CTR, CTI, and IPM: Optimizing the path to install conversion

Over the last few years, much has been discussed about the post-install journey — marketers need to measure this data, then connect to a user’s pre-install behavior to optimize their future marketing efforts. Emphasizing user “value” over “volume,” is mission-critical for marketing profitability.

In addition to post-install analytics, it is important to closely monitor pre-install data (not to be confused with pre-installed apps), which offers key insights that inform creative optimization, ASO, targeting, and bid management. (check out this list of 16 KPIs gaming app marketers should measure).

Pre-install metrics help marketers to:

- Measure the value of ad creatives and their ability to drive users to perform a desired action (e.g. click, install, registration, purchase). To improve these metrics, marketers need to optimize the creatives (design and copy), a/b test ad placements, improve targeting, etc.

- Know the quality of media sources they work with by comparing their supply variety, scale, global reach, and business logic (machine learning complexity that determines where, when and to whom your ad will be shown). This will allow campaigns to reach optimal pre-install metrics under their given limitations (budgets, frequency caps, targeting, etc).

This post will cover the importance of pre-install metrics, and provide data-driven trends and benchmarks per genre.

What are conversion rates and why are they important

Pre-install conversion rates are used to measure the volume of users that make it through your conversion funnel to install. They offer key insights on creative optimization, App store optimization (ASO), targeting, and bid management.

While an install is not considered the real “end game” of marketing efforts, it is still an important milestone, as users must physically download the app to their phone and invest attention and/or resources into it.

A pre-install conversion rate can be the number of installs divided by either the number of total ad clicks or ad views, depending on what you’re trying to measure. These metrics are click to install rate (CTI) and impression to install rate (IPM), respectively.

In the past, when granular data was less accessible, mobile marketers relied more heavily on pre-install conversion rates, trying to reach high engagement and choose the partners that can help them rapidly grow while maintaining high quality.

Today, pre and post-install metrics are both an integral part of every user acquisition strategy.

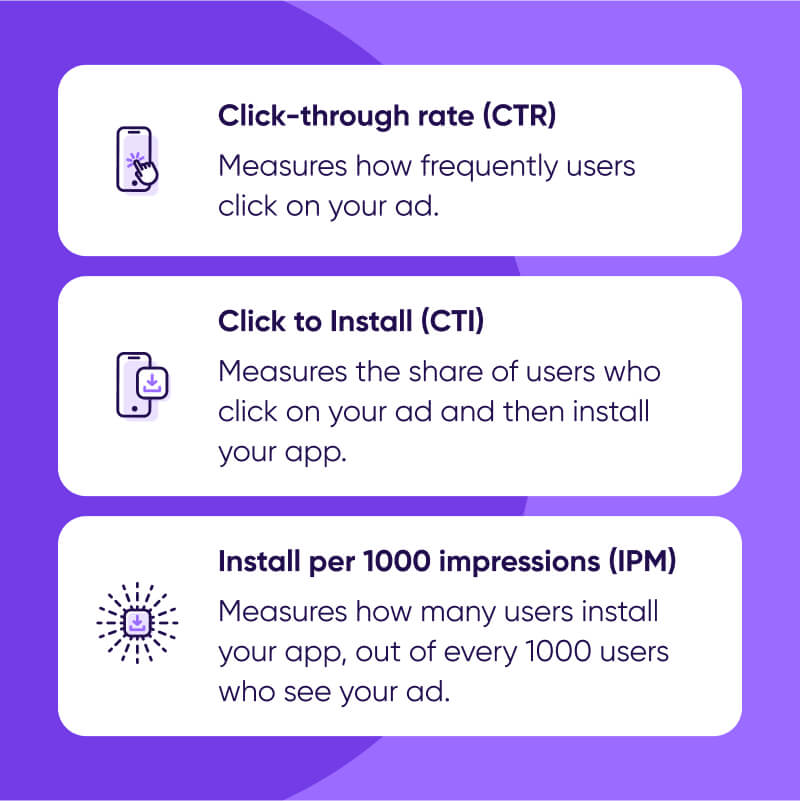

Pre-install metrics explained

Let’s explore each metric:

