proven value waiting for the right re-engagement approach. These users cost significantly less to reactivate because they already understand your products and trust your institution.

The challenge lies in how banks approach dormant user identification. Traditional segmentation relies on demographic assumptions rather than behavioral indicators that predict re-engagement likelihood. Marketing teams spend weeks building segments based on age, income, or geography while missing the behavioral patterns that actually matter.

Manual audience creation compounds the inefficiency. By the time segments are built and campaigns launch, the most receptive dormant users may have already moved to competitors offering more timely and relevant engagement.

How to build audiences that actually convert

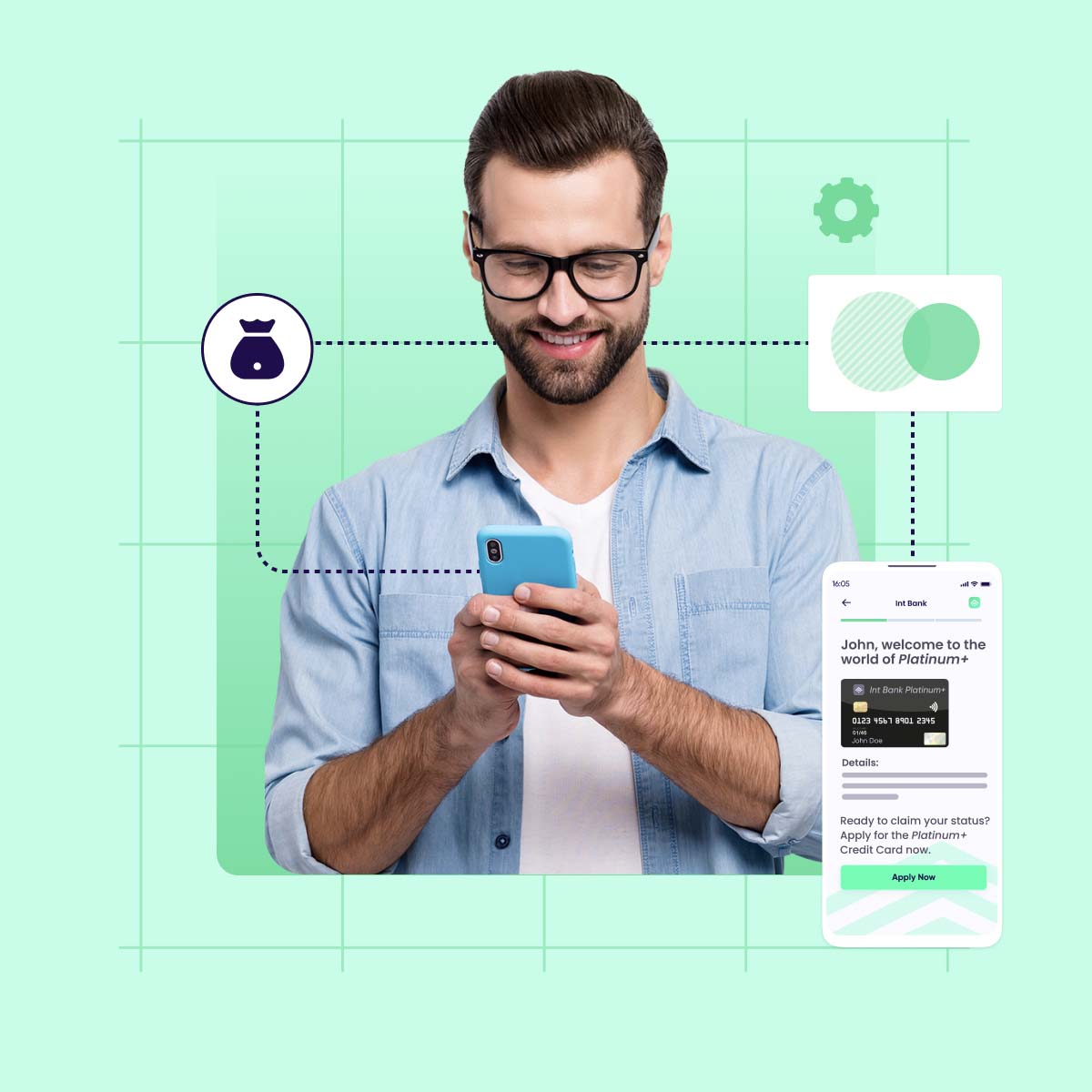

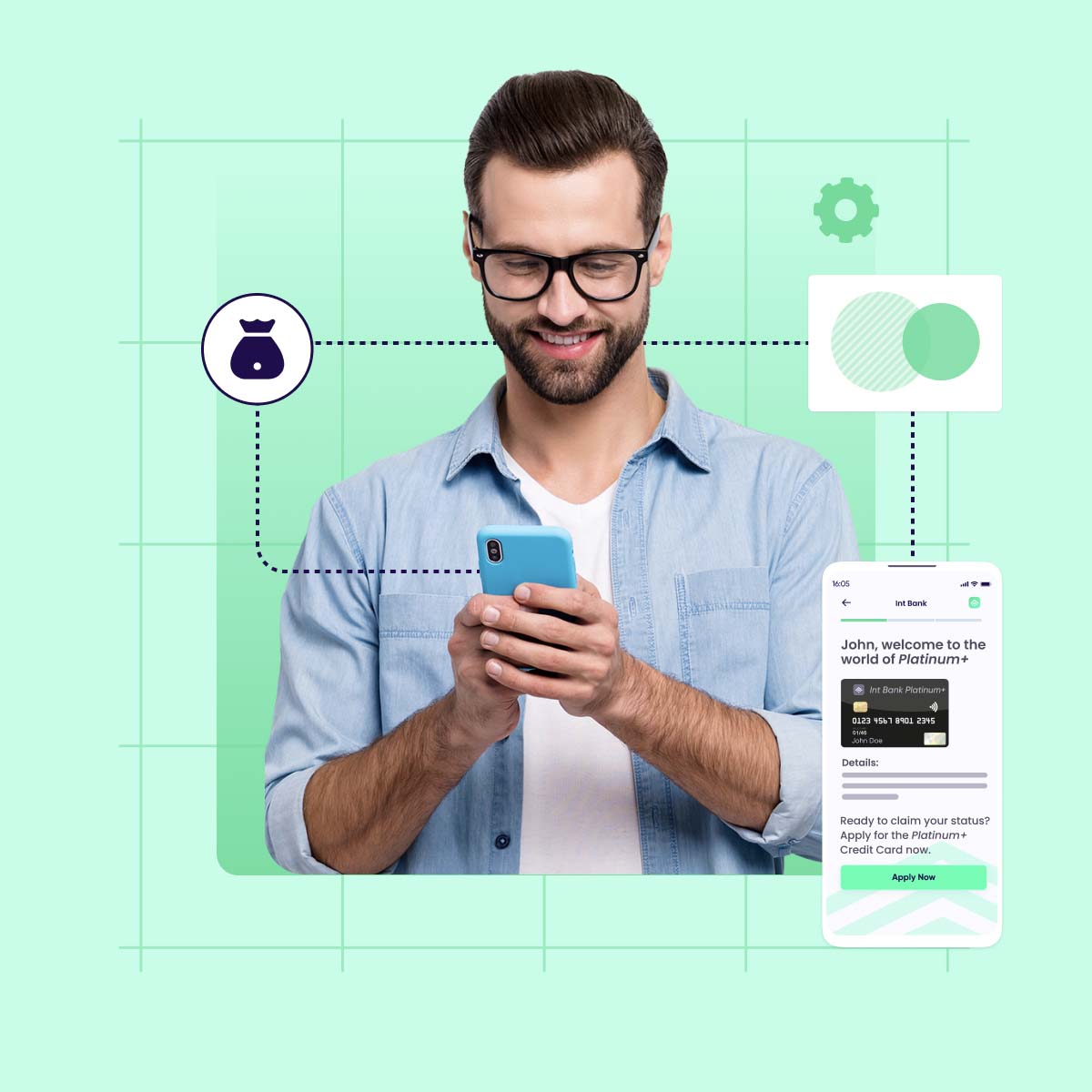

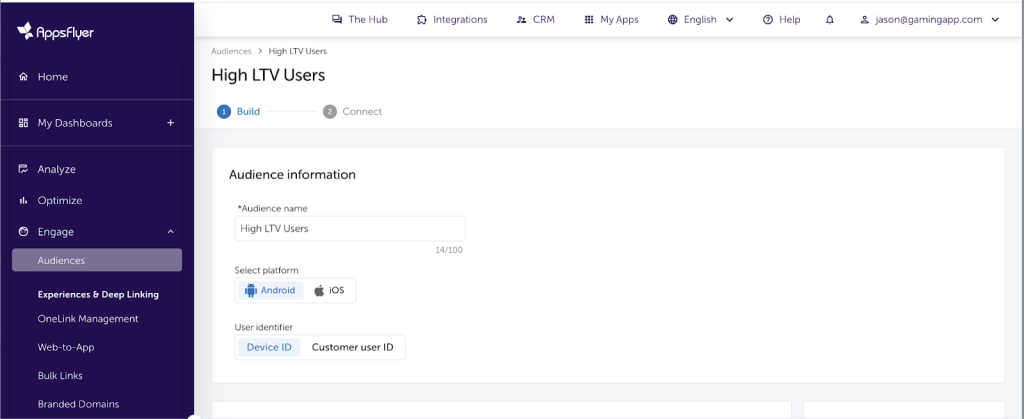

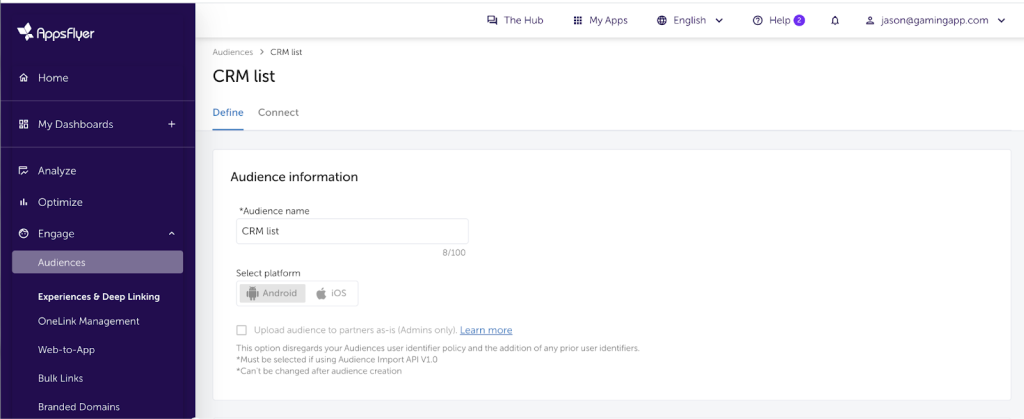

AppsFlyer’s audience segmentation focuses on what customers actually did, not who we think they are. Instead of targeting by demographics like age or location, banks can target based on specific behavioral patterns such as transaction frequency, product usage, and engagement timing. Past behavior predicts future behavior more accurately than demographic assumptions.

Instead of broad demographic targeting, focus on specific behaviors that signal reactivation opportunities. A customer with high deposits who hasn’t logged in for 30 days gets a personalized high-interest savings offer. A user who checked loan rates but didn’t apply receives simplified approval messaging.

See audience segmentation in action:

Real-time audience updates protect your marketing budget from chasing customers who’ve already moved to competitors. When engagement patterns shift, audiences automatically refresh so your team stops wasting spend on outdated segments that no longer convert.

First-party data enrichment adds meaningful context without compromising privacy. CRM attributes, transaction history, and product ownership information enhance behavioral segments while maintaining GDPR and CCPA compliance. This creates remarketing that feels personalized rather than generic.

