Key findings

Introduction

Retail media is growing up

Retail media has experienced incredible growth over the past few years. According to WARC, global retail media spending surpassed $150 billion in 2024 and is projected to exceed $200 billion in 2025, reaching $280 billion by 2027. RMNs now represent a staggering 20% of all digital ad spending, a dramatic shift that reflects their growing centrality to modern advertising strategy.

What used to be a last-click tactic for CPG brands has turned into a boardroom-level conversation across industries. But rapid growth brings complexity. RMNs are being asked to prove incremental value beyond clicks, scale data partnerships without drowning their engineering teams, balance privacy requirements with actionable insights, support multiple identity frameworks simultaneously, and demonstrate real business outcomes to increasingly sophisticated advertisers.

The market has also matured in ways that create new friction. Clean rooms and data collaboration platforms, once positioned as neutral tools for secure data sharing, have largely been acquired and folded into larger strategic platforms. Today, the most recognizable clean room offerings sit inside cloud providers, identity companies, publishers, or agency holding companies.

This wave of consolidation has altered the economics and incentives around data collaboration, leaving RMNs in a position where they’re increasingly dependent on infrastructure that may not have their best interests at heart.

To operate at scale, RMNs need collaboration infrastructure that works across any agency or publisher, in any cloud environment, and doesn’t force them into a specific identity spine. Neutrality has become imperative.

RMNs have moved beyond selling ads. They’re building the infrastructure that makes data-driven marketing work. Those that design for openness, integration, and measurable results will be the ones that last.

This research was designed to help the industry move forward — by identifying where retail and commerce media networks are thriving, where they’re constrained, and what kinds of infrastructure and partnerships will unlock their next stage of growth. Drawing on our experience working with leading networks and advertisers worldwide, we set out to provide an informed view of what it takes to scale these businesses sustainably.

Methodology

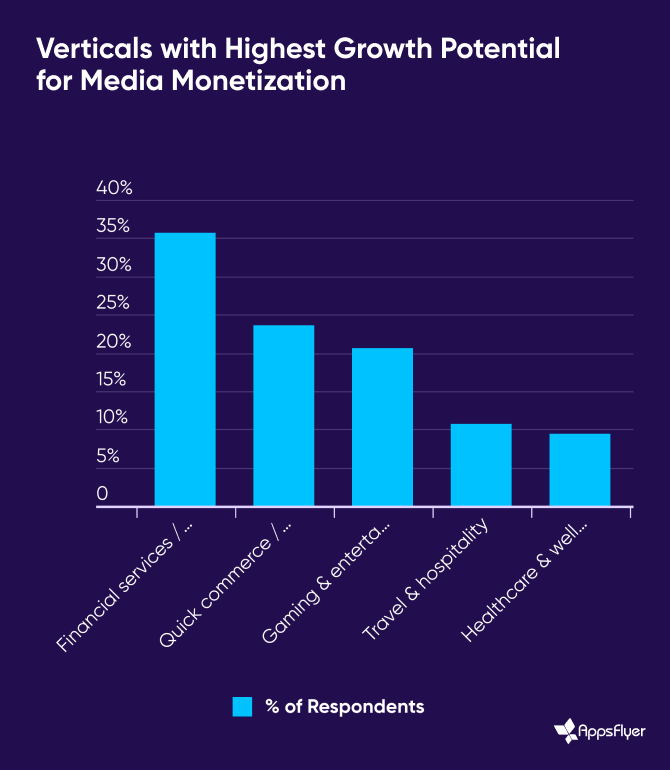

480Retail Media Network professionals spanning industries including retail, quick commerce, gaming, travel, fintech, and health and wellness.

Key Trends

The identity rebellion is on

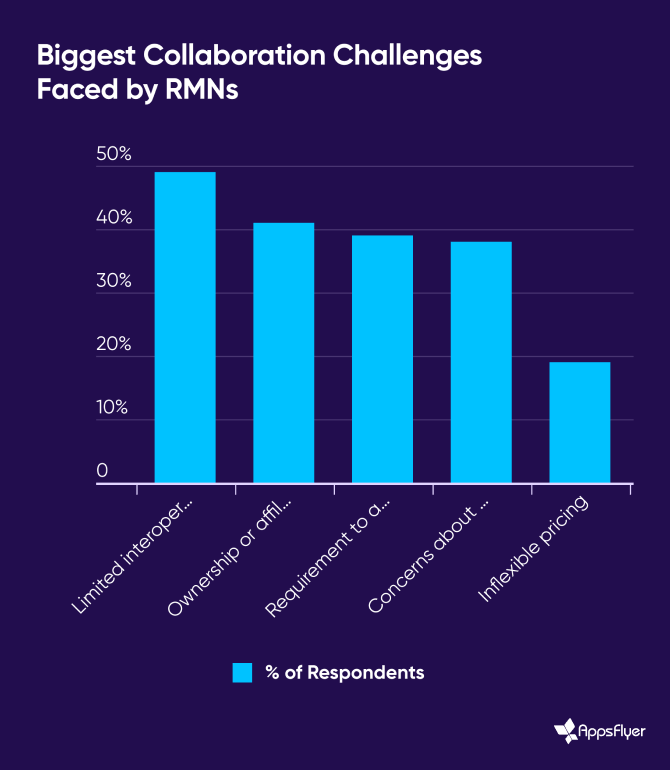

Thirty-nine percent of RMNs cited being locked into a specific identity graph as their biggest collaboration blocker. This was the single most common pain point we heard.

