Late start, strong finish: 3 in-store brands net big gains from updated mobile apps

Just because a company leads its category, doesn’t mean it can stop innovating. There are always competitors ready to steal market share.

Cases in point? These three stories. They show how enterprises have used an innovative mobile app to fend off competitors, maintain or retain their marketing-leading positions, and breath new life into their legacy brands.

Pizza Hut: an app to take back their top(ings) spot

For decades, Pizza Hut was the clear leader of the fast-casual pizza chains. They built their empire around in-store experience—iconic red-topped restaurants were the go-to spot after ball games, dance recitals, and other family outings.

But Pizza Hut’s dine-in dominance became their undoing as consumers decided to eat their pizza at home. Revenue declined as same-store sales slipped nearly 18% from 2012 to 2015.

Dominos, on the other hand, was perfectly positioned to meet the trend. As an “e-commerce store that sold pizza,” the rival chain focused on building a digitally-driven order, pickup, and delivery system. In 2017, Domino’s swiped a big slice of Pizza Hut’s market share—and its place as the world’s largest pizza company.

The Hut bets on a beefed-up app

Pizza Hut’s parent company Yum Brands wasn’t about to let Domino’s eat their lunch without a fight, so in 2017 it entered into a $130 million “transformation agreement” with their franchisees. At the heart of the agreement was a big investment in upgrading tech, including an app update to smooth out the mobile ordering process.

“Pizza Hut understands that digital, especially mobile, is where consumers are, and we want to step up the game around that,” Chris Dargis, Chief e-commerce officer for Pizza Hut U.S., said in 2017.

It was a sensible bet, given that in-app orders at Taco Bell, another Yum Brands chain, were on average 30% higher than orders from its other channels.

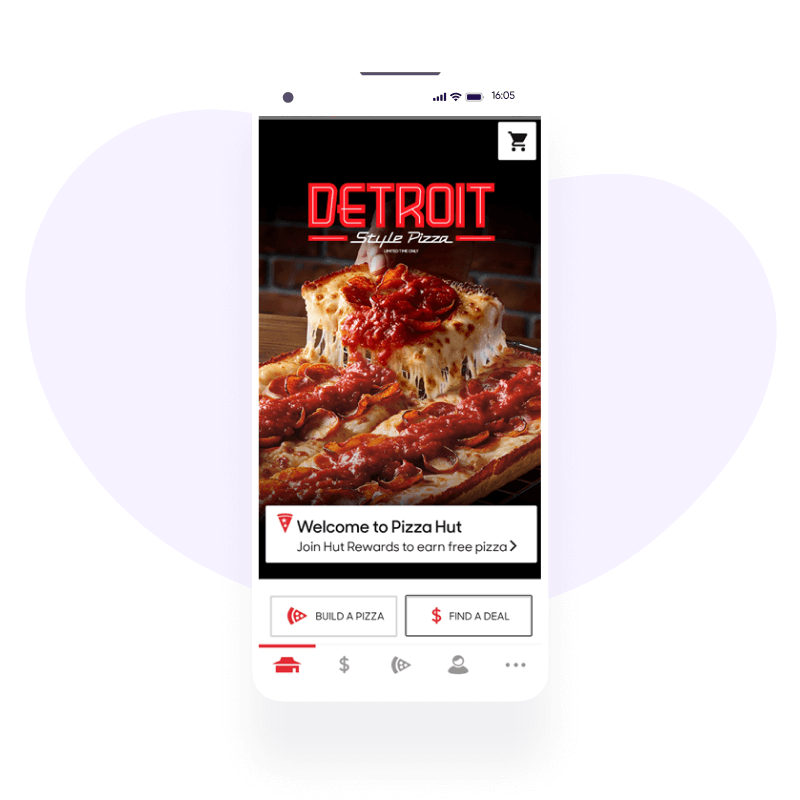

The reimagined Pizza Hut app was built to make ordering easier and keep customers coming back. It included a delivery tracker, store finder, and pizza builder.

Pizza Hut used discounts to drive adoption of the new tool. For example, during the first week of the launch, hungry customers who placed an order through the app received an immediate 50% discount.

Once in, users who signed up could link their Hut Rewards account and reorder their favorite food with a single click—increasing the chance new adopters would become loyal users.

Returning to the upper crust

Pizza Hut’s big bet on the app has paid off, helping the chain to top its competitors right where it hurts—in delivery and pick-up sales.

For example, Pizza Hut’s same-store, off-premise (pick up and delivery) dining surged by +21% in 2020 Q4, besting Domino’s increase of 16% over the same timeframe.

The app proved to be a valuable asset in the Hut’s turnaround. A recent experiment showed that Pizza Hut app users were more loyal and had a higher order volume than non-app users. And since the app was downloaded 300k times in August, 2021, the return on the app investment will continue to compound.

