What is OTT advertising?

OTT (over-the-top) advertising is the delivery of video ads through streaming content online, bypassing traditional broadcast TV or cable boxes to reach viewers on devices like desktops, mobile phones, and Smart TVs.

Try searching for

Television isn’t dying — it’s evolving.

Cord-shavers, cord-cutters, and cord-nevers have become the norm. The evolution, accelerated by entertainment-deprivation during COVID lockdowns, has led to a major boom in content streaming.

And where the attention is, marketers will follow. There’s still big money in traditional TV advertising, but the balance is likely to tip: as more viewers move to streaming services, so will the advertising dollars.

Enter: OTT advertising, aka over-the-top.

Has OTT gone over your head? Don’t sweat, because in this guide, we’re going to cover everything you need to know about OTT, from the very basics all the way to strategies on how to execute OTT strategies.

Let’s get studying!

OTT is the practice of delivering digital content online in place of traditional broadcast TV or cable boxes. It bypasses (or goes ‘over the top’ of) these familiar ways of watching TV, enabling viewers to stream content on desktop, mobile, gaming consoles, and tablet devices through dedicated apps and websites.

Customers are free to watch what they want, when they want, without being tied to a schedule set by a big distributor.

OTT platforms include Netflix, Disney+, Pluto TV, Hulu, Tubi, Peacock, Paramount+, Apple TV, and more. Aside from desktops and mobile devices, you can view their content using devices like Smart TVs, Apple TVs, Chromecast, Amazon Fire Sticks, Roku, and gaming consoles such as Xbox and Playstation.

OTT not only gives customers more choice and flexibility — it has big benefits for advertisers too, which we’ll explore in detail a little later. In short, OTT enables precisely targeted video ads to be dynamically placed within episodic content, on-demand programming, and even live streaming.

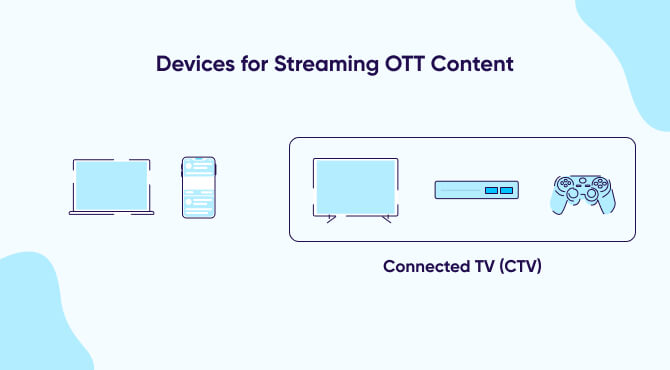

Marketers love acronyms, and equally love mixing them up. OTT and CTV are often used interchangeably, but in reality they refer to two different concepts.

OTT is a broader term and refers to the delivery of video via the internet with any device — connected TVs, Roku sticks, and consoles included. CTV (connected TV) only accounts for the delivery of video content to a connected or Smart TV.

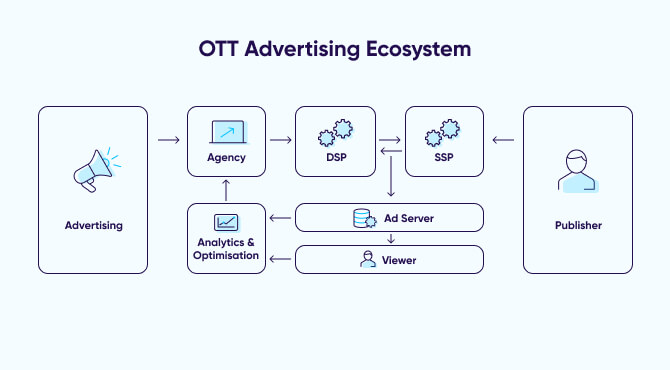

The ability to serve video ads within streaming content, reaching the right audiences in seconds, is a scientific breakthrough. Without getting too technical, let’s break down how the entire process works, starting with the major players in the ecosystem.