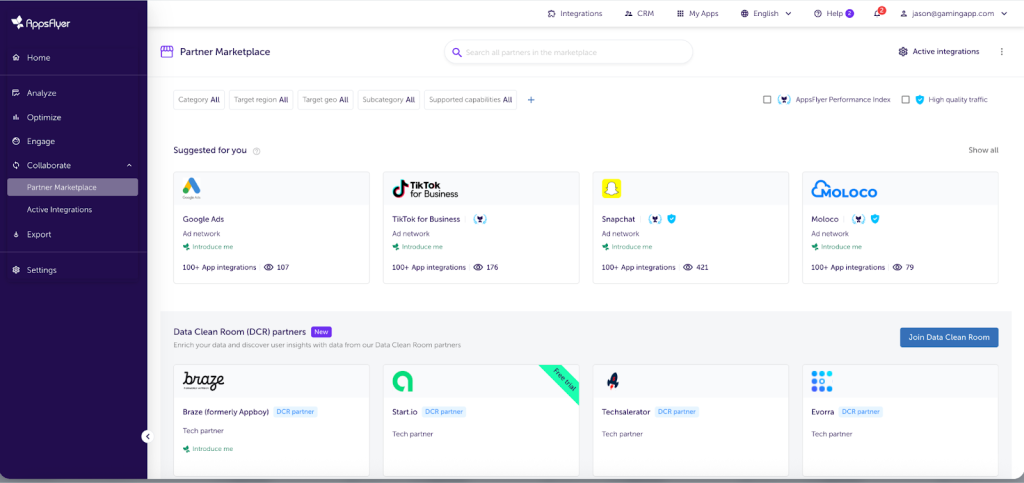

Automated partner syncing distributes audiences across Meta, Google, TikTok, and 140+ advertising platforms simultaneously. Manual audience uploads become unnecessary as segments sync automatically across all channels, ensuring consistent targeting while reducing operational overhead.

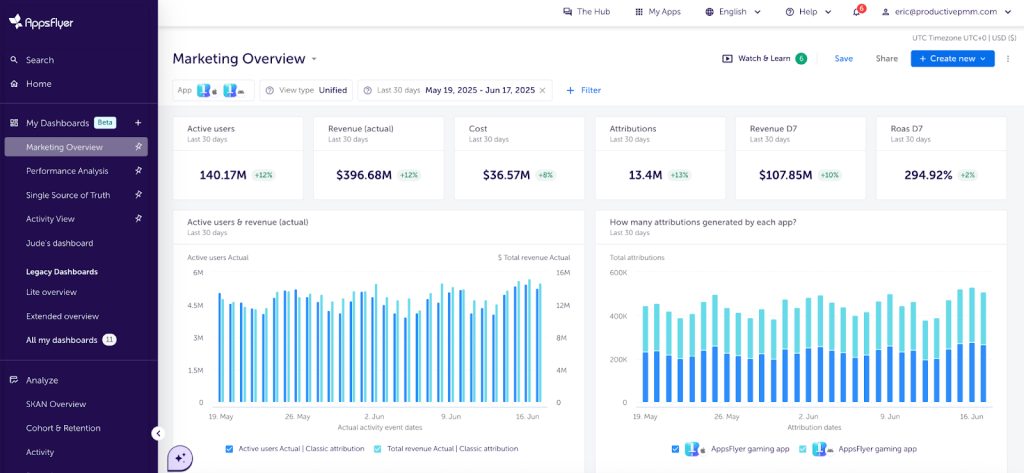

Cross-platform measurement finally gives your CFO the proof they need about marketing ROI. See exactly how email, push notifications, and paid advertising work together to drive account growth and fee income, so you can confidently defend marketing budgets and reallocate spend to what actually works.

Four remarketing use-cases for banks

1. High-value customer reactivation

Target customers with strong historical engagement who haven’t used core banking features for 30-90 days. Use transaction patterns and product usage history to create relevant comeback offers.

2. Loyalty program revival

Reactivate customers who earned rewards but stopped engaging with loyalty features. Segment by reward tier and spending patterns to deliver appropriate incentives. Create urgency through exclusive member benefits or expiring point notifications that drive immediate action.

3. Cross-sell to engaged users

Target customers who use one product intensively but haven’t explored complementary services. Use product usage patterns to identify natural expansion opportunities and remove barriers to adoption through simplified onboarding flows.

4. Acquisition budget optimization

Exclude existing customers from paid acquisition campaigns to eliminate wasted spend. Use cross-platform identity matching to prevent serving acquisition ads to current users, reallocating those budgets toward genuine prospect targeting.

Customer reactivation: The impact on revenue and retention

The shift toward remarketing reflects broader industry changes in marketing efficiency and privacy regulations. AppsFlyer research shows remarketing campaigns are 5 times more cost-effective than acquisition, with contextual campaigns delivering 12.3% conversion rates compared to 4.9% for generic messaging.

Banks using behavioral remarketing see conversion rates improve while cost per conversion drops compared to acquisition campaigns. The difference comes from targeting users who already trust your institution and understand your products. A dormant customer costs less to reactivate and often shows higher long-term loyalty than a newly acquired user.

Automated audience syncing reduces manual campaign management significantly. Marketing teams shift focus from operational tasks to strategic optimization as real-time audience updates eliminate constant segment maintenance. This operational efficiency allows teams to concentrate on performance improvement rather than data management.

Customer lifetime value increases as dormant users return to regular engagement. Reactivated customers often demonstrate higher loyalty than newly acquired users because they’ve already established trust and understand your products. Banks typically observe improved retention rates among successfully reactivated users.

Next steps to reactivate dormant users

Start with dormant high-value customer reactivation as your highest-impact remarketing scenario. This approach targets users with proven engagement history and clear reactivation potential while generating immediate revenue improvements.

Focus measurement on incremental revenue rather than engagement metrics. Measure reactivated users who complete high-value actions like account funding, loan applications, or investment product adoption. Business impact matters more than click-through rates.

Scale gradually from single remarketing scenarios to comprehensive programs. Begin with dormant user reactivation, prove the concept through measurable results, then expand to cross-sell optimization, loyalty revival, and acquisition suppression as your team gains expertise.

The reality for banking marketers

You know the pressure. Every quarter, leadership asks for more customers while cutting your budget. Your acquisition campaigns cost $561 per customer, and you watch 34% of those expensive acquisitions go dormant within twelve months. Meanwhile, your compliance team questions every new platform, your IT department wants six months for any integration, and your CFO wants proof that marketing actually drives revenue.

The good news? Your dormant customers are waiting for you to find them again. They already trust your institution. They understand your products. And they cost significantly less to reactivate than acquiring new customers.

AppsFlyer’s audience segmentation combines behavioral targeting, automated cross-platform syncing, and banking-grade compliance to turn dormant customer data into active revenue streams. Want to see how it applies to your specific situation?

Schedule a strategic consultation with our banking specialists.

The bottom line

Your dormant customers represent untapped revenue opportunities that cost significantly less to activate than new customer acquisition. While most banks continue chasing expensive new prospects, smart financial institutions are leveraging behavioral remarketing to reactivate existing relationships.

AppsFlyer provides the leading platform specifically built for this opportunity, combining behavioral audience segmentation, automated cross-platform syncing, and banking-grade compliance in one solution. With real-time audience updates, deep linking for seamless user experiences, and comprehensive attribution across all touchpoints, AppsFlyer transforms dormant customer data into active revenue streams.

The technology exists. The opportunity is quantifiable. The compliance is built-in.

Ready to transform dormant customers into active revenue drivers? Discover how AppsFlyer’s financial solutions help banks turn existing relationships into competitive advantages through intelligent remarketing.

Key takeaway: Your existing customer relationships are your most valuable marketing asset. AppsFlyer helps you reactivate them strategically.