There is no retention without attention.

Retention rate is a key performance indicator that provides valuable insights into an app’s performance, particularly in terms of user loyalty and engagement. It plays a pivotal role in optimization, monetization, and revenue forecasting. Giving proper attention to retention allows us to stay on track with our campaigns and make informed decisions.

But let’s face it, making it work is a huge challenge. Mostly because of Intense competition (and that’s an understatement) within popular categories, and the increasing demand and expectation from users for a super smooth experience.

After high retention rates during covid days in 2020 and 2021, when people were looking for entertainment when social distancing measures were in place, numbers naturally declined in 2022. But 2023 marked a low point for performance with a drop of roughly 12% in daily rates.

Explore app retention benchmarks – average and top 10%

On top of that, there is the challenge of privacy — namely the loss of user-level data and data signals beyond the first days of a campaign. It is no surprise that app marketers often feel as if they’re operating in the dark.

The reality is that relying on user-level data to measure and optimize campaigns is quickly becoming a thing of the past — currently in iOS and soon on Android. Instead, app marketers will have to be more savvy, taking advantage of new measurement methodologies to optimize user acquisition campaigns to pinpoint channels that drive loyal users.

While retention is currently difficult to measure on iOS devices, benchmark data continues to be a valuable resource based on data from consenting iOS users (although a minority, it’s not a negligible number), Android usage, and overall retention rates from organic and non-organic installs combined.

Owned media activities like push notifications, email, and SMS have become a crucial component of a comprehensive app marketing strategy, offering new opportunities to drive lifts in retention and long-term LTV of existing users.

The data used in this report covers 18 billion app installs across 17,000 apps in the third quarter of 2023. Data is fully anonymous and aggregated. To ensure statistical validity, we follow strict volume thresholds and methodologies.

Daily retention across iOS and Android dropped 12% in 2023

As time goes by, retention becomes a bigger challenge. The outcome is a decrease in retention rates, compared to the same period last year, as users are less loyal to one particular app.

Several events were reflected in the retention rates throughout the calendar year. Firstly, the impact of COVID-19 and the home quarantines boosted screen time across a larger selection of apps.

After steady retention rates, overall daily retention across both platforms dropped about 12% in 2023, as iOS joined Android in the decline this year. iOS apps saw Day 30 retention decrease by 4.4% in 2022, and by almost 14% in 2023. Android figures for Day 30 were even grimmer, dropping 18% YoY.

Mixed bag of results on a category level: Transportation, Photo & Video, and Travel enjoy growth but Casino & Gambling, Dating and Social media apps decline

As a marketer, it is natural to aspire for a compelling growth story. However, this year we’ve witnessed notable success primarily in Android Transportation, Photo & Video, and Travel apps. On the other hand, News apps continue to maintain their category-leading position with a retention rate of 9.1%, despite experiencing a decline of 12% in the retention rate.

When we dive into Android app categories, we see that Gaming and Lifestyle apps managed to keep their average Day 30 retention rate at the same level. However, Casino & Gambling apps experienced the most significant decline with a 31% plunge, joining Dating apps with a 20% drop and Social media apps with an 18% drop.

Similarly, iOS retention rates have also shown less favorable outcomes, with a YoY Day 30 retention decrease averaging 8% across most app categories. While Android Photo & Video apps witnessed an increase of 13% in Day 30 retention, iOS apps saw a decline of 5%. Moreover, substantial declines were observed in categories such as Entertainment (-19%), Finance (-18%), Utility & Productivity (-14%), Food & Drink (-12%), Social Media (-11%), and Shopping (-8%)

In short, marketers will need to think creatively how to regain their users’ loyalty, ensuring they are less likely to abandon the app.

Gaps in retention in developed compared to developing countries

Looking over the map pokes out the differences between Day 30 retention in developed countries and developing countries. We can see that the rate is higher in developed countries/regions. This can be attributed to various factors, including the constant pursuit of discounts by users in developing countries. With a greater emphasis on price, brand loyalty tends to diminish.

In terms of Android Day 30 retention rates, developed countries like Australia, Canada, France, and Germany surpass the average rates. Conversely, countries such as Vietnam, Nepal, and Indonesia display lower rates below the average. On the iOS platform, some developed countries like the United Kingdom and the United States fall below the average retention rate.