L’Oréal’s business model gets a makeover with the Makeup Genius app

L’Oréal has relied on innovation since its origin in 1909 when a young French chemist sold a new formula for hair dye to Parisian stylists.

But as shoppers migrated from bricks to clicks, the beauty brand found itself behind the curve. While their e-commerce sales were growing, online orders only accounted for 5% of L’Oreal’s business in 2015. At the time, more than 10% of total retail revenue was from web sales.

The problem is cosmetics aren’t the most e-commerce-friendly products. Blush, eyeshadow, and lipstick are highly personal products that are never one-style-fits-all. Buyers were used to standing at the makeup counter and trying out the latest shades and application techniques before committing to a purchase.

So how could they meet the conflicting demands of the “try-before-you-buy” model and online shopping convenience?

Making makeup mobile

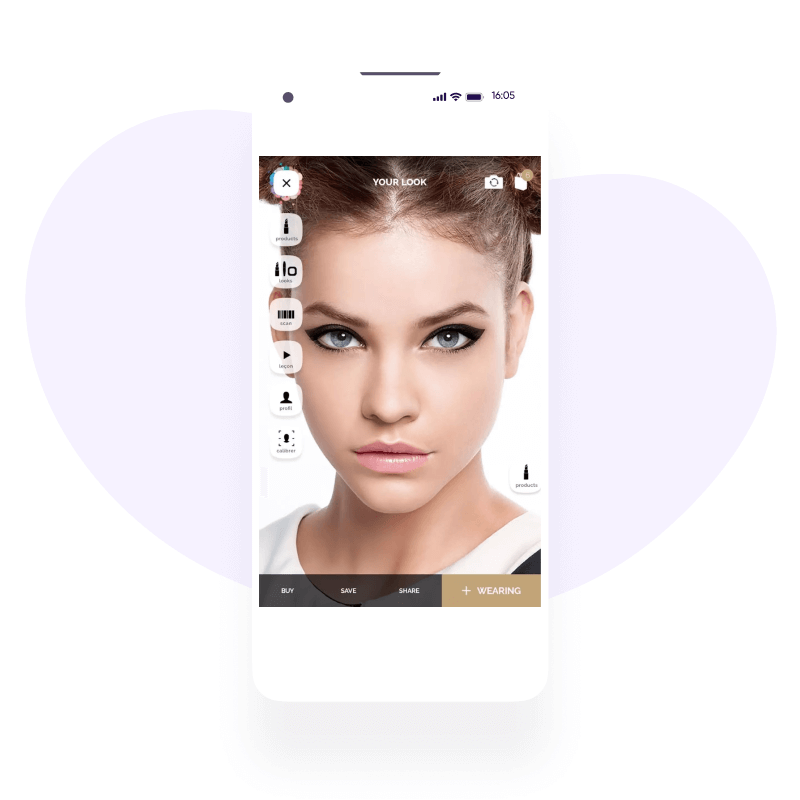

Not surprisingly, L’Oréal solved the digital demand dilemma through cutting-edge innovation by launching the Makeup Genius app.

The augmented reality-powered app allows users to virtually try on makeup right on their mobile device.

After scanning 60 characteristics of a user’s face, Makeup Genius shows how a product would look in real-time. Shoppers can even test out curated looks from real makeup artists and then share their new look on social media.

Once a customer finds a product that works, they can buy it directly with a couple of clicks. The app even lets shoppers scan products in-store to see how they look virtually.

To further personalize the experience, buyers receive suggestions, discounts, and info on relevant new products based on their previous behavior in the app.

Rebalancing the balance sheet

The Makeup Genius app became hugely popular with L’Oréal’s customer base and has been downloaded more than 20 million times. The app’s popularity helped the company exceed its e-commerce goals and became a valuable source of customer intelligence.

What’s more, the app has helped the historic brand transform its business model to meet e-commerce trends. Digital sales now make up 25% of its business, and L’Oréal’s chief digital officer believes half of all its revenue will come from e-commerce by 2023.

But the app isn’t just generating sales directly. It’s helping to inform how L’Oréal engages with their fans on every channel, says CMO Marie Gulin-Merle:

“This app is a unique asset both as a branded channel for engaging with customers and as a ‘fire hose’ of incoming information about how our customers engage. It allows us to understand the needs of our loyal users and tailor meaningful, assistive experiences for them.”

IKEA assembles an app to make its products more accessible

“Quick and convenient” are not adjectives most shoppers would use to describe a trip to IKEA. That’s no accident. The Swedish purveyor of flat-pack furniture designed an experience—from meatballs to maze-like layouts—to keep people in their huge showrooms as long as possible.

IKEA was slow to embrace e-commerce; their first forays into digital shopping were designed to improve the in-store experience, not make it easier to buy online. Neither their augmented reality product nor their online catalog allowed you to actually make a purchase. You had to drive to a store to do that.

