App marketing in times of uncertainty – the experts’ take

The world is currently dealing with an unprecedented reality, as employees and businesses alike are facing significant economic uncertainty. The coronavirus has already hit the global market hard – especially in some industries and regions more than others – and a recession is likely ahead.

What does the future hold for marketing in such circumstances? While many other industries have seen revenue drops, the same may not necessarily be true for apps.

AppsFlyer has been keeping up with coronavirus marketing trends as they occur and we’ve seen that there are many opportunities for mobile apps. In fact, many app verticals have seen a surge in usage and significant revenue uplift in the last few weeks as people are at home and turn to apps for social and practical use.

To better understand how to manage marketing budgets during the uncertainty of the times, we sat down with three experts from leading apps across regions and verticals to get their take:

- Manav Sethi: the Group Chief Marketing Officer from Eros International, one of the leading global companies in the Indian entertainment industry with over 26M paying users and 180M registered users.

- Shay Ze’ev Yosifon: is the VP of Marketing at Beach Bum, one of the top card and board gaming companies with leading evergreen games like Lord of the Board and Spades Royale.

- Stephanie Pierce: the Head of Growth Marketing at Quicken, maker of America’s best-selling personal finance software, and newly released Simplifi by Quicken, a personal finance app.

Read on for more!

Marketing spend

AppsFlyer: How do you see the marketing spend going forward? In the short term, many verticals are seeing increased usage in app activity as people stay at home. On the other hand, as the recession is looming and people are losing their jobs, consumer LTV can drop, which can obviously impact spend in the long-term. How do you see this on your end?

Shay Ze’ev Yosifon: It’s an interesting question. I think that in the short term, we’re seeing two contradicting trends. On one hand, we’re seeing the supply grow as people spend more time with their devices consuming content. On the other hand, in some verticals, there is a drop in demand where, in others, a lot more competition.

When looking at Entertainment and more specifically, at Gaming, there’s definitely a lot of competition. All the big players are moving very aggressively. So, the competition overall has not gone away completely. Since some players understand that it is an opportunity, we’re going to see an increase in competition for that screen time.

Longer term, yes, a recession always hits everyone’s pockets, but I do think that people still need entertainment. Some might say that it’s a form of escapism. It’s a way to forget your troubles for a while.

Therefore, I don’t think [corona] is going to necessarily have a very big impact [on revenue for certain verticals especially]. I think it can, but we also need to adjust our approach accordingly. It’s how we handle our customers and how we retain them and how we make sure they’re entertained even though they’re not paying users.

I do think that it’s only a midterm drop in revenues and that, longer term, we’ll see that coming back up.

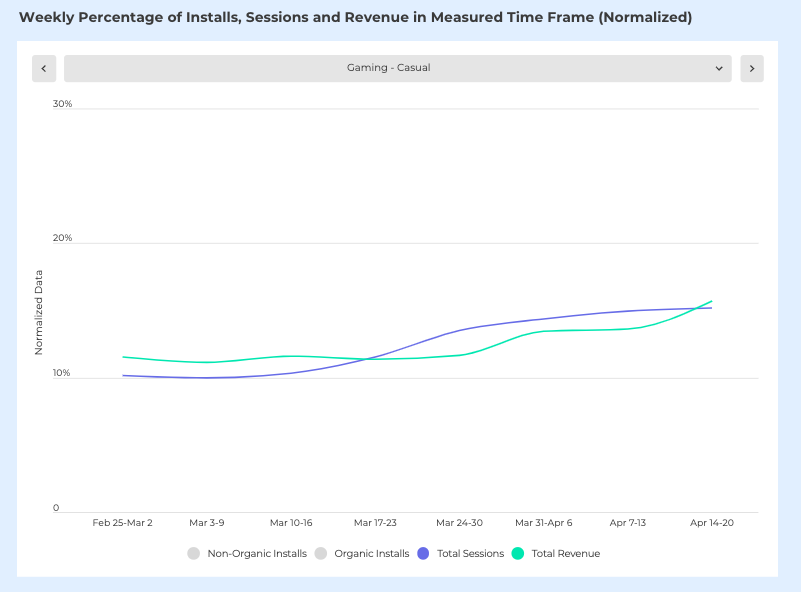

(AF: Beach Bum Games belong to the Casual Gaming vertical, the latest session and revenue trends for which are highlighted in the graph below)

Stephanie Pierce: I was in the digital media space during the last recession back in 2008/2009, where we did see a decrease in ad spending across some of the clients I was working on, agency side. But this is completely different, which makes it hard to draw too many similarities.