On top of that, Japan continues to stand out as the leading developed country with an impressive Day 30 retention rate of 4.98% on Android and 5.25% on iOS.

How to improve retention rates

With challenge comes opportunity. Yes, the competition is getting heated. Yes, users are more price-conscious than ever and have increasingly higher expectations. No, the situation is not impossible. Here are some ideas on how you can improve your user retention heading into 2023:

- Create superb UX: Strong retention rates begin with effective first time user experiences. Set realistic expectations with your users at the moment of install and deliver on what you promise. An exceptional user-experience plays a key role to drive ongoing customer loyalty and profitable LTV.

- Utilize deep linking: Make sure you use deep links in your UA campaigns, and deliver a seamless onboarding experience where users are taken directly to the content they are most interested in viewing. The goal is to streamline the customer journey, moving the user from advertisement to install to conversion without friction.

- Leverage owned media: Take advantage of your owned media sources such as push notifications, email and SMS campaigns to drive higher engagement and improved retention rates. Lifts in day 30 retention for apps that use owned media remarketing show that there is untapped potential for this medium in the coming years.

- Invest in re-engagement campaigns: Invest in consistent and value-driven re-engagement campaigns tailored to the user, beginning within a week of the install and continuing throughout the customer’s lifecycle.

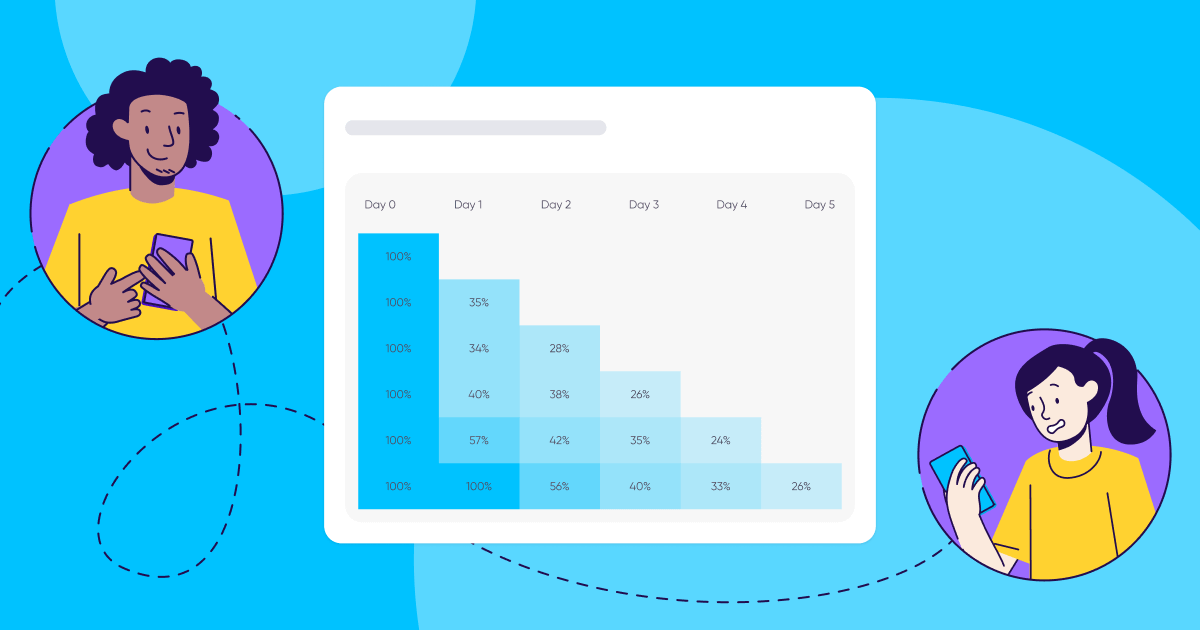

- Embrace new measurement frameworks: In today’s privacy-centric reality, the main challenges in driving re-engagement campaigns are limited data, and the need to rely on aggregated data of user level metrics. Implementing measurement frameworks such as incrementality, predictive, and cohort analysis will help you plan, execute, and optimize your re-engagement strategy.

- Compare against benchmark retention data: If you haven’t already, begin leveraging a wider range of app metrics. Even though iOS user-level information and retention data may not be available, benchmark reports and Android app trends can offer valuable insights that can be used to build out retention strategies.