The market is flooded with closed-loop identity solutions from cloud platforms, walled gardens, and retail tech vendors. Most of them promise interoperability, the ability for systems to work together across different platforms, but deliver dependency.

RMNs are required to license an identity spine they didn’t choose, align with a framework that doesn’t match their audience strategy, or accept that working with certain partners means adopting their entire ecosystem.

The problem is strategic, not just technical. When clean rooms are coupled with proprietary identity graphs, participation often requires using that framework as a condition of entry. This limits interoperability, increases costs, and creates the kind of vendor dependency that RMNs are actively trying to avoid as they build out their media operations.

RMNs want something simple: systems that work together. They want to collaborate with advertisers across multiple identity frameworks without sacrificing privacy or utility. They want to bring their own identifiers when it makes sense and integrate with external identity providers when it doesn’t. They want flexibility, not another walled garden disguised as a solution.The takeaway: Retail media’s identity rebellion is real. If your platform forces RMNs to adopt a single identity framework, you’re not solving their problem, you are becoming part of it.

Control is the new compliance

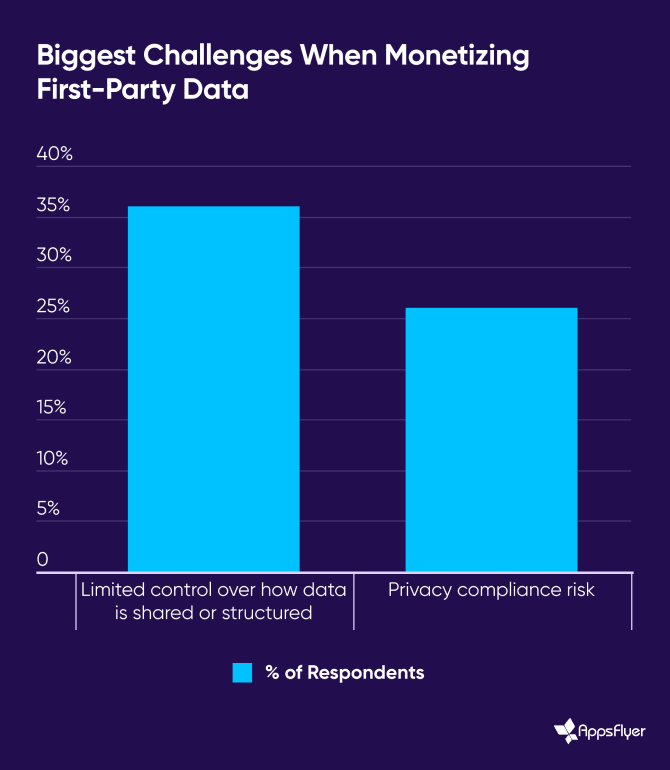

Thirty-six percent of RMNs said their biggest challenge when working with brand advertisers is losing control over how their data gets structured, shared, or used. This isn’t about checking privacy boxes or meeting regulatory requirements. Those are baseline expectations. This is about governance.

RMNs want to dictate how their data is used, who can access it, what they can do with it, and when that access expires. They want audit trails, consent-based permissions, andthe ability to revoke access if terms change or partnerships end. Clean rooms solve part of this problem by creating secure environments for data analysis, but they don’t solve the issue of governance, especially when the clean room itself is owned by a media buyer, agency network, or publisher.

These embedded structures create unavoidable conflicts of interest. When the infrastructure you’re using to collaborate is owned by someone who competes with you or buys from you, trust is compromised. RMNs working with multiple brands and advertisers need the clean room to serve as neutral ground, not as a lever for someone else’s commercial strategy.

The shift from privacy compliance to data sovereignty is happening fast. Standards like the IAB Tech Lab’s Data Clean Room (DCR) framework, Publisher Advertiser Identity Reconciliation (PAIR) guidelines, and Attribution Data Matching Protocol (AdMaP) are emerging to help establish best practices. But standards alone won’t solve the structural problem. RMNs need infrastructure that’s built for independence, not embedded within competing business models.

The takeaway: Clean rooms aren’t enough. The next generation of collaboration tools will be defined by transparency, access control, and governance that RMNs can actually enforce.