Click-through rate (CTR)

| Formula | Number of clicks / number of ad views |

|---|---|

| Informs | Creative optimization |

| Explanation | Higher in the funnel, CTR directly reflects the effectiveness of a creative in a campaign, but has limited value in informing other overall marketing goals. |

Click to install (CTI)

| Formula | Number of installs / number of ad clicks |

|---|---|

| Informs | Creative and app store optimization; targeting; and/or tech implementation (for example, your MMP, internal ID matching tech, and time between the game loading and the attribution provider firing an install event to the API) that can affect loading and downloading times |

| Explanation | Measuring the direct conversion between the two strongest touchpoints on a pre-install user journey, CTI is both socially and technically critical, as lower rates might mean less relevant audiences, ineffective creatives, or slow loading time before an install is complete. |

Installs per mille (IPM – Install per 1,000 impressions)

| Formula | Number of installs / 1,000 impressions |

|---|---|

| Informs | Creative optimization; lowering CPIs; boosting install volumes; and/or effective waterfall bidding and management |

| Explanation | IPM shows the full picture of the user journey when targeting new users. A high IPM also directly impacts the waterfall ad bidding process, moving the rank of a given ad campaign towards the top due to the high performance of a creative, ad, and campaign in generating installs. In turn, the ad receives more traffic and a higher volume of impressions, further boosting install rate. |

Gaming genre trends

The comprehensive data set used in this research covers 517 billion ad impressions, 58 billion clicks, and 2.7 billion installs of 4,500 apps in the past 1.5 years. It included top media sources used by Gaming app marketers, whose inventory is mostly comprised of video placements (rewarded and interstitials). The data set does not include Facebook and Google inventory.

The fact that video covers most of the data explains why the average CTR values are significantly higher than in cases where display (standard static banners) is more dominant.

Advanced technology and constant training of machine learning algorithms drive performance, delivering the highest returns of campaign investments. Some genres do it better.

According to our data, Midcore and Hyper Casual games are the most popular genres, with the largest scale and fastest growth. It is therefore no surprise that these genres are leading all three metrics in the graph above.

According to our data, there was a 50% uplift in CTI among Social Casino and Casual games between Q1 2020 and Q2 2021, while other genres experienced uplift rates of up to 30%.

Hardcore games are very popular among specific types of players, making it harder to drive scale through UA because of a smaller pool of potential players. However, they’re still growing every year (Q2 vs Q2) in CTR (+8%), CTI (+8%), and IPM (+21%).

Regional trends

In our State of Gaming report we’ve shown the vertical’s significant growth across the globe. Clearly, mobile games are engaging more users and more users in every country, increasing its reach in different regions with different cultures.

As we can see in the chart above, there has been a significant increase in regional pre-install metrics. Rising above is Latin America, where the YoY (Q2 vs Q2) increase across CVR (+12%), CTI (+15%), and IPM (+20%).

The fact that pre-install performance is on the rise across every region worldwide reflects progress in creative optimization, and the ability to match creatives to multiple cultures. As a result, ads are more relevant to the end-users wherever they are.

Benchmarks

The following tables include pre-install metrics, showing the average per app, market, and gaming genre during H1 2021.

In addition, we added the percentile 90 value to show the performance of the top 10% of apps (per the KPI measured) — a great way to put a number by a goal in your game’s genre:

Key takeaways

- Pre-install conversion rates are used to measure the volume of users that make it through your conversion funnel to install. They offer key insights on creative optimization, App store optimization (ASO), targeting, and bid management.

- The predominant use of video ads translates into much higher CTR than when display is mostly used.

- Midcore and Hyper Casual games are the most popular genres, with the largest scale and fastest growth. It is therefore no surprise that they top CTR, CTI, and IPM metrics.

- The fact that pre-install performance is on the rise across every region worldwide (LATAM in particular) shows that creatives are properly localized. As a result, ads are more relevant to the end-users wherever they are.

- Pre and post-install metrics are both an integral part of every user acquisition strategy.