Why banks lose mobile customers (and how deep linking wins them back)

TL;DR

- Over 75% of banking app users drop off after the first session. Deep linking fixes that by routing users directly to relevant in-app experiences from any entry point: web, QR code, SMS, email, or app

- AppsFlyer’s Deep Linking Suite eliminates friction by routing users directly to relevant in-app experiences from any entry point: web, QR code, SMS, email, or app

- Deferred deep linking ensures users without the app installed still reach the intended destination after download, maintaining campaign intent through the app store journey

- Deep linking delivers 110% improvement in day 30 retention when used for personalized onboarding

- AppsFlyer’s deep linking maintains compliance while delivering personalized experiences at scale

The conversion crisis hiding in plain sight

A customer clicks your high-yield savings email. They land on your mobile website. They try to open an account. The form doesn’t autofill. They need to download the app. They forget why they came. They leave.

You just lost a customer who was seconds away from depositing funds, and wasted hundreds of dollars in acquisition costs for nothing

Banking apps face significant day-1 retention challenges, onboarding requires customers to enter extensive details for account verification, making seamless cross-channel experiences critical, like starting on the web and continuing in the app without re-entering information.

Customer acquisition costs in banking continue to rise significantly. When most prospects abandon mid-journey due to technical friction, the financial impact compounds quickly. A bank spending $5 million annually on digital acquisition wastes millions on users who wanted to convert but couldn’t navigate the fragmented experience.

The root cause isn’t customer intent but technical implementation. Traditional links drop users into generic home screens. Users must manually navigate to find what they clicked. Each additional tap creates an exit point where motivated customers abandon.

Your competitors with intelligent deep linking capture those same customers by preserving context from click through completed conversion.

Why traditional linking fails banks

Context loss and no support for non-app users

Traditional links drop users into generic home screens, forcing manual navigation. When non-app users click links, they hit error messages instead of smooth app store transitions. Your highest-intent prospects become edge cases.

Invisible attribution and manual errors

Traditional linking provides no visibility into which campaigns drive revenue versus app opens. Developers manually configure tracking for each campaign, creating inconsistent data. Without attribution connecting touchpoints to revenue, optimization becomes guesswork.

Security and compliance risks

Basic deep linking passes sensitive customer data through URLs, creating compliance risks for GDPR and CCPA. These limitations translate directly to lost revenue and competitive disadvantage.

How deep linking solves a complex problem

Connecting user journeys is a hard problem to solve. Users come from multiple combinations of devices, browsers, platforms, and apps. They might be existing users, new users, or users who uninstalled and returned. Each combination creates complexity that breaks traditional linking infrastructure.

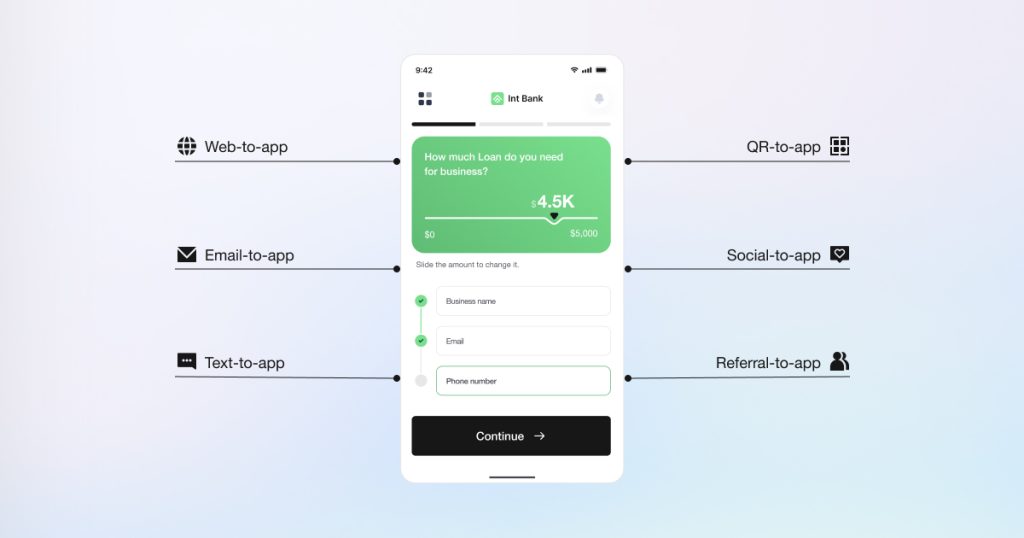

AppsFlyer’s Deep Linking Suite addresses these challenges through capabilities designed for banking’s requirements across paid acquisition, owned communications, and every touchpoint. Here’s how:

Universal deep linking preserves context

One infrastructure handles all entry points: web banners, branch QR codes, SMS, email, paid ads, push notifications. All route seamlessly whether the app is installed or not. Customers arrive at the exact in-app destination intended, eliminating navigation friction. Universal links and app links provide the technical foundation for seamless routing across platforms.

Deferred deep linking works for non-app users

When users without your app click links, AppsFlyer routes them to the app store, measures installation, then guides them to the intended destination after download. The user experiences one cohesive journey. These conversions represent pure incremental revenue traditional linking abandons. Deferred deep linking technology preserves campaign context through the installation process.

Smart Script and Smart Banners optimize web-to-app

When customers browse your mobile website, Smart Script detects their device and displays contextual banners that guide them to your app with preserved intent. A customer researching mortgage rates sees a banner to continue in the app with their calculator inputs maintained. Smart Banners enhance the customer journey by reducing friction at the critical web-to-app transition.

Branded domains maintain trust

AppsFlyer supports custom domain deep linking. Banks use their own URLs (app.yourbank.com) rather than generic shortened links, maintaining brand consistency and satisfying security requirements.

This is especially critical in text campaigns (SMS, WhatsApp, Telegram, WeChat) where the link is visible. For financial apps, branded domains signal legitimacy and build trust before users even click.

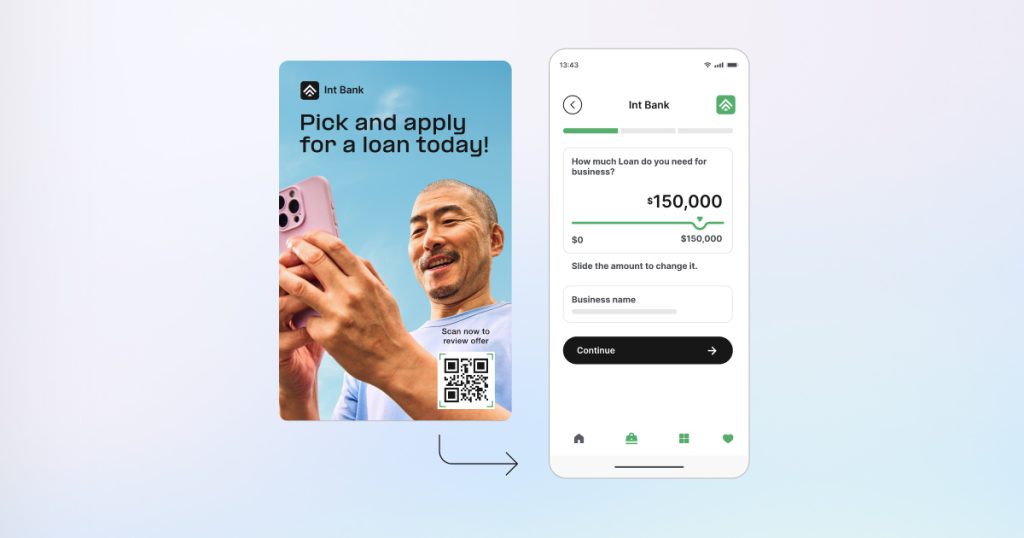

QR-to-app bridges physical and digital

Branch staff provide QR codes that launch specific in-app experiences: account opening, appointment scheduling, personalized offers. The branch conversation carries through from the physical interaction carries through to digital conversion. QR code deep linking enables banks to seamlessly connect offline conversations to digital actions.

