The gaming world never stands still, and as always, the drive for increased revenue and audience continue to be the key agents of change. And boosting revenue and audience pools is exactly why many mobile game studios are making a shift to offering their games on PC and console platforms as well.

So what’s driving this change? Well, as in so many other areas, the pandemic has played a big part. It’s common knowledge that gaming did well during COVID-19. According to Newzoo, the number of gamers jumped by 12% from 2020 to 2022, with PC and console each scoring over 15% player growth in the same period.

What’s more, privacy regulations and saturation of mobile users mean mobile game developers are on the lookout for new audiences and revenue streams. They’re at different stages of building games to serve the growing body of PC and console gamers. And while this wasn’t a major theme pre-Corona, there’s a noticeable shift to allowing play across platforms.

If this shift piques your interest, read on, because in this guide, we’ll dig into how mobile gaming publishers are taking advantage of the PC and console opportunities. We’ll cover how they can turn PC and console into performance marketing channels by measuring cross-platform flows. And finally, we’ll share use cases that shine a spotlight on these flows.

Multi-platform in 2023? Game on

The gaming industry has been navigating through choppy waters since the pandemic hit in early 2020. Despite the difficulties brought on by COVID-19, or perhaps because of them, gaming surged just as much of the “outside world” shut down and people remained in lockdown.

The surge was followed by a natural, organic correction as people, including gamers, emerged from their homes, with work, school, physical shopping, and live entertainment all eating into hours previously spent gaming.

But, thankfully, there’s a silver lining in these post-pandemic times. There are considerably more players now than in 2020 across all platforms (see Table 1) — with PC and console up by 16% and 17%, respectively — and engagement is higher, too.

| Platform | 2020 | 2021 | 2022 |

| PC | 2.07 billion | 2.23 billion | 2.40 billion |

| Mobile | 2.68 billion | 2.91 billion | 3.15 billion |

| Console | 1.33 billion | 1.44 billion | 1.56 billion |

Why is the shift happening now?

The growth in numbers and in player diversity present mobile gaming publishers with opportunities to garner revenue from titles offered on PC and console. And there are other reasons that studios are looking beyond their mobile comfort zone:

- Attractive console ARPU: ARPU (average revenue per user) is 67% higher on console compared to mobile, so it’s easy to see why mobile game studios are enthused about bringing their games to this platform.

- Improved technology: Technological advances have made it simpler and more cost-effective for mobile gaming studios to build their games for other platforms.

- Privacy challenges: While Apple’s privacy regulations may be beneficial for users, they present a hurdle for gaming developers trying to create personalized and engaging gaming experiences.

- Market saturation: The mobile gaming market is becoming increasingly saturated, with many new entrants and established players competing for a limited user base and revenue streams.

- Influencer streaming: Developers understand the power of influencers streaming games, and the quality of PC game streaming is higher than that of mobile games. The easier publishers make it for streamers to make quality videos of games, the more they will stream.

- Immersive gaming: From the gamer perspective, there’s increasing demand for high-quality games that are more immersive and engaging.

How does it work in practice?

Now that we know why gaming studios are expanding, let’s turn to the two primary ways of bringing mobile games to PC and console:

- Per platform: A new version of the game developed “stand alone” for a specific platform, for example, a mobile game brought to Steam with multiplayer elements available only on Steam.

- Cross-platform: A game that can be played on any device on the same session or account, for example, Fortnite, Genshin Impact, or Summoners War Chronicles.

Prescient developers have delivered, and games originally available on mobile only — like Summoners War Chronicles, Genshin Impact, Fortnite, and Minecraft — have been developed for console and PC. Their success has generated additional interest in offering other mobile games for PC and console.

As for business models, at this point, mobile gaming companies are looking at bringing their mobile monetization models to PC and console; that is to say, providing free-to-play games that drive revenues from in-app purchases.

In short, we’re witnessing a growing swell of mobile gaming companies seeking to monetize their IP on PC and console.

PC and console measurement: The promise and challenges

As mobile game studios are increasingly building games for PC and console, what’s on their marketing wish list?

Accustomed to the measurement, attribution, and analytics provided by their MMPs (mobile measurement partners), marketers naturally want to measure the impact of ads for PC and console games appearing nearly anywhere on the planet.

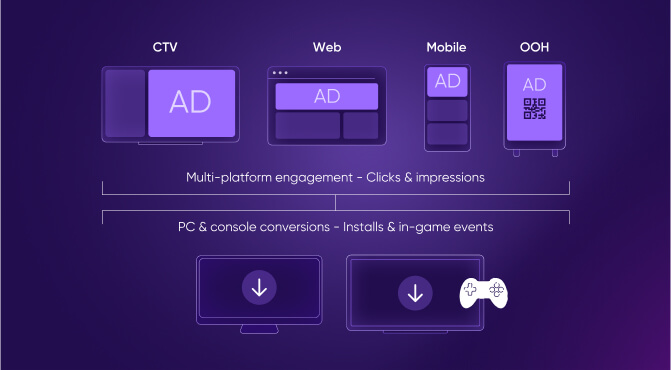

This means understanding complex flows such as:

- A social media ad leading to the publisher’s web store, then to the platform (for example, Xbox or Playstation) store, and finally to a download of the game on the console.