The fact that we don’t know how long everyone will be in this situation makes it very hard to predict much, if anything.

From my perspective, media spend predictions in the short term will vary drastically by industry. Obviously, Travel has been hit really hard, which is sad, but not shocking. [Many retailers] in the United States have had to close their brick-and-mortar businesses and so, I think that it could go either way.

Maybe they will take marketing dollars that normally support their brick-and-mortar stores and put more towards online.

However, in the [Fin]tech space, at least for a company like Quicken, we’re a little bit more resilient, as our products, both Quicken and our new mobile-first product, Simplifi by Quicken, are extremely helpful for people right now. There is no better time to get on top of your personal finances, plus many people have extra time to do so.

I think this is just so different from any type of recession in the recent past, which makes it very hard to know what it will be like in six months or a year, etc.

Manav Sethi: Unlike in the past, this is possibly the first time where internet and mobile-led internet is available at scale. That has never happened in the history of the human race.

What you’re saying is absolutely right: there is an uptake in consumption, downloads, monetization, and revenues in categories like Shopping and Video. So short-term, I think that there are [significant growth trends for two main] categories, which are low-price entertainment and utilities.

If you look at eCommerce, there is a new category called Essentials, because we know that the constraints are not only from the availability of the SKU spread, but also from a distribution POV. Meanwhile, people are still using shampoos, soaps, basic detergents, groceries, consumables, etc.

That is still continuing to happen, and there continues to be a need. So I think in the short term, such SKUs and categories will continue to grow.

From a long term standpoint, I think it depends on how long this period will be. As it happens in every downturn, people start to look inwards. As a marketer, it is incumbent to look at the emerging segmentations and categories which possibly either never existed before or where you didn’t focus many resources.

In this new normal, their entire demand has shifted because consumer patterns have shifted as people start to conserve more cash. On the other side of this, consumption will come back to normal, though it will take time, perhaps as late as Q2 or 3.

Also, this is possibly the first time where [all our] behaviors, psychology, interactions with others, and interactions with our surroundings are going through such a shift. So a lot of new trends, new patterns, and new categories, which never possibly existed at scale, are going to emerge on the other side.

From a marketing standpoint, because of this, we will need to take a balanced approach between being defensive as well as offensive.

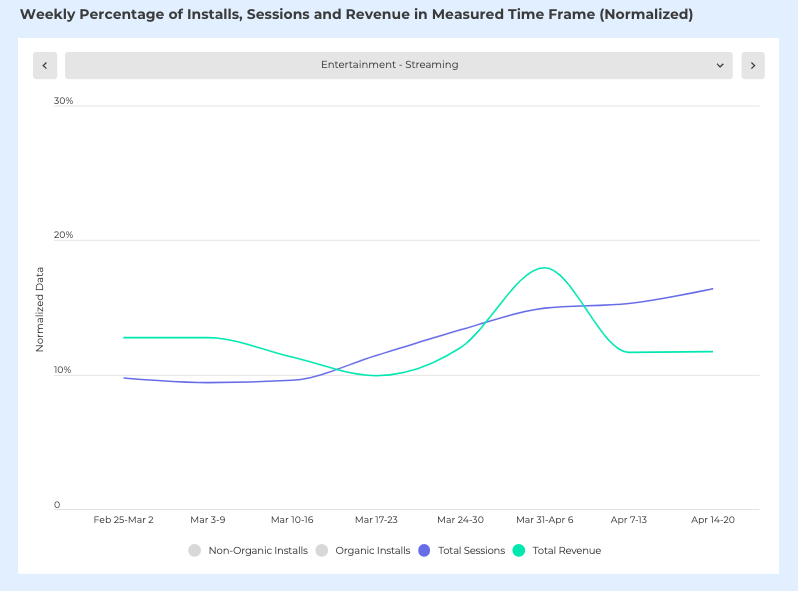

(AF: Eros International belong to the Streaming Entertainment vertical, the latest session and revenue trends for which are highlighted in the graph below)

Number of media sources

AF: In terms of the number of media sources that you use, are you decreasing or increasing the amount, or will you keep it the same?