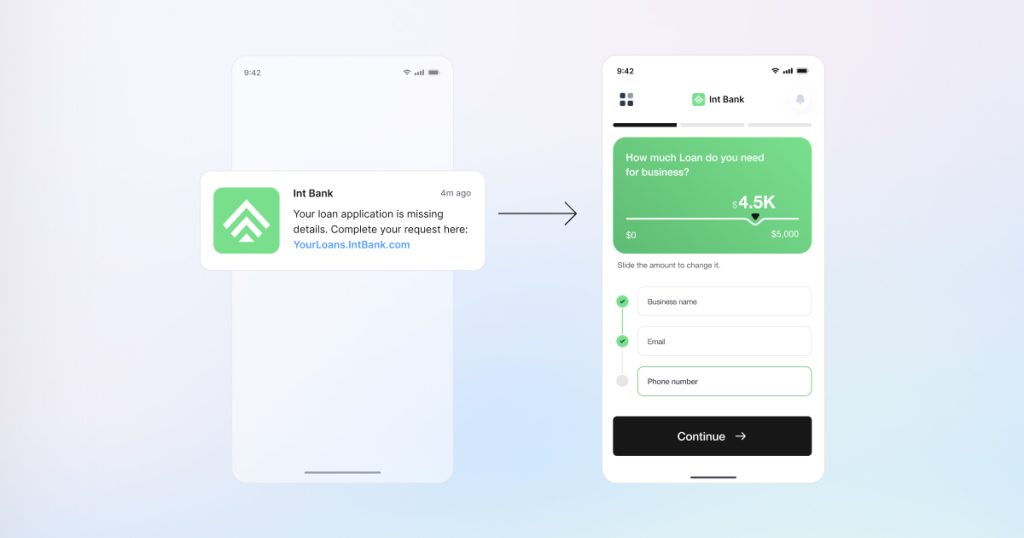

Text-to-app preserves urgency

Time-sensitive SMS notifications deep link directly to relevant app screens. A fraud alert routes customers immediately to their transaction history filtered to the flagged transaction.

Branded domains are recommended for text campaigns, providing a 40% lift in engagement based on AppsFlyer benchmarking data. Email and SMS deep linking integrates with communication platforms for automated link generation.

Real-time attribution connects touchpoints to revenue

AppsFlyer measures the complete journey from marketing exposure through conversion events like account funding, loan applications, and deposits across all channels. Marketing teams see which campaigns drive actual business outcomes. CFOs get proof that both paid acquisition and owned retention generate measurable ROI.

Automated parameter management eliminates bottlenecks

Marketing teams create and launch campaigns without engineering involvement. Measurement parameters and deep link destinations are configured automatically. What previously required developer sprints now happens in minutes.

Privacy-first architecture maintains banking compliance

All deep linking occurs through encrypted channels with no sensitive data in URLs. AppsFlyer maintains SOC 2 Type II, GDPR, and banking-grade security standards. Compliance teams approve the infrastructure while marketing teams gain personalization capabilities.

Technical implementation integrates with existing AppsFlyer SDK installations, requiring minimal additional development. Here’s how banks put this into practice:

Four deep linking scenarios that drive revenue

1. Frictionless account opening from any touchpoint

Challenge: Prospects click high-yield savings ads on Meta or Google, land on your mobile website, then abandon when asked to download your app to complete account opening.

Solution: Web-to-app deep linking routes users seamlessly. Prospects with your app installed land directly in the account opening flow with interest rate and account type pre-selected. Prospects without your app route to the app store, install, then automatically continue to account opening with all campaign context intent maintained.

Impact: Banks eliminate navigation friction. No repeated login or re-entering information. Users land directly in account creation, completing only remaining steps. Different campaigns route to different journeys: high-yield savings ads to savings accounts, credit card offers to applications. Every acquisition dollar drives more completed accounts because the journey stays continuous from ad click through funding.

Implementation: Create campaign-specific deep links for each product offering. Configure in-app destinations for account types. Enable deferred deep linking for non-app users. Measure conversion from click through account funding to calculate true acquisition ROI.

2. Owned channel optimization

Challenge: Your email campaigns generate strong open rates but disappointing conversion. Customers click mortgage refinance emails, land on your app’s home screen, then abandon because they can’t find the refinance application they clicked.

