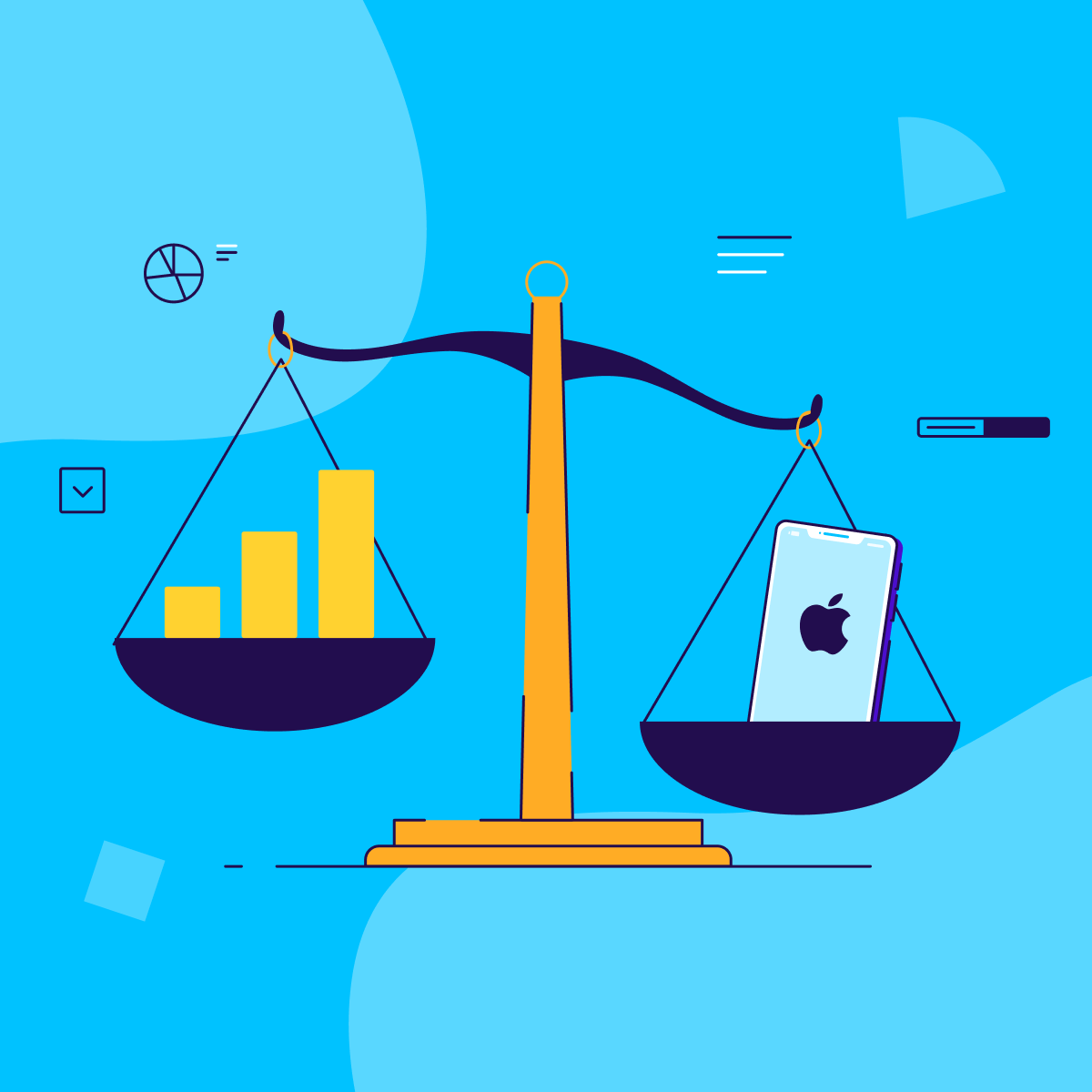

Mind the gap – bridging the divide between high ATT opt-in and low IDFA collection rates

Let’s talk about a glaring gap in the post iOS 14 world.

On the one hand, ATT prompt opt-in rates are proving to be much higher than anticipated at 40%-50% across industries. On the other hand, IDFA collection rates still lag far behind.

But why is that?

As we’ll soon see, while some of the causes are a given, others are definitely in our hands and can help narrow this gap while increasing IDFA collection rates.

Before we dive into the details, it’s important not to confuse IDFA collection rates – or the share of installs with an IDFA, with IDFA attribution rates – where users are required to give their consent on both the advertiser and publisher’s side (excluding web2app scenarios).

Count ‘em out – LAT and restricted users are not being tracked

Some users don’t have an IDFA because they weren’t given the option to opt in to begin with, which means they couldn’t be measured prior to iOS 14 and can’t be measured now either. These users include:

LAT-enabled

Up until the release of iOS 14, Apple’s Limited Ad Tracking (LAT) option was the primary way in which iOS users could opt out of sharing their IDFA across all apps.

In today’s iOS 14+ reality, Apple automatically labels former LAT users with a ‘Denied’ tracking status, which means that they are not served with a prompt.

This group is significant and stands at over 30% of global iOS devices.

