Discipline before cuts: how to approach rough times methodically

Rising interest rates have made it challenging for startups to secure funding from venture capitalists. And those existing investors? They’re cracking the whip, demanding nothing less than a clear path to profitability.

Profitability? Seems like a significant hurdle for most startups, especially when they’re required to balance essential expenses such as salaries and tools.

As the pressure mounts, it becomes crucial for businesses to reevaluate their ad spend and answer a burning question: How to navigate through these challenging times without compromising the long-term vision?

In this blog, we delve into a critical mantra that’s often overlooked when the going gets tough: Discipline before cuts. Forget hastily slashing marketing budgets and retreating into survival mode. There’s a smarter, methodical approach to empower startups to optimize spending.

1. Assess the situation — what’s your runway

The first step is to get real and assess your company’s financial situation.

We’re talking about your runway — how much money you’ve got left in the bank to keep your business afloat. Think of it as the financial lifeline that indicates how long your business can continue operating with its current cash reserves before getting critical.

So, first things first, check your bank balance. How much cash do you have stashed away? Then look at your monthly cash flow — that’s money in minus money out.

Now comes the kicker — how many months of runway do you have? Imagine nothing changes in your current affairs — no sudden influx of cash, no miraculous turnaround. How long before the cash runs out?

Here’s the reality check: if you’ve got less than six months of runway, you’re in the “red zone.” That’s when you need to act fast.

2. Decide on strategy — exit the red zone

Increasing revenue

If your cash burn is looking positive, and you’re confident you can raise funds before hitting runway, then go for it, no holding back!

But if you find yourself in the red zone, losing money, and not confident about securing external funding, it’s time for some tough but strategic decisions.

Now, before we talk about cutting costs, consider how you can pump up your revenue without adding extra expenses — or in other words, improve monetization.

For instance:

Can you increase your Average Revenue Per User (ARPU) within months through rigorous A/B testing and clever monetization strategies? (Check out our app monetization guide for some suggestions)

Can you bring revenue forward by encouraging monthly subscribers to switch to a yearly subscription plan, enticing them to commit to a longer-term plan? This will help you secure a larger upfront payment and potentially improve cash flow.

Once you’ve figured out monetization, the next step is to dive into your costs — time to be ruthless!

Salaries & tools

Take a hard look at your expense structure and identify where your money is going. Salaries are usually touchy territory, so tread carefully. But marketing ad spend and tooling? There might be some trimming to do there, like that tool no one’s even using or other extravagant expenses.

Within this realm, redundancy operates subtly, siphoning away valuable resources. This manifests as unused tools or duplicates, and at times, tools possessing similar features.

Consider the scenario: Can AppsFlyer’s OneLink effectively replace Bitly? Can Zendesk encompass ASO reviews? Do we need separate vendors for attribution and cost reporting or attribution and deep linking? Overlapping functionalities are commonplace, beckoning us to discern if a tool truly warrants its cost or if an existing solution could suffice.

The remedy lies in centralization, enabling us to distinguish between the tools that are essential and those that are more of a luxury. To illustrate:

Notice how you need the must-have tools to operate, but removing the nice-to-haves won’t have significant affect on your operations.

To navigate this terrain, create an organized overview of the various tools your company uses, along with their respective stakeholders, categories or departments they pertain to, yearly cost estimates, and renewal dates. This kind of information can be very helpful in managing and budgeting for the tools your company relies on.

Focus on strategic cost cuts to eliminate all useless spend and save your precious resources.

Projects

Next up, assess every project and prioritize your core business activities. Eliminate anything that’s not delivering the goods and refocus your resources in areas where you’re getting the biggest bang for your buck.

Identify those long-term bets, high-risk bets, and pet projects that might be nice but aren’t helping your immediate bottom line. Make the tough calls and decide if they’re worth pursuing or should be postponed for better times.

Remember, in tough times, there’s no luxury for distractions. It’s time to tighten the belt and stay laser-focused, keeping your eyes on the prize: profitability.

3. Stay focused and communicate internally — work smarter, not harder

When times get tough, and you’re readjusting your strategy, remember to keep your team in the loop.

Communication is key! Inform the relevant people about the game plan, aligning them with the vision and goals. Transparency is essential here, but stay positive — stressed-out employees won’t perform at their best. Make it clear you’re not cutting down everything and closing shop; instead, it’s all about being super focused on the company’s core business.

Also, ensure team members understand that optimizing business spend isn’t about working harder and hustling like crazy. No, it’s about working smarter to achieve the desired goals.

Pinpoint what really moves that needle on your cash burn, and let your team in on the secret. Make sure they are all centered around these goals, prioritizing projects and app metrics that improve profitability and cutting down those expenses.

4. Deep dive into your ad spend — allocate better and smarter

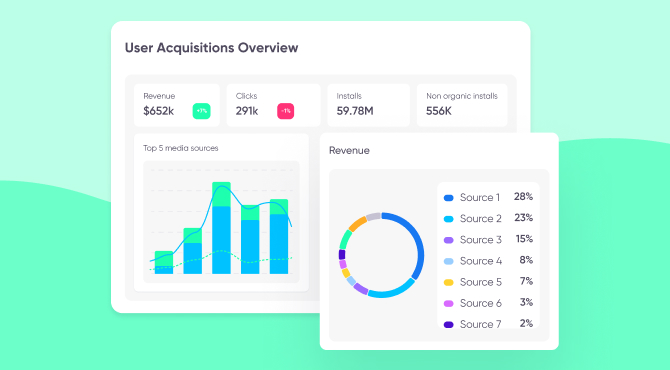

Your main goal when optimizing ad spend is to “trim the fat” — identify and eliminate money losers. But to determine profitability, you have to measure your ad spend properly.

Just to be clear, we’re not telling you to reduce your ad spend — rather we’re urging you to spend wisely and reallocate from what’s not working to what’s driving real results. No cost-cutting here, it’s all about spending smarter and more strategically.

You can use two methods to get into the nitty-gritty of measuring your ad spend and cut out the wasted cash.

First up is the bottom-up approach that gives you a granular perspective on your ad spend.

- Measure the return of your ad spend in detail, focusing on individual actions and results (ROAS) — granularity is key: all the way down to creative variation level and even beyond country level.

- Pay special attention to iOS users, they’re essential for success. Sure, there are limitations with measurement in the post-ATT (App Tracking Transparency) era and SKAN (SKAdNetwork) can be challenging, but you can overcome them.

- Optimize ATT prompts to drive consent rate up and utilize the data from your consenting cohort to inform better targeting and optimization in the non-consenting cohort (check out my blog about how to utilize existing IDFAs)

- Rely on a single source of truth (SSOT) to overcome the complex measurement reality of multiple data sