5 mobile adoption plays banks are using in 2026

TL;DR

- Over 2 billion people will bank on mobile in 2026 while digital banks gain market share through superior execution

- Web-to-app journeys with deep linking turn website visits into completed app actions with measurable lifetime value

- Email deep linking achieves 4X higher click-to-install rates by landing customers on exact promised screens

- Branch QR codes convert in-person visits into ongoing app engagement

- SMS with 98% read rates turns urgent moments into completed actions rather than support calls

- Re-engagement campaigns recover high-value customers who abandoned during onboarding

- Traditional banks have existing customers and trust but risk losing competitive ground to competitors executing these plays

The mobile measurement gap in banking

Over 2 billion people will bank on mobile in 2026, but the challenge is proving marketing ROI to leadership while digital banks gain market share.

Traditional banks struggle to connect marketing touchpoints to revenue. A customer scans a branch QR code, downloads the app, visits the website, clicks an email, and funds their account. Each interaction lives in separate dashboards, so marketing struggles to answer which channels drive funded accounts.

Digital banks eliminate friction at every touchpoint and measure complete customer journeys. Mobile banking now generates 50 times more customer touchpoints than physical branches, with leaders in mobile outgrowing competitors through lower costs and superior customer experience. Every quarter traditional banks delay, competitors gain ground.

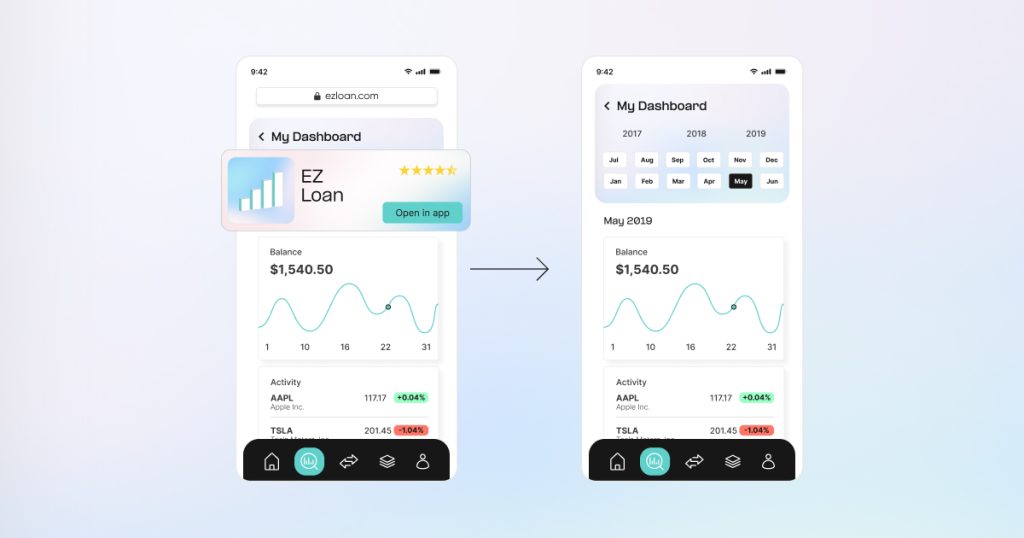

1. Move customers from web to app with continuous journeys

When customers start opening an account on your website and tap “continue in app,” the app opens to the homepage instead of the account setup page. The customer is now stuck looking at the homepage with no clear path forward. They must search through menus trying to find where to continue opening their account. Most abandon the task entirely.

Nubank and Revolut use continuous web-to-app journeys. Smart banners explain why the app provides a better experience. Deep linking opens the exact screen where the customer left off on web. If customers lack the app, they install it first, then land on that same screen with their information ready.

Website visits become completed in-app actions. Web-to-app attribution connects banners to business outcomesMarketing sees each customer’s first transaction, return frequency, recurring deposits, and feature usage. This reveals which banners brought customers with higher lifetime value and actual revenue.

Start with your highest-traffic web pages where customers begin tasks they could complete in-app. Deploy smart banners with deep links to the exact screen matching their web activity. Connect web analytics to your measurement platform to track banner-to-conversion journeys. Test one flow, measure completion rates, then expand.

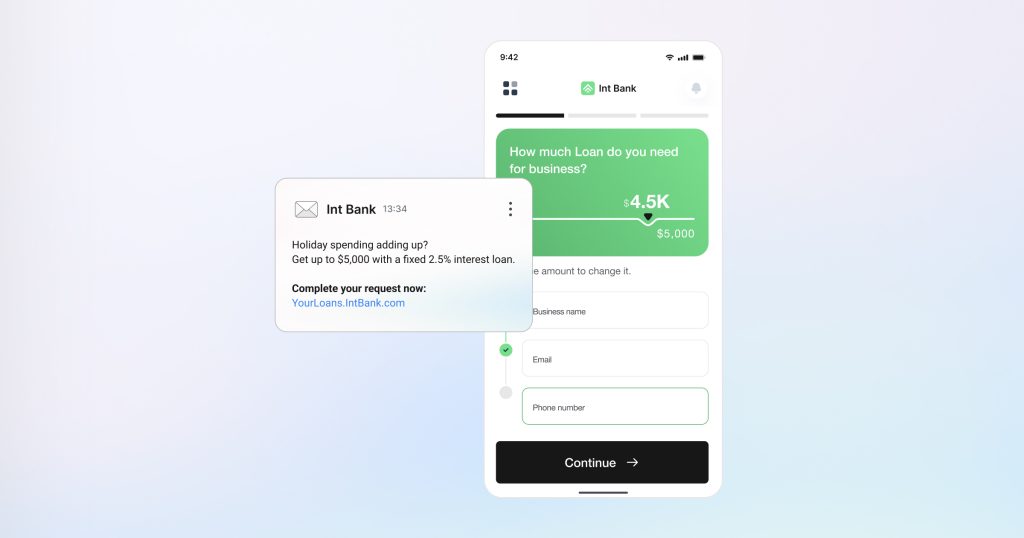

2. Drive email-to-app conversions with precise deep linking

Customers receive numerous emails daily. When they tap a call-to-action expecting a specific task but land elsewhere, they abandon immediately.

The fix is straightforward: statement notifications should open that specific statement, and payment reminders should open the exact payment screen.

Citibank implements this precisely. Each email deep links to the exact screen promised, enabling instant task completion. Banks executing this correctly achieve 4X higher click-to-install rates.

Replace generic app store links in high-volume emails with deep links to specific screens. Configure deferred deep linking for customers without the app. Test one campaign against standard links to establish your baseline, then measure click-through rates, app opens, and task completion to prove revenue impact.

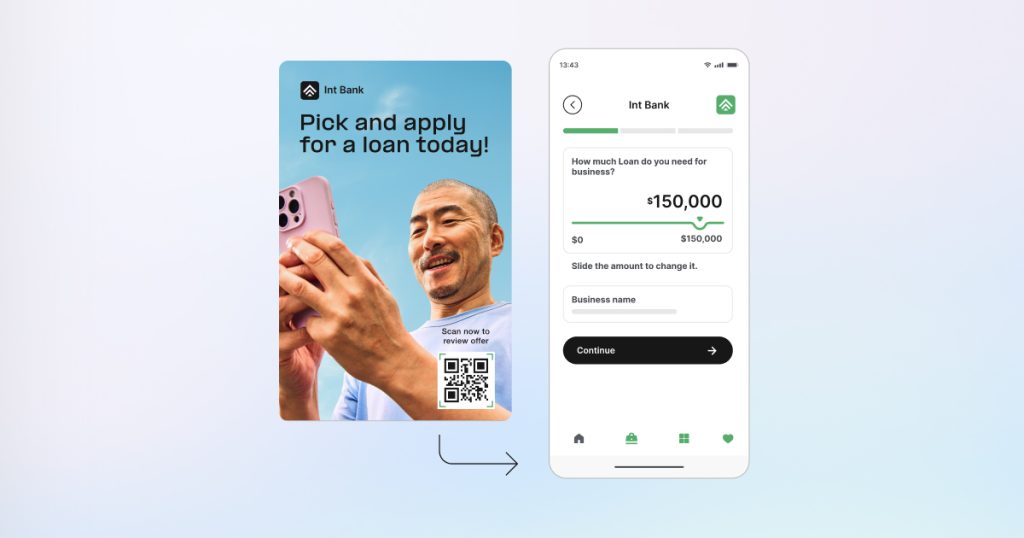

3. Convert branch visits into app momentum with QR codes

Branch traffic is declining, but each visit represents an opportunity to build app habits. The key is demonstrating immediate app value.

Bank of America places QR codes at teller windows. When customers complete transactions, tellers direct them to scan for continuing their banking tasks in the app. The customer scans, lands on the contextually relevant screen, and completes the next steps.

This converts in-person visits into sustained digital engagement, boosting customer engagement between branch visits and growing overall lifetime value. Marketing gains attribution connecting offline branch interactions to downstream app behavior and revenue. Previously unmeasurable physical touchpoints now tie directly to digital engagement metrics.

Deploy QR codes at high-traffic branches for specific use cases: account opening, card activation, mobile check deposit. Train staff on when to direct customers to scan. Each code should deep link to the relevant feature. Measure scan rates by location and 30/90-day retention to prove lasting digital habits.

4. Support urgent moments with SMS deep linking

SMS achieves 98% read rates, making it one of the fastest channels for driving immediate app actions.

Consider a customer receiving a declined card alert while at checkout. If they tap the link and land on a login screen or homepage, they call support or use a different card.

The better approach: when the customer taps the SMS link, it opens directly to the declined card transaction screen showing “Was this you?” with two action buttons. The issue is resolved in 5 seconds.

Landing on the right screen turns urgent moments into completed actions, not support calls. Marketing demonstrates SMS campaigns drive measurable app engagement while reducing operational service costs.

Implement SMS deep linking for time-sensitive alerts: fraud notifications, unusual activity, large purchases, low balances. Configure deep links to the specific transaction screen. Balance convenience with authentication for security-sensitive flows. Measure response times, resolution rates, and call center reduction to quantify operational savings.

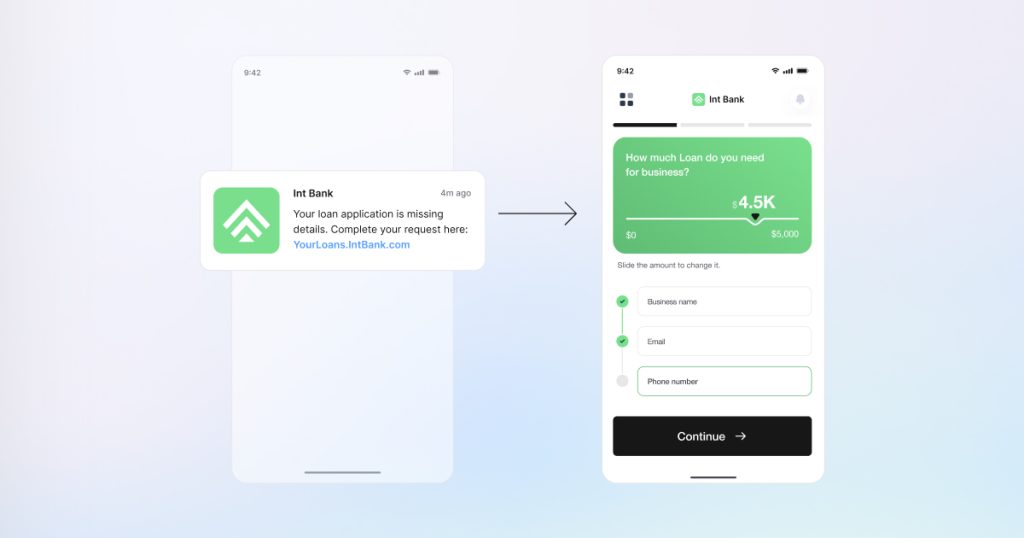

5. Re-engage customers who never activated

Many customers download apps but never become active. They demonstrated intent, but something prevented activation.

This group is a high-value opportunity. Recovering customers who already demonstrated interest costs significantly less than acquiring new prospects. The key is bringing them back to their exact abandonment point.

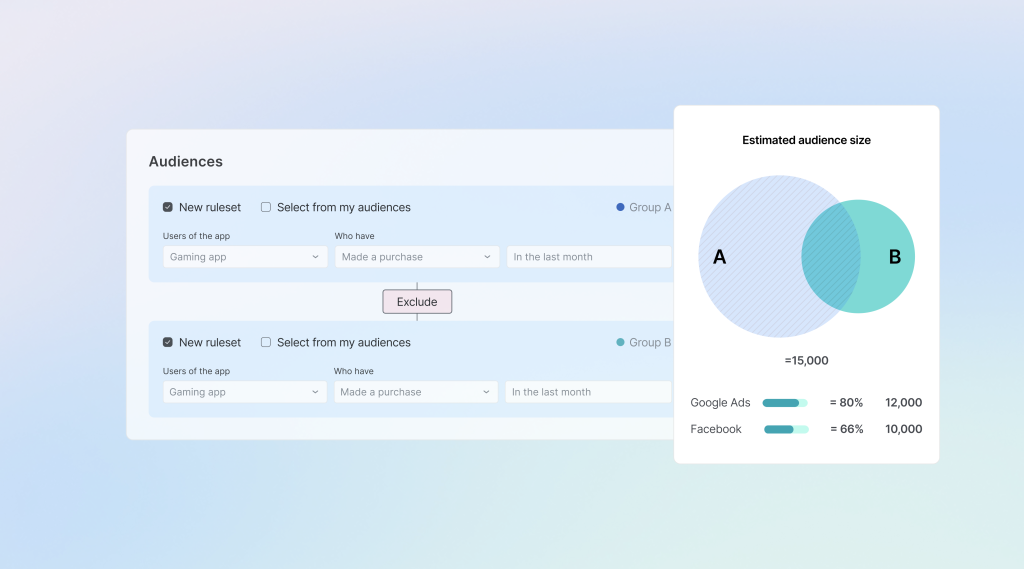

Segment audiences by previous behavior for personalized re-engagement. Customers who paused during onboarding receive “Finish your setup in 60 seconds.” Customers who checked loan rates but didn’t apply receive “Your pre-approved rate of 6% expires in 24 hours.” Re-engagement campaigns activate across push, email, and SMS. Deep links return customers to their exact abandonment point.

Target customers who abandoned in the last 30 days. Identify your top three drop-off points and create segment-specific messages. Use multi-channel outreach: push, then email, then SMS. Include deep links resuming their journey. Test timing with initial contact 3-7 days post-abandonment. Measure reactivation rates versus new acquisition costs.

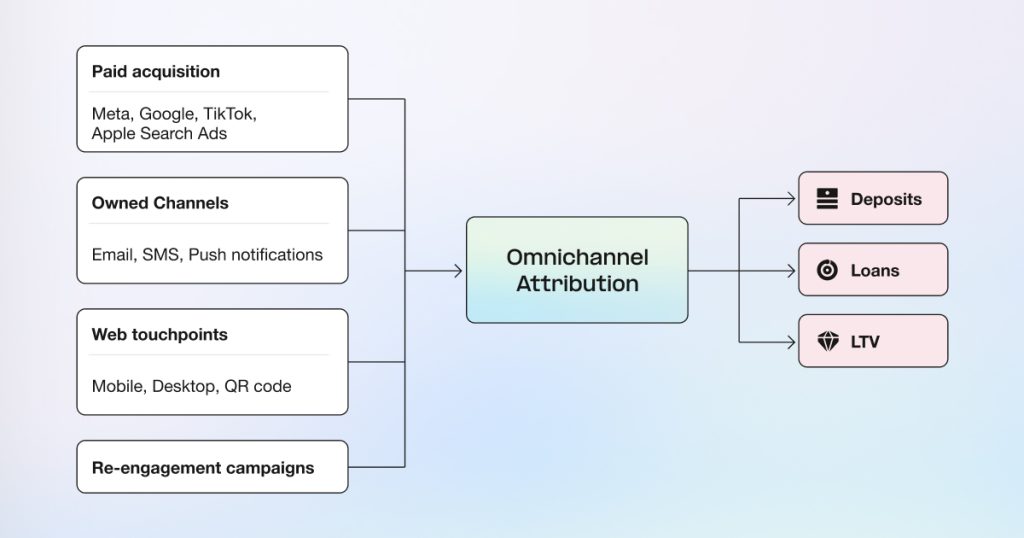

Measurement proves which touchpoints drive revenue

Your leadership wants to know which marketing channels actually drive revenue. The challenge is fragmented data across disconnected systems.

Marketing measures each channel separately across disconnected systems, making it impossible to answer leadership questions about ROI with confidence.

Omnichannel measurement stitches complete journeys together, providing one source of truth across every channel.

You walk into leadership meetings with concrete proof connecting campaigns to business outcomes like funded accounts and card activations. Instead of defending spend with incomplete data, you demonstrate measurable business impact.

Raw data exports integrate with existing BI infrastructure, allowing analytics teams to combine mobile attribution with customer lifetime value models.

Marketing teams need infrastructure supporting these 5 plays while meeting banking compliance requirements. AppsFlyer provides unified attribution across web, branch, email, SMS, and app touchpoints with raw data exports for BI integration. ISO 27001, ISO 27701, GDPR compliance, and SOC 2 Type II certification address regulatory concerns.

For comprehensive technical guidance on implementing measurement infrastructure, event mapping, deep linking, fraud protection, and attribution across all customer touchpoints, see our complete guide to winning mobile banking users.

Implementation priorities

Prioritize based on current volume and measurable impact. Start with highest-traffic touchpoints: web-to-app journeys for popular pages, email deep linking for top campaigns, branch QR codes at busy locations.

The urgency is real. Digital banks execute these plays daily while traditional banks struggle with fragmented measurement. Users spent 21.4 billion hours in finance apps during 2024, up 17% year-over-year, with mobile banking touchpoints reaching 150 per customer annually. Every quarter spent defending budgets with incomplete data is a quarter competitors gain ground.

Why traditional banks must act now

Digital banks excel at mobile execution but operate from weakness: zero existing customers and minimal trust, spending billions to acquire what traditional banks already possess.

Traditional banks have established customer bases, decades-proven trust, and regulatory expertise. Branch networks provide physical touchpoints digital banks cannot replicate.

But this advantage won’t last. Digital banks capture market share by executing these 5 plays while traditional banks debate implementation. With $6.47 billion in U.S. financial app advertising spend in 2024, a 33% increase year-over-year, the competitive intensity is undeniable. The question isn’t whether to invest. It’s whether you’ll move before other banks prove mobile ROI and secure the budget you’re still defending.

Banks implementing these plays now will demonstrate measurable business outcomes while competitors remain stuck explaining why they can’t connect marketing spend to revenue.

Take action before competitors prove mobile ROI first

AppsFlyer’s platform enables the 5 plays covered in this article. Whether you’re optimizing an existing mobile app or beginning digital transformation, we provide the infrastructure that connects marketing spend to business outcomes.

The window is closing. Banks moving first will secure leadership buy-in and continued investment.

Speak with our banking team to see how these plays work with your existing systems.

Key takeaways

- Web-to-app attribution connects browsing behavior to funded accounts and lifetime value

- Email deep linking achieves 4X higher click-to-install rates by eliminating friction

- Branch QR codes turn declining foot traffic into measurable app adoption

- SMS with 98% read rates converts urgent moments into completed actions

- Re-engagement campaigns cost significantly less than new acquisition while recovering high-intent prospects

- Omnichannel measurement provides one source of truth across all touchpoints

- Digital banks executing these plays daily are gaining market share while traditional banks debate implementation