Retail media budgets are booming, and go beyond retail

Twenty-four percent of respondents identified quick commerce and delivery as the top growth vertical for retail media beyond traditional retail. Meanwhile, 24% of RMNs reported a 20% or greater increase in advertiser budgets towards retail media.

This is where the narrative around retail media needs to catch up with reality. Retail media is becoming commerce media. It’s not just grocery chains and big-box stores anymore. It’s ride-share apps analyzing trip data to sell ad placements;fintech platforms monetizing spending behavior; travel sites leveraging booking intent; and gaming environments turning engagement data into targetable inventory.

These companies might not call themselves retailers, but they have the same assets: high-intent users, logged-in traffic and 1st party data, transactional data, and the ability to close the loop on outcomes. The infrastructure that powers retail media, such as identity resolution, audience segmentation, and closed-loop measurement, applies just as well to these verticals, and in many cases, the data is even richer.

The expansion of retail media into adjacent categories isn’t theoretical, it’s happening now at a rapid pace. Social commerce sales are projected to reach approximately $900 billion globally in 2025, driven largely by platforms like TikTok and Douyin that have turned short-form video into a performance format. Retail media CTV ad spend is also expected to exceed $10 billion by 2028 as retailers extend their reach into connected TV environments.

What this means for RMNs is straightforward: the market opportunity is much bigger than traditional retail, but the infrastructure needs to be flexible enough to support vertical-specific use cases. A travel platform’s measurement needs are different from a fintech app’s. A gaming company’s identity strategy won’t look like a grocery retailer’s. The RMNs that can adapt their platforms to serve diverse industries without requiring massive custom builds will be the ones that capture this growth.

The takeaway: Retail media is morphing into commerce media, and it’s expanding into every industry with real-time user data and untapped monetization potential. Build for horizontal scale, not just retail.

Incrementally Is urgent. And mostly unsolved

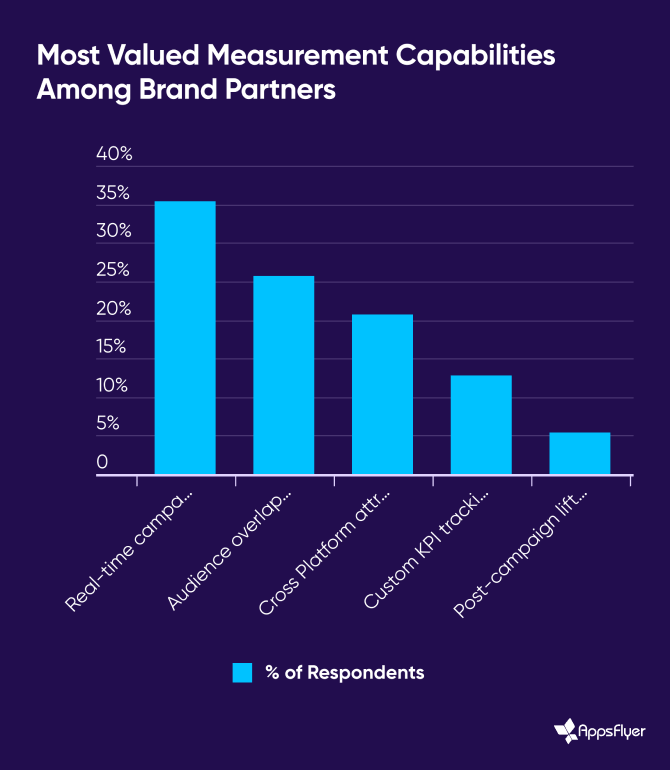

When we asked RMNs what measurement capabilities they need most, 21% said cross-platform attribution and incrementality. When we asked about their biggest ROI challenge, 16% said proving incremental impact — making it a top request and not a nice-to have.

Brands are moving real budgets into RMNs, and they need to know what’s actually working. To do that, they need to utilize complimentary measurement methodologies: both bottom-up (attribution of specific user actions and real time campaign performance reporting), and top-down (incrementality, which looks at aggregate, causal impact — how much of the observed performance would not have happened without marketing).

The problem is that most RMNs, especially newer ones, don’t have the infrastructure to measure either properly.

Advanced measurement requires integrating disparate data sources, supporting cross-device compatibility, and enabling SKU-level tracking across onsite and offsite media. It also depends on machine learning models that can account for incrementality without relying on PII, along with the capacity to run lift studies, deduplicate conversions across channels, and deliver closed-loop reporting brands can actually trust.

This is where retail media’s next chapter will be decided. The RMNs that can quantify incremental value will lock in bigger budgets and deeper partnerships. The ones that can’t will get squeezed out by platforms that can.

The takeaway: Retail media’s future depends on proving what truly works, Incrementality can unlock long-term brand investment, and RMNs need infrastructure that can deliver it at scale.