There are three primary ways to purchase OTT ads: directly from platforms or publishers, buying from middleman resellers, or programmatically (the most popular approach).

In direct buying, advertisers need to work directly with the publisher (like Netflix) to purchase ad space. High-priced premium ads are typically reserved for direct buys.

Alternatively, you can buy ad space through resellers or aggregators who hold inventory across multiple platforms and sell it in bulk.

But today, it’s programmatic ad buying that’s getting everyone talking. This approach involves automatically purchasing ad spaces through digital auctions in real-time, cutting out the middleman and making it the fastest, easiest, and most popular way to buy OTT ads.

In the simplest form, OTT ads are delivered in four steps:

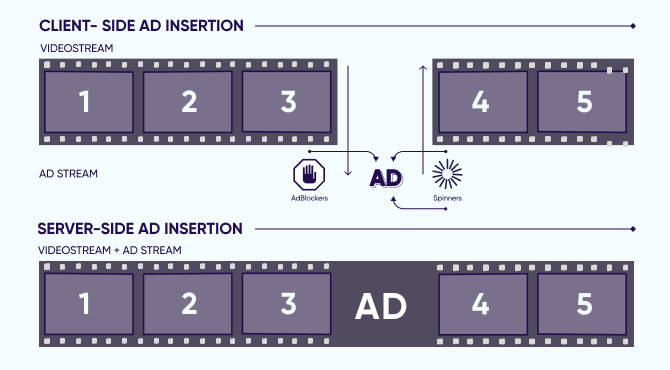

We’re now entering into technical territory. There are two ways ads are placed between video content: one is client-side and the other is server-side.

CSAI is the most prevalent ad insertion method, and means ads are loaded in the OTT device itself. Although CSAI is currently the industry standard, it’s susceptible to ad blocking, increased latency, and spoofing, heightening the chances of ad fraud and poor user experiences.

With SSAI, ads are “stitched” into the content: in other words, inserted into it in real time by the server showing the OTT video content. This makes it difficult for ad fraud and ad blockers to disrupt the experience. The lack of latency also improves consistency and reliability of ads being shown, improving the overall viewing experience for the OTT service as well.

Like any other advertising channel, OTT advertising costs vary according to multiple factors including the platform, target audience, ad format, competition (demand), and placement. The benefit of OTT advertising is that programmatic technology has streamlined the ad buying and selling process, making it more cost-effective than television advertising.

There are three primary pricing systems:

When starting from scratch with no data, it’s important to keep in mind that the testing phase will be more expensive. However, as you gather more data, optimize your campaigns and improve your targeting, you can expect the costs to decrease. This highlights the importance of testing, analyzing and optimizing your campaigns to achieve maximum results while minimizing costs.

OTT advertising, especially when compared to traditional television advertising, is an extremely effective way to generate more leads, build brand awareness, and drive app installs. Here are some of the main benefits:

You’re not limited to just TVs: you can now meet your audience where they are, reaching them on the device of their choice at the time they’re most engaged. OTT also makes it easy to track across multiple devices, providing a more holistic view of ad performance.

OTT advertising allows you to pause, restart, and optimize your ads on the fly. Whether you’re using a self-serve model or leveraging an agency to run your campaign programmatically, underlying technology like real-time reporting makes it easy to shift gears when a campaign is doing better or worse than expected.

OTT advertising leverages in-depth audience data like demographics, age, interests, behaviors, location, custom audiences, and so on — so advertisers can reach more specific audiences in a more engaging, targeted, and personalized way. OTT combines TV audience data with first- and third-party datasets to ultimately help advertisers reach the most relevant audiences.

As privacy changes are expected to continue impacting the advertising landscape, TV is becoming one of the most targetable devices. It doesn’t use cookies or IDFA, which is where most of the privacy changes today are impacting, ultimately making first-party publisher data worth its weight in gold.