IKEA’s insistence on brick-and-mortar sales came at a cost. By 2017, digitally native rival Wayfair had built a $4 billion business out of selling home goods online. And Williams Sonoma, parent to IKEA competitors West Elm and Pottery Barn, had already shifted 50% of their sales to digital transactions. IKEA accepted that to stay competitive they couldn’t keep making customers trek to the big blue box.

New app makes IKEA more accessible

In January 2020, IKEA announced it was changing its analog-only ways and launching a newly-designed, full-service e-commerce mobile app.

In the press release, Umesh Sripad, IKEA US’s Chief Digital Officer, put it this way, “At IKEA, we are on a journey to transform the way we meet our customers, and the IKEA app is an important step we’ve taken to become more accessible and convenient to the many.”

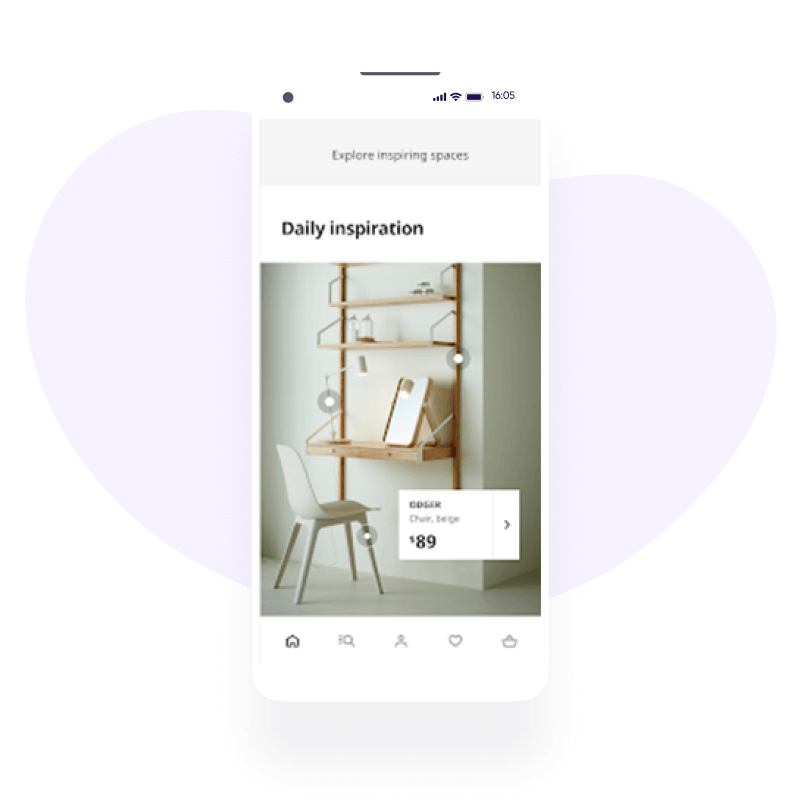

The app was built to retain the core function of the in-store experience: a chance to get design ideas and inspiration. So users can shop by the room or collection and see thousands of high-quality images of products in place.

The app isn’t short on convenience, either. A shopper can quickly read reviews, see if a product is in stock locally, and arrange for pick-up or delivery, all from their mobile device. Users can even scan a product in-store, see other colors or patterns, and, in some countries, pay on the spot and skip the lines.

IKEA’s app was the missing piece for growth

The IKEA mobile app was instantly popular—it was downloaded 4.9 million times during a limited, eight-country launch in 2019. And it was downloaded 900,000 times in August, 2021, more than 4x the clip of competitor Wayfair’s e-commerce application.

Not only are people downloading the app, but they’re also using it. User retention—measured as the portion of people who use the app a second time within a month of their first interaction—is 25%. And Chief Digital Officer at IKEA Retail, Martin Coppola, says conversions grew after the app launch.

With so many people using the app repeatedly, it’s not a shock to see digital sales grow. In 2020, e-commerce purchases made up 16% of IKEA’s total revenue—softening the blow of store closures during the pandemic.

What likely wasn’t as easy to predict was the shift in demographics the app brought about. “We are seeing a new user segment emerging through the app, compared to the IKEA website,” said Sandra Osbeck, Product Manager of IKEA’s largest franchisee, Ingka Group. “It is attracting a much younger audience – three out of four users are under 34 years old.”

Is your app under-supported?

At one point, Pizza Hut, L’Oréal, and IKEA all fell behind the m-commerce curve. Their stories prove that big brands can not only catch up, but even surpass digitally native competitors with the right app investments. Here’s a recap of how they did it:

- Make shopping in your store as easy as shopping in your app

- Use your app to add transparency to the purchase and delivery process

- Add experiences to your app that used to be only available in store

- Use discounts as a motivator to both download the app and make a habit out of using it