Shay: I think it’s pretty much the same, but we’re always looking for opportunities. Right now, I don’t think it’s necessarily to reach out to new sources, but if you were planning on expanding, then now is a good (and maybe cheap) time to do so.

We’re expanding our portfolio according to the opportunities that we find. Ultimately, I think it’s a matter of allocating budgets according to where you see growth potential.

Stephanie: I would say it’s fairly business as usual, but we are trying some new channels to evolve with the changing times. The big players in the space, regardless of these times, remain important for scale.

Manav: I think the channel mix and layering is going through a complete change. For example, realize that, at least in India, we are not getting print paper at all, as well as that India is not a significant smartphone population (300M+ against 1.3B people). So people are going to read in PDF on their screen, but they’re not gonna invest, recall, or focus on the ads on their screen.

[As for mobile specifically], absolutely yes. I mean, who would have thought that Gaming would acquire such scale in these times, because people have disposable time and are at their homes where they have access to Wi-Fi. So I would want to go back and realign that equation across more networks.

And I’d also want to reallocate from inefficient publishers, or apps, which are witnessing incremental uptake.

(AF: The AppsFlyer Performance Index is one of the best resources for evaluating media source quality across regions, verticals, and subcategories.)

Marketing methods

AF: What about changes in terms of the methods that marketers are using? Are you going to also look more at retargeting or maybe use more your own channels like social, cross-promotions, things that are cheaper?

Shay: I mean, 2020 is the year of remarketing anyway, and more and more mediation platforms offer easier ways of cross-promotion. So I think, anyways, that 2020 was a year of moving away a little bit from user acquisition [towards retargeting], and the current situation might accelerate that growth.

That being said, you can find good opportunities in all marketing channels and you shouldn’t necessarily push one over another. Now is a good time (for some verticals) to expand on all marketing fronts and see where we get the most value.

Stephanie: Yeah, the marketing plan and tactics that we had originally set for 2020 have changed a little bit. Peoples’ lives and their media consumption behaviors have changed drastically in the last four weeks, meaning video consumption has gone up a lot because people are stuck at home.

We all need to adjust for [these changes in consumer behavior] and so we’re making those adjustments on our side, whether investing in specific channels or trying new ones.

AF: By using user acquisition or re-engagement?

Stephanie: A little bit of both. Simplifi by Quicken just launched in January, so it’s a fairly new product of ours and we’re definitely in that growth phase still. Therefore, a lot of what we’re doing is obviously UA-focused.

Manav: Sure. We both know that the cost of acquiring a new consumer is a lot more than retaining one. So, the focus has to be inverted now on retention, on your loyalty cohorts, on all those cohorts which are due for lapsing, especially in these times when audiences on networks are shrinking (think the auto and luxury industries mentioned earlier).

How are you bringing them back? Are you extending them more of the same buck you weren’t earlier? It goes without saying that retention remains the mainstay in such times, right, but there are also certain opportunities which these times present.

The immediate point I’m saying is that we should be looking at the complete value chain around [your users’] basic consumption and see which cohort lends you the most opportunity.

This is largely for the categories where consumption has stopped or reduced significantly (non-essentials), like eCommerce and entertainment. You see that there is a humongous uptake because, again, the cheapest form of entertainment is where it is happening on mobile and the internet.

Additionally, with both incrementally increasing user time on social and the tools that social platforms provide to connect and disseminate information, brands have started to use social as a push medium. We have seen brand awareness videos for education apps on platforms like TikTok and social responsibility videos on ErosNow.

Revenue

AF: If you look at your revenue streams, for either your app or in general, are you seeing a decrease in IAPs? If that’s the case, will or do you expect increases in IAA to compensate?

Shay: At the end of the day, IAAs and IAPs have a very close relationship because IAAs come mostly from other advertisers. If everyone is spending less because their revenue drops, then your chance of making that money on IAA won’t necessarily pick that up.

Manav: From a SVOD standpoint, we have seen double digit growth in paying users.

Media costs

AF: What do you think is going to happen with media costs? On the one hand, as you said, if you look at things overall, are you going to see a drop in ad spend across the board? Many different industries are suffering. On the other hand, you also said that there is increased competition for screen time, especially among mobile apps as people are staying at home.

Do you see media cost potentially going down or up in either the short term or long term?

Shay: In terms of media costs now and for the short term, I think they’re going to stay lower than they were. If we saw a big drop, they might have a very slight increase but not something substantial. As we start rolling out from this, we’re going to see a bigger increase in cost. However, midterm, it’s still going to stay lower than it’s been.

Stephanie: Where’s my crystal ball? I think that’s really hard. [On the one hand], we could have some industries divest their spend because they don’t physically have a business anymore. But also, you have others that are pumping more into digital, which obviously includes mobile, to capture that [current] user behavior.

So, it could end up being net zero change. I think it also depends on the type of media, your product, and who you are competing against in any given space.

Manav: Yeah. So I think, short term, CPIs and CPAs are gonna be nuanced in terms of certain categories. Let’s say we have a portal or an app which was doing reviews of new car launches, versus travel/OTA and hospitality apps, they’re surely going to get ahead. Essentially, advertisers will go to places which have audiences… but also audiences have moved in these times.

Second, from the brand standpoint, remember that not everybody is in the luxury position of continuing to spend. People are looking towards the same capital, which was ready to be deployed exclusively for marketing, to reallocate to various other functions within the organization.

Third, in the midterm, specifically in these higher consumption verticals, CPIs and CPAs will continue to be the same, if not decrease. On the other side of it, when the new normal comes in, I think, they are going to start to emerge back. However, nothing is going to stay the same for long because, as history has told us, consumer behavior also shifts, and quickly.

Finally, do understand that we all are dealing with something and the nature of these phenomena is such that we don’t know the outcome of that on the other side. This is why we don’t know for how long and to what extent it will impact.

(AF: Given the projected changes in media costs, the image below illustrates how costs vary between ad formats)

LTV predictions

AF: Okay, so it’s still a little bit premature to think about the long term and how recession will impact consumer spend. However, when we build a prediction model, is this something that you think should be changed [to reflect the situation]? Are you changing your prediction model in times of uncertainty? Are you more conservative maybe?

Shay: One of the things about prediction models is that most of them are built on historic data. I don’t think there has been a recession since the app industry was mature enough. I think it’s more difficult to predict how a recession will affect LTV, but it’s definitely going to require everyone [to be a little more conservative] – not just apps.

Stephanie: Not necessarily, not for us. We’re only in month five or so [of our app]. For the time being, no, that’s not something that we’ll be doing for our business.

Manav: For entertainment apps, LTV is also a function of new content/shows released on the platform. Given that all shoots are held up and new content is a challenge for many, I believe new cohorts will definitely emerge. However, this will largely depend, post recovery, as to the availability of capital and new content.

Product development

AF: Do you think now is a good time to release new titles or features, new significant updates?

Shay: Definitely. Since your user base is at home and they’re playing more, you’re going to get more data more quickly. It’s definitely smart to give more content to your users now. People are looking for something new. They’re looking for their next chase.

However, try not to be cynical about it. I wouldn’t necessarily monetize on their pain right now. Try giving them something as a trust sort of activity.

AF: Is it also the time now to spend a lot on UA for such a launch?

Shay: I think so because you’ll get a lot more bang for your buck. Also, during a soft launch, it’s all about data, right? So now it’s going to be cheaper and quicker to get that data. It’s exactly what a new game needs.

Stephanie: Is it something that’s going to provide value or boost engagement for your product? Of course that should be done. We should never stop improving our products and releasing new features, but if it’s a fundamental change in your business model, I would take a step back and think about that a little harder. I think it’s dependent on your industry and the type of feature it is.

Manav: Absolutely yes, ZOOM is a classic example. Keep your eyes and ears on new emerging cohorts leading segmentation and keep adding new features to build incremental consumption and loyalty.

Corona-related features, updates, or offers

AF: In the past few weeks, have you done or released anything innovative – perhaps a unique campaign, a creative, an offer – that has been driven by the Coronavirus pandemic?

Stephanie: Yes, we have been able to offer discounts for our new customers in the thought of helping people get everything organized and provide some peace of mind for understanding their finances completely.

AF: It’s probably not too easy now to come up with copy. You don’t want to come across as exploiting the situation, right?