- A connected TV (CTV) ad which triggers a gamer to head to Steam where they purchase, download, and play the game.

With so many “points of departure” (mobile apps, CTV, web, even out-of-home ads), there are multiple paths users can take before they ultimately purchase, play, and buy in-game.

The takeaway here is obviously that to take advantage of the PC and console opportunity, there needs to be a way to measure PC and console campaigns. This is especially true for the free-to-play model, where performance marketing and ROAS measurement determine the success or failure of a game.

But alas, it’s not that simple. Without the right infrastructure, measurement is extremely challenging. Building an attribution solution for these various paths is no mean feat, and the challenge is exacerbated by the curveball thrown by Apple and Google limiting unique identifiers. And then there’s the perennial problem of siloed reporting and analytics.

In short, the lack of a real-time marketing picture for PC and console campaigns has impeded mobile gaming studios’ grabbing the PC and console with both hands.

Measuring PC and console campaigns

Question: What do mobile brands building games for PC and console need in order to measure their campaigns?

Answer: A measurement partner that allows them to turn PC and console into performance channels by offering the ability to:

- Connect the dots across the various user flows, all the way to game download and in-game conversions.

- Provide a real-time view of campaign performance.

- Advertise nearly anywhere, direct users to the right platforms, and have conversions attributed to the right sources.

- Gain the same visibility on PC and console that they enjoy with mobile attribution, with all campaign metrics in one place.

- Create games that can be played anywhere, allowing players to move seamlessly from one platform to another and to spend more time in the game.

A solution with these five attributes will allow gaming publishers to more fully cash in on the PC and console revenue opportunity. It can bring performance marketing to PC and console, enabling marketers to allocate ad spend to optimal marketing channels.

In line with its goal of helping brands measure pre- and post-conversion activity and events on any platform, AppsFlyer offers such a solution, empowering gaming brands to unlock untapped revenue streams.

It’s based on three complementary layers:

- Cross-platform conversion measurement: Gaming developers can attribute conversions or installs that take place on one platform to clicks and impressions taking place on a different platform.

- Post-conversion measurement: Post-conversion events such as in-game purchases are measured, providing insights into campaign success and enabling ad spend optimization.

- All metrics in one place: Publishers can gain a complete picture of ad media budget distribution and performance across multiple platforms, devices, and channels.

Bottom line: Marketers of mobile games can now take advantage of new revenue streams by building games for PC and console platforms and by leveraging measurement technology offered by the right partners.

Use cases

In this section, we share a number of cross-platform user flows to illustrate how you can begin to tap into the PC and console opportunity. Note that the use cases below represent a small sample of the many possibilities out there, and that the last step —PC or console — is interchangeable; that is, a flow ending with a PC can end with a console and vice versa.

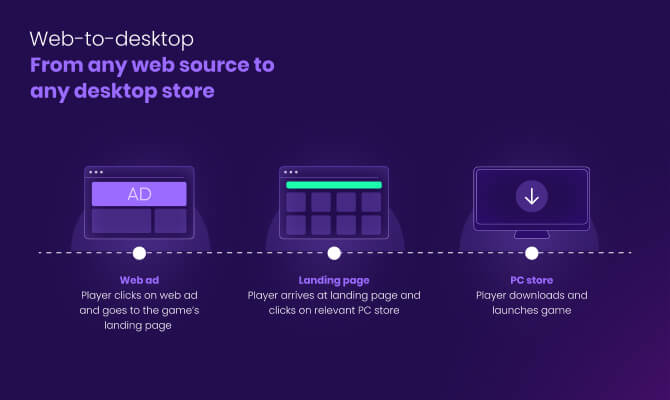

Web-to-desktop

A great entry point for mobile marketers is to start with the familiar: web ads. After all, mobile marketers are well-versed in setting up, deploying, measuring, and optimizing web ads. In addition, they know how to take advantage of the high intent associated with users clicking on search and web ads.

In the above example, a player clicks on a web ad and arrives at a landing page. From here, the user clicks on a link to the right PC store, downloads the game, and then plays it.

The impression and UTM are captured on the landing page, enabling the marketing to understand the gamer’s flow. Measurement of various flows allows the marketer to understand which campaign is performing best and to subsequently allocate budget accordingly.