But it’s not all rainbows and unicorns —OTT has its flaws, too. Here are some of the issues to watch out for.

While OTT provides a lot more measurement options than traditional TV, this element still has its pitfalls. Brands that purchase inventory through resellers and aggregators have less transparency over where their ad is showing and who’s seeing it.

Because OTT campaigns are viewed passively, primarily through a television screen, viewers are less likely to engage or click on the ad. This makes it more difficult to measure your ad’s effectiveness. To counteract this, you can measure brand lift whenever an ad is shown.

While Hulu boasts a robust ad platform, its biggest competitors are still playing catch-up. Advertisers should expect some limitations at this stage of OTT, but the opportunities will only grow as ad offerings continue to expand.

OTT ads are designed to look effortless and intuitive, but behind the curtain, there’s a diverse range of business models that dictate which ads are shown, at what price, and to which viewers.

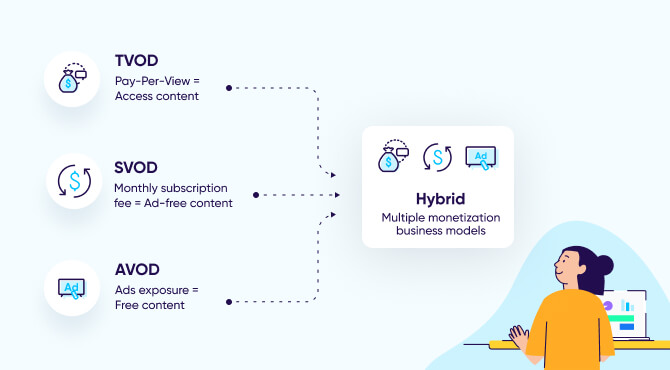

AVOD is a popular monetization model where the streaming service offers a freemium or discounted membership in exchange for watching ads. The most popular AVOD platform is YouTube, which gives free access to over 500 hours of video content uploaded every minute. Other AVOD services include DailyMotion, Pluto TV, Tubi, and 4OD.

Traditional TV isn’t dead, and there’s plenty of budget to go around. BVOD is a way for traditional TV broadcasters to repurpose their content produced for linear television, making it available online and on any device. The key BVOD providers include NBC Universal, Sling TV, Hulu, and Pluto TV.

With SVOD, customers can watch as much —or as little — TV and movie content as they want for a set price each month. Some popular SVOD services are Netflix, Amazon Prime Video, Apple TV+, Hulu, HBO Max, Disney+, and Sky.

With no long-term contracts, viewers can control when they want to start or stop their subscription. Although this offers up more opportunities to churn, it also incentivizes publishers to continue producing high-quality, binge-worthy content native to their platforms, and build out their unique IPs like Disney’s Marvel.

In contrast to SVOD models, TVOD operates on a pay-per-view system, where consumers purchase individual pieces of content rather than paying a flat monthly fee.

Viewers can buy individual films, television shows, and other video content on an as-needed basis, rather than committing to a recurring subscription.

TVOD has two subcategories:

TVOD works best for OTT publishers that have access to unique sporting events (UFC pay-per-view), new releases, or timely and exclusive content.

Most leading streaming services or OTT providers are currently using — or in the process of implementing — a hybrid business model.

One example is Amazon, which charges a fixed monthly fee for access to its vast library, with additional charges to watch the SuperBowl or certain new releases.

This hybrid model allows for a balance between providing a wide range of content at a set monthly rate, and giving consumers the option to purchase specific content that they may be interested in. That creates a flexible, yet sustainable business model for the OTT provider, and a more tailored viewing experience for the consumer.

The OTT advertising landscape is diverse and allows advertisers to deliver impactful ads in various formats. Before we dive into each individual platform, let’s talk about the most common OTT ad formats available today.