Stephanie: Exactly and we’re not. This is normally a busy time of year for a lot of types of financial services, as people like to get their finances in order at the beginning of the year – kind of aligns with the tax season, although that has been extended in the US for a couple more months.

So yeah, we don’t want to take advantage of the situation. I’ve been very fortunate to be at a company with a leadership team that is so wonderful and respectful of people’s changing lives and having to adjust to this. Not everyone was made to work from home 24/7.

So for us, it’s more of wanting to be there for our customers and helping them through this time of uncertainty.

Manav: Yeah, so we have made changes across all three strategy lines we spoke about before.

On the retention side, we have started to go back to the consumer more often and [send relevant re-engagement messaging]. From that standpoint, there is a lot more that we are doing, and we have seen healthy matrices and uptake [from these efforts].

On the creative side, in earlier times, we were able to take a slapstick, humorous, funny, satirical approach. Today, it is a lot more empathy-led. Today, it is a lot more emotions-led. Today, it is also a lot more awareness-led of launching new shows, new platforms, new base layers, which never existed before.

For example, if you have 10,000 movies on your platform, you might have been too busy earlier launching new movies to notice many old movies which even consumers didn’t know existed. Now, you may be discovering [them] and working off that.

Therefore, I suspect that a lot more predictive analysis, which goes into bringing out more [previously existing] content is coming.

From the channel mix side, we have been one of the organizations which has always put more belief in digital as a mainstream media, which is why the largest chunk of our marketing money has always gone to digital. That’s why we have relocated all those category spends, as I discussed earlier.

Lastly, from a pricing plan POV, we have extended the duration for the same dollar spend.

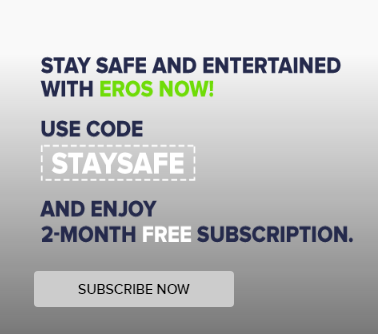

(AF: The image below shows one of the creatives for a corona-specific promotion from Eros Now)

Ad engagement

AF: Are you seeing CTR improvement in your ads, perhaps more than usual? Is this kind of message resonating at this time? Are they thinking a lot about this or is it concerning to them or something else?

Stephanie: Yeah, we are, and it’s a little bit of both. Two or three weeks ago, I think people were more distraught as they adjusted to their new normal of self-isolation and social distancing.

Now that we are a few weeks in and, at least here in the States, more or less know that this is going to be going on for a while, I feel that people are a little bit more calm in terms of understanding what tomorrow brings.

Final thoughts

AF: Any last words of wisdom for app marketers who are now thinking about planning for the month of May?

Shay: I think this is the best time to be flexible in budget allocation and optimization. Keep true to what you usually do, but don’t forget that the state of the world changes every week, and even every couple days; new things happen. Now it’s about one’s ability to react quickly rather than have a plan for the next month or two.

Stephanie: For me, I think it’s understanding what’s going on in the market. I’ve been trying to stay up to date on marketing and advertising trends so I have a better perspective and how that compares to my own performance.

The other important thing is to really be flexible and agile in what you’re doing, and realize that we will most likely have to pivot multiple times in the next few months.

Manav: First, as I said before, don’t cut spend. Just be smart about it and allocate your budgets where there’s an opportunity.

Also, keep your eyes and ears open for the new segments and cohorts forming which might not have existed or emerged earlier.

For example, if you look at all the eCommerce companies right now, they are shouting through the roof on essentials. So while there’s a new normal, there’s also a new essential. A sulfur-free shampoo may be essential for you, whereas another guy may not have access to a normal shampoo.

But do remember that both cohorts have their own scale. So from a marketer standpoint, now, you need to go back and say, “Okay, maybe I was not focusing on a normal shampoo because it was not my margin driver, but today, because people don’t have access to that normal shampoo in an offline channel or their grocery store, they’re going to look to the Amazons of the world to order that normal shampoo as well.”

And certainly, if your catalog or your merchandising plan did not include promoting a normal shampoo at front, it will now, probably also seeing humongous orders.

Basically, you have to reassess customer priorities, relocate the budgets, switch your brand positioning within the same scheme spread, possibly look at emerging new product activities, and, of course, redefine the value.