Restricted devices

This group includes under aged users, or users whose age is unknown, and constitute about 14% of all devices (counted within the original LAT figure).

Interesting fact: about 30% of gamers nestle under this age group, so the impact on the ability of gaming apps to attribute holistically using IDFA – is understandably significant.

The restricted group also includes devices that are in Education mode, devices with an App Store account that was created by an educational institution (i.e. Managed Apple ID), or devices that were installed with a preset restriction (e.g. set by organizations on employees’ devices).

So far, we’ve already excluded over 30% of devices, and haven’t even addressed users that are actually served the prompt.

The deal breaker – most applications have yet to deploy the prompt

Despite promising numbers, where nearly 50% of users allow tracking upon being served the prompt, about 55% of app owners have yet to deploy it in their apps.

Concerns that displaying the ATT, with its somewhat off-putting language (“Allow ‘App’ to track your activity across other companies’ apps and websites”), would generate an unpleasant user experience for their fickle users, and trigger prompt-induced churn.

This brings most app owners to relinquish any IDFA reliance in favor of alternative measurement solutions, such as:

- Aggregated Advanced Privacy and Probabilistic Modeling – statistical techniques designed for estimating campaign performance in an aggregated manner.

- SKAdNetwork – Apple’s privacy-centric attribution solution that helps ad networks and advertisers measure their ad activity on an aggregated level.

That said, SKAN does come with some significant limitations such as poor granularity, postback delays, ad fraud risks, lack of re-engagement attribution, and a very limited, time-restrictive way to measure ROI/LTV.

So how does the ATT implementation rate impact the IDFA collection rate?

Let’s break down the relevant ATT status groups first so we can make sense of the bigger picture:

- The authorized group consists of ATT consenting users.

- The denied group consists of both non-consenting users, restricted users, and former LAT-enablers.

- And the not determined group is comprised of four sub-groups:

- Users who didn’t respond to the ATT prompt

- Users who weren’t served the ATT prompt yet

- Users who installed apps that didn’t implement the ATT prompt

- Users who installed apps that didn’t deploy the ATT prompt properly, which in turn doesn’t trigger the MMP’s SDK

Pie chart #1 | Current state of ATT distribution, across all users and apps

The chart above represents the distribution of users across all apps, including formerly restricted and LAT-enabled users.

In order for us to focus on the group of users that can actually opt in, we’ve removed the restricted and ex-LAT bunch from the picture, leaving us with the following:

Pie chart #2 | Current distribution of users across all apps (excluding previous LAT-enabled and restricted users):

The chart above represents the current state, where consenting users stand at 15%, non-consenting users grab 19% of the pie, and the ‘not determined’ paint the wall gray with no less than 66%.

Keep in mind that the vast majority of the ‘not determined’ group are users who installed apps that didn’t implement the ATT prompt.

Pie chart #3 | Distribution of users across ATT-enabled apps (excluding LAT-enabled and restricted users)

In this chart, we’re focusing on the percentage of consenting, non-consenting and ‘not determined’ users only within apps that deployed the ATT prompt.

Unsurprisingly, with high opt-in rates and with so many more users seeing the prompt, the rate of consenting users soars to 26%, non-consenting users volume drops to 27%, and the ‘not determined’ group settles for 47% (which are users that were served the prompt after the MMP’s SDK was triggered).

Going from 13% to 31% is massive considering the value of each IDFA-enabled user in terms of attribution, LTV measurement, and re-engagement.

Pie chart #4 | Theoretical distribution of users if 80% of apps were to deploy the ATT prompt

Since a scenario where 100% of all apps implement the ATT prompt is not realistic, what would IDFA rates look like at 80%? What we know for sure is that it would have a substantial impact on apps’ ability to gain crucial insights into the success of their campaigns.

In this scenario, apps could enjoy a rate of 24% consenting users (double the current rate), while reducing the volume of non-determined users to 50% (16% drop compared to current rate).

Feeling a bit more reassured? Good. Now let’s go back to reality.

What can you do to bridge the gap?

Pretty simple, really. First and foremost and as we’ve shown above, higher ATT adoption rates would mean higher IDFA rates, which in turn would enable better, more accurate measurement and optimization.

Still concerned with chasing your users away? We got you covered.

Apps can perform a number of simple steps that have already been successfully tested across early ATT adopters, proving that you can minimize ATT-led churn without compromising your much needed insights.

Here are your main takeaways:

- Timing is everything – Find the precise moment in your user journey to serve the ATT prompt. Establishing trust by presenting the value of your product before serving the pop up – is highly likely to increase your chances of opt-ins.

- Know your audience – You can choose to serve the ATT prompt to existing users only, who already know and trust your brand.

- Customized purpose string – The unbolded text in the ATT prompt can be edited. Use this opportunity to explain why it would be in your users’ best interest to opt in (e.g. allowing for a more contextualized user experience).

- Pre-ATT prompt – Try displaying a pre-ATT pop-up, gating Apple’s dialogue behind your own native prompt. The latter is entirely your own, so you can customize the design, timing, and messaging to best fit your app, and ultimately show users the value of opting-in.