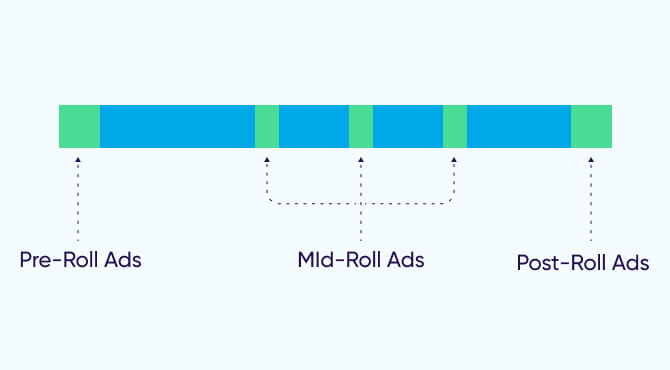

Pre-roll ads: Short ads that are shown before a video is played. These may be skippable or non-skippable.

Mid-roll ads: Ads that play during the video. To provide the best user experience, mid-roll ads should be shown between natural breaks like commercial breaks or major scene changes.

Post-roll ads: Ads that play at the end of the video.

Picture-in-picture ads: A pop-up video that appears on the corner of the content being watched. The ad plays while the main video content is playing.

Interactive ads: Ads that allow viewers to engage with them via a survey, clicking a link, and so on.

Companion banner ads: Banner ads that appear alongside the main video content and are often used to promote a brand’s website or social media channels.

Out-stream video ads: Video ads that appear outside of the video, including in-article, in-feed, or in-banner.

Let’s take a look at some of the most popular OTT platforms and the advertising options available.

A commanding 95.8% of OTT viewers in the United States will have watched YouTube at least monthly this year. Even with fierce competition from Facebook, Instagram Reels, and TikTok, YouTube continues to dominate and is projected to comfortably maintain its position at the top with 230.6 million viewers, growing by 2.1% year over year.

YouTube offers the following ad options:

Netflix is the second most popular OTT video streaming service, with 177.7 million viewers and a 2.5% year-over-year growth.

Netflix’s new ad tier has seen slower growth than initially hoped. According to the data analytics firm Antenna, over half (57%) of the ad-tier subscribers in November 2022 were new or returning customers, while 43% were subscribers downgrading from their fully paid subscriptions. Only 0.2% of total subscribers were on the ad-supported plan. However, projections estimate that Netflix will reach 10 million ad-supported subscribers globally by the end of 2023.

The major announcement of its ad-supported tier also comes with a new OTT advertising option:

Hulu boasts 42.8 million subscribers, and roughly half of them are subscribed to the platform’s ad tier. As the leader in the ad-supported tier, Hulu provides a wealth of advertising options with its robust ad platform.

Hulu offers three main ways to advertise.

The first option is broad appeal or national local ad campaigns. These enable advertisers to reach a specific location or a combination of several locations. National local ad campaigns also allow advertisers to target audiences by interests, behaviors, demographic, and location.

The second option is a premium programmatic advanced TV campaign. This option leverages programmatic advertising to automatically bid on premium inventory via an invite-only auction.

The third is self-service, which allows smaller advertisers to set up their own ads with a minimum budget of $500.

Here are the advertising options available on Hulu today:

Home to over 1.25 billion (yes – billion with a b) video viewers daily, Facebook Watch presents an advertising opportunity that’s too big to ignore.

This platform provides two main video advertising options:

Boasting over 2.6 billion downloads globally, TikTok has become a global phenomenon. It’s home to arguably the fastest growing and most engaged user base today. Although it’s a relative newcomer, TikTok provides low-cost and highly targeted OTT advertising options, including:

According to our 2023 CTV trends report, the top KPIs advertisers are measuring with OTT and CTV campaigns are ROAS, LTV, CPA, and CPI. Let’s go through each one (and some bonuses) in case you’re not familiar with the acronyms.

ROAS: return on ad spend, or the profit generated from your OTT campaigns divided by your total spend.