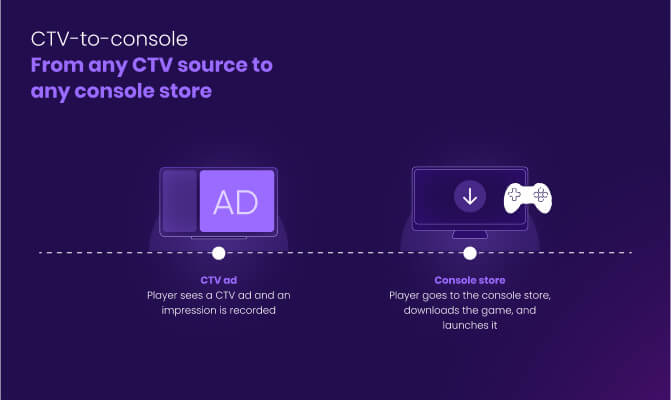

CTV-to-console

The CTV opportunity has grown by leaps and bounds in recent years, as more viewers opt to stream content over the internet rather than watch linear TV. CTV ad spend in the US alone is expected to grow from $25 billion to $33 billion in the next two years. Not surprisingly, gaming brands such as Kabam, Playtika, and Mistplay have been at the forefront of advertising on CTV, which is emerging as a viable performance channel.

Below, a viewer sees a CTV ad for a console game. She then heads to the console store, downloads the game, and launches it.

The ad impression is captured and matched with the download on the console. Any in-game purchases that may happen in the future are attributed to the CTV ad.

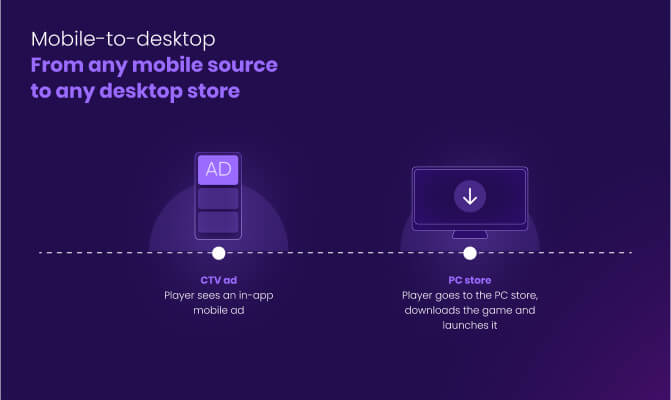

Mobile-to-desktop

Like web ads, mobile ads are a great way to quickly leverage the PC and console opportunity. Again, mobile marketers are right at home in this territory.

In the flow below, a gamer sees an ad for a game in their favorite social media app. The player heads to the PC store where he downloads and starts playing the game.

By matching the ad impression to the download, the measurement solution is able to attribute the download to the original ad that the viewer saw.

Out-of-home-to-desktop

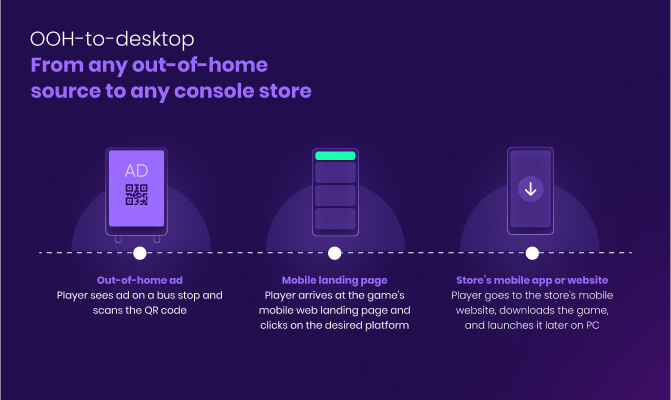

Gaming marketers can use out-of-home (OOH) advertising to convert captive audiences at bus stops, metro stations, subways, and train platforms into game customers. The QR code comeback has seen marketers worldwide jump on the technology, and QR codes have become commonplace on commutes, runs, and physical shopping experiences.

In the above use case, a player captures a QR code at a bus stop and is brought to a mobile landing page. The player clicks on the desired platform and gets to the store’s mobile website. She purchases the app and later heads to her PC to download and launch the game. The measurement platform records the QR code capture and matches it with the store purchase and launch on the PC.

- A growing number of mobile gaming brands are expanding their offering to PC and console, developing existing games or launching new ones to be played across platforms.

- The main impetus for the shift is new audiences and revenue streams.

- Additional reasons for the new trend include privacy restrictions, a saturated mobile gaming market, and high console ARPU.

- Measuring the dozens of flows that ultimately bring players to PC and console is challenging, but it is possible with the right partner. These flows include taking users from a web page, CTV screen, mobile app, or out-of-home ad to download and play the game on their chosen device.

- Gaining the ability to measure PC and console campaigns is key to turning these platforms into performance marketing channels.