Solution: Deep linking transforms owned media performance by preserving context. Email deep links route customers directly to mortgage refinance applications with their property information pre-populated from their existing account. Push notifications about payment due dates deep link to the payment screen with the amount ready. SMS appointment reminders link directly to the appointment details with directions.

Impact: Users engaging via deep links show 2X higher transaction likelihood and 2.7X higher spend versus generic app opens. Additionally, 10-15% of users who uninstalled or switched devices return via targeted emails, with attribution tracking their post-reinstall journey. Owned media drives results when touchpoints lead directly to action.

Implementation: Audit existing email, SMS, and push campaigns. Identify high-volume communications with low conversion. Replace generic links with deep links to specific in-app destinations. Measure conversion rate improvements and transaction completion.

3. Branch-to-app QR experiences

Challenge: Branch staff build relationships and create interest, but customers who promise to “download the app later” rarely follow through. The trust and context from the in-person conversation disappears.

Solution: Branch staff provide QR codes on tablets or printed materials. Customers scan and route directly to relevant in-app experiences: account opening for the checking account just discussed, appointment scheduling with the specific banker, personalized offers mentioned during conversation. QR codes seamlessly connect physical branch interactions with digital banking experiences.

Impact: QR-to-app conversion rates remain strong because context remains intact. Customers who scan in-branch demonstrate higher completion rates because they’re converting interest into action immediately rather than relying on delayed intent.

Implementation: Deploy QR code generation for branch tablets. Configure deep links for common scenarios: account opening, appointment scheduling, product applications. Use short links that allow updating destinations without reprinting QR codes. Measure scan-to-install conversion versus customers who leave without engaging digitally.

4. Service efficiency through contextual routing

Challenge: Customer service teams spend excessive time helping customers navigate your app rather than resolving actual issues. Call times increase while satisfaction decreases.

Solution: Support teams send deep links via email, SMS, or in-app chat to relevant functionality. A customer calling about a disputed transaction receives an SMS linking directly to that transaction with dispute filing instructions. A customer asking about direct deposit setup gets an email linking to account settings with routing numbers displayed.

Impact: Average handle time decreases as navigation becomes instantaneous. Customer satisfaction improves because service teams solve problems rather than provide directions. Support costs decrease as more issues resolve through first contact.

Implementation: Integrate deep linking into CRM and support platforms. Train support teams to send contextual deep links. Create templates for common scenarios. Measure impact on average handle time and first-contact resolution rates.

Why banking compliance works with deep linking

AppsFlyer’s Deep Linking Suite meets banking security requirements. SOC 2 Type II and ISO 27001 certification demonstrate infrastructure meets banking standards. All deep linking occurs through encrypted channels with no sensitive data in URLs. Deep linking respects user consent preferences, with personalization occurring only for opted-in customers. Complete audit logs track every deep link for regulatory reporting. AppsFlyer supports GDPR, CCPA compliance, and data residency requirements.

Your next steps

Start with high-value acquisition campaigns

New customer acquisition represents your largest marketing investment and greatest conversion friction. Measure deep link performance to quantify improvement in conversion rates and customer acquisition efficiency.

Start with high-value acquisition campaigns to quantify conversion improvements. Expand to owned communications (email, push, SMS). Deploy QR-to-app for branch staff. Focus measurement on conversion completion, not app opens. Use attribution data to demonstrate marketing’s ROI contribution to leadership.

Key takeaways

- Over 75% of app users drop off after first use due to friction. Deep linking maintains intent from click to completed action, driving measurable conversion improvements across acquisition and retention.

- Deferred deep linking converts non-app users after installation. Owned channels deliver 2X higher transaction likelihood and 2.7X higher spend. QR codes connect branch conversations to digital conversion.

- Banking compliance is built-in. SOC 2, ISO 27001, GDPR, and CCPA compliance work alongside personalization without compromise.

- Attribution connects spend to revenue. Cross-platform measurement shows which campaigns drive actual account openings, deposits, and loans.

Turn every marketing touchpoint into a completed conversion. See how AppsFlyer’s Deep Linking Suite helps banks create seamless journeys from click to revenue or book a demo.