LTV: lifetime value, which is the total amount of money a customer is projected to spend over the course of their relationship with your brand. CPA: cost per acquisition, which measures the total cost of a customer converting on your ad or taking a specific action.

CPI: cost per install, which measures the cost per installation of your app. This is measured by dividing your ad spend by total installs.

CTR: click-through rate, which measures the average number of clicks your ad gets in relation to the number of times the ad is shown. High CTR doesn’t necessarily translate into revenue, but it does show your ad is generating attention and interest.

ARPU: average revenue per user, which measures the amount of money you project to generate from one customer. This is measured by dividing total revenue by your total number of users from your OTT campaign.

On top of these metrics, it’s important to measure your overall marketing performance whenever ads are shown. This includes:

Know your platforms. Each OTT platform attracts different types of audiences. While Hulu draws a younger crowd, HBO leans toward an older demographic. Research each platform’s audience and the unique ad formats they provide to create the most engaging and impactful experience. .

Be timely and personal. OTT advertising provides abundant audience data to make your targeting less of a guessing game. You can leverage this to improve your messaging, creatives, and even timeliness.

Capture attention early. OTT ads are short and you don’t have much time to make a strong impression. Even if they’re unskippable, ensure your creatives are memorable from the very start.

OTT advertising has made tremendous strides in a short period of time. This rapid evolution brings tremendous opportunities, but there are bound to be some growing pains along the way. Here are a few things we anticipate in the next year.

Netflix’s unveiling of its ad-supported tier stole the headlines in 2022 following its first decline in monthly users, while other streaming platforms that followed suit went largely unnoticed. As platform competition increases, so will content bloat.

According to Recode, all of Netflix’s major competitors are losing money in an effort to catch up with its huge subscriber numbers.

Another factor is the economic squeeze. As discretionary spending slows, investors will begin mounting pressure on OTT services to improve their ad product and non-subscription revenue.

5G technology is on the cusp of being readily available, which will change OTT content consumption and adoption. 5G will enable publishers to broadcast immersive experiences, including live sports events, in 4k. The massive jump in download speeds will also make it easier for mobile users to watch high-quality streams without disruptions.

In fact, it’s already happening. 5G is installed in over 25 NFL stadiums (most recently in Buffalo), and Amazon is already experimenting with broadcasting sports games using 5G technology.

Data is the new oil, especially in an advertising environment that is increasingly prioritizing data privacy. Viewing behavior can be huge for contextual advertising. Additionally, data clean rooms allow OTT media publishers to share customer data with advertisers while maintaining consumer privacy. A combination of first-party and third-party data can help advertisers capitalize on reaching a huge yet targeted audience pool.

For brands that want to reach cord-shavers, cord-cutters, and cord-nevers, OTT advertising can be an effective marketing channel. With the massive adoption of streaming content, advertisers can tap into a broad and highly targeted audience in a much more affordable, streamlined, and measurable way than they could with traditional TV.

But as with all marketing advice, there’s a caveat: OTT may not be for everyone. In particular, brands with tight budgets, and those that perform better on traditional forms of advertising like TV and out-of-home, may struggle to find value in it.

OTT (over-the-top) advertising is the delivery of video ads through streaming content online, bypassing traditional broadcast TV or cable boxes to reach viewers on devices like desktops, mobile phones, and Smart TVs.

While OTT refers to video delivery via the internet on any device, CTV (connected TV) refers specifically to video content delivery on connected or smart TVs.

OTT advertising costs vary based on factors like platform, target audience, and ad format. There are three main pricing models: cost per view (CPV), cost per completed view (CPCV), and cost per mille (CPM).

The main OTT ad formats include pre-roll ads (shown before content), mid-roll ads (during content), post-roll ads (after content), picture-in-picture ads, interactive ads, and companion banner ads.

YouTube leads with 95.8% of U.S. OTT viewers, followed by Netflix. Other popular platforms like Hulu, Facebook Watch, and TikTok also offer significant OTT advertising opportunities.