The European Finance app market is changing. Here’s what the data shows

TL;DR

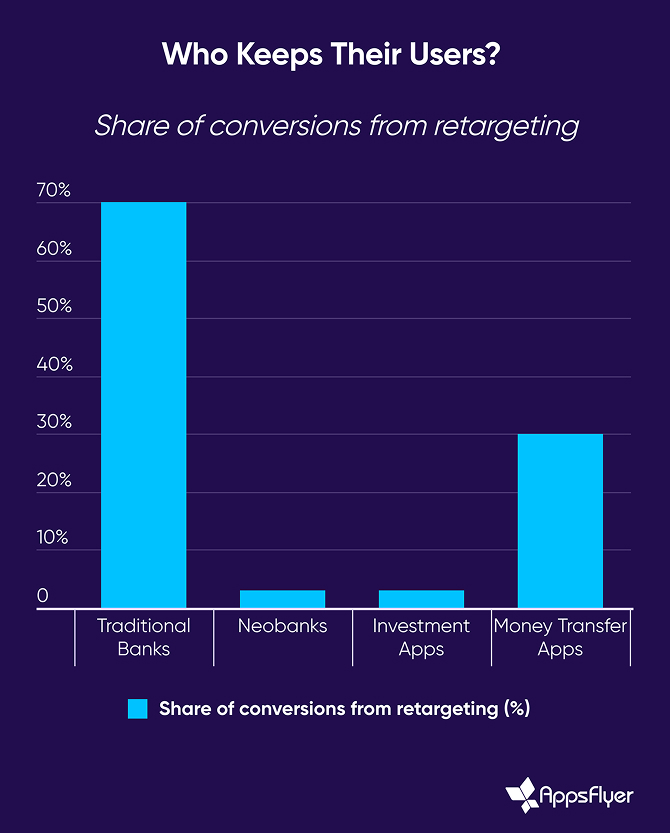

- Banks excel at retention: Retargeting drives 55–85% of their conversions, but new user growth has flatlined.

- Neobanks lead in acquisition: In France, they attract twice as many new users as traditional banks, but only 3–4% of conversions come from retargeting.

- Investment apps are international and volatile: Over 85% of installs come from non-European providers; growth rises and falls with crypto cycles, while retention drops to just 4% by Day 30.

- Money transfer apps grow fastest: US and Nigerian providers dominate; retargeting drives up to 40% of conversions, one of the highest rates in finance.

- The opportunity lies in cross-learning: The next winners will combine the strengths of each model — banks’ retention, neobanks’ digital-first acquisition.

Europe’s finance app market has matured — and fractured

Europe’s finance app market is in transition. The digital banking boom that once powered rapid user growth has reached a point of maturity. Today, competition is no longer about launching a finance app — it’s about sustaining and scaling one in a crowded, data-driven market.

Across the region, consumers are more mobile — both literally and digitally. They’re switching between traditional banks, neobanks, and global platforms with unprecedented ease, drawn to new features, better experiences, and real-time access to financial tools.

Using anonymised data from more than 180 million installs across 187 apps in the UK, France, and Germany, AppsFlyer’s latest analysis reveals how different players are performing in this new stage of the market. The findings show sharp contrasts in strategy — and major opportunities for those willing to learn from other segments.

Traditional banks, neobanks, and international platforms each dominate in their corners. But while every segment has cracked part of the growth equation, none have built a balanced strategy across acquisition and retention. The next winners will be those who step outside their silos and borrow from their neighbors’ strengths.

Key findings by segment

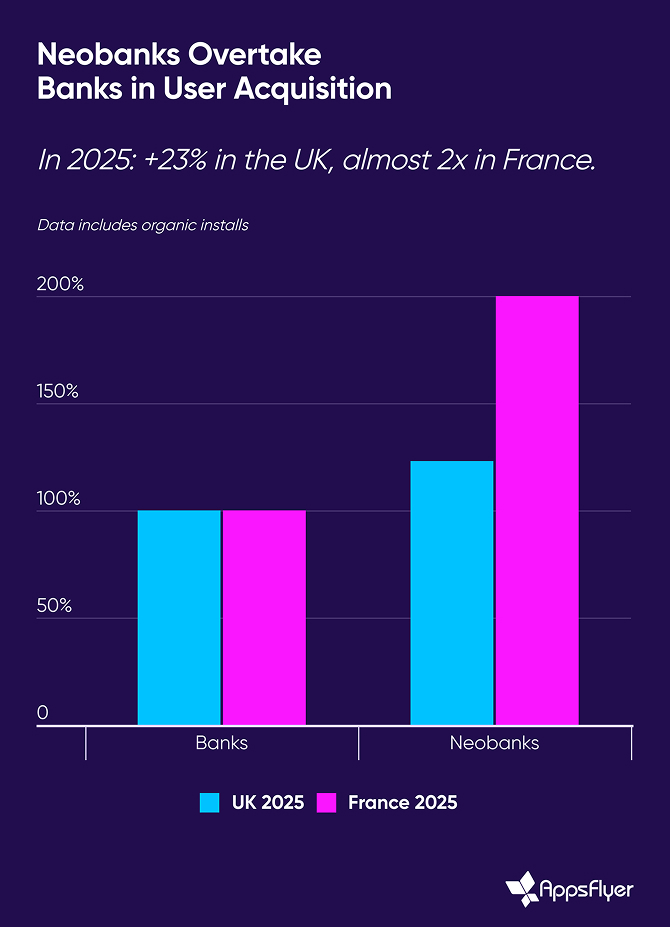

AppsFlyer’s latest analysis across the UK, France, and Germany shows the scale of the challenge. More than 85% of installs in investment apps now come from international providers, money transfer apps are the fastest-growing finance segment, and in France,

neobanks are attracting twice as many new users as traditional banks.

Banks: masters of retention, but stuck on growth

Traditional banks are unmatched in their ability to keep customers engaged. Retargeting drives up to 85% of their conversions, helping them achieve day-30 retention rates that are 1.5–2x higher than neobanks. They’ve built sustainable acquisition models by cross-selling to existing customers and converting web or branch users into app users, with nearly half of installs generated by owned media.

But growth has flatlined. Across Western Europe, there’s no recorded increase in new users. Banks’ reliance on their existing base makes them strong in the short term, but leaves them vulnerable to neobanks and fintech apps that are winning the race for new users.

Neobanks: winning new users, missing out on retention

While banks lean on retention, neobanks have taken the lead in acquisition. In both the UK and France, they’ve surpassed traditional banks in attracting new customers. In France, the shift is striking: consumers now show a two-to-one preference for neobanks and digital wallets over traditional banks.

Their growth comes from diversification. Around 35% of their installs still come from owned media, but they’ve invested heavily in SANs — led by Google, with TikTok playing a key role in reaching younger audiences underserved by traditional banks — alongside ad networks and DSPs. This approach has helped them capture younger demographics that banks struggle to reach.

Yet retention remains their weak spot. Just 3–4% of neobank conversions come from retargeting, leaving long-term value untapped.

Investment apps: global dominance, volatile performance

Investment apps operate on a very different model. They are overwhelmingly international, with more than 85% of non-organic installs across the UK, France, and Germany coming from providers outside Western Europe.

More than three-quarters of installs are paid, and growth rises and falls with Bitcoin and other crypto prices. When markets rally, installs spike; when they fall, churn accelerates. Retention is especially weak: only 19% of users remain on day one, and by day 30 the figure drops to just 4%.

The media strategies behind this growth are also unusual. Over 80% of paid installs come from smaller agencies and ad networks, while only 15–20% come from SANs or owned media. This long-tail mix enables scale but often results in sub-par traffic quality, compounding churn during downturns.

Money transfer apps: fast growth, high reliance on existing users

Money transfer apps tell yet another story. This is the fastest-growing sub-vertical in Western Europe, led by providers from the US and Nigeria, with Indian players also gaining traction in the UK.

Unlike investment apps, money transfer apps thrive on re-engagement. Between a quarter and 40% of their conversions come from retargeting. That reliance on existing customers has helped them grow quickly while maintaining active usage.

Missed opportunities across segments

Each category has carved out a winning formula, but also exposes weaknesses. Banks are experts in retention but ineffective in net-new user growth. Neobanks scale acquisition rapidly but neglect retention. Investment apps drive volume but churn heavily. Money transfer apps are thriving today but must defend against intense global competition.

Taken together, these blind spots create a fragmented market where no single player has a complete growth strategy. Closing those gaps will require a more collaborative mindset — learning from what’s already working in other parts of the ecosystem.

What finance apps can learn from each other

Each segment has developed its own strengths — but no single approach works in isolation.

- Banks can modernise acquisition by borrowing from neobanks’ diversified, digital-first strategies and experimenting with new channels like TikTok.

- Neobanks can strengthen lifetime value by adopting banks’ retargeting frameworks and applying ecommerce-style predictive LTV and re-engagement models.

- Investment apps can use banks’ retention and cross-sell playbooks to engage users beyond the first transaction and build resilience during downturns.

- Money transfer apps show how retention-led growth can scale sustainably — a model other categories can emulate as they mature.

The strategic imperative

Specialisation has carried each segment this far. But the future belongs to those who blend the best of every model: banks’ retention, neobanks’ acquisition agility, investment apps’ scale, and money transfer apps’ re-engagement strength fuelling their growth.

Banks must expand digital acquisition without losing their retention edge. Neobanks that already offer investment products should put more focus and campaigns behind them to compete directly with global platforms. Investment apps must reduce their dependency on volatile crypto cycles with stronger engagement strategies. And money transfer apps should continue leveraging their strong retargeting base while preparing for intensifying competition.

The bottom line: in today’s crowded market, the most effective strategies aren’t always invented in-house. They’re borrowed, adapted, and refined — often from competitors who have already proven what works.

About the data

This analysis is based on anonymous, aggregate data from 187 finance and fintech apps across the UK, France, and Germany, covering the period from January 2022 through July 2025. It includes data on more than 180 million app installs and over 65 million retargeting conversions annually. Non-organic installs, retargeting conversions, and retention metrics were derived from AppsFlyer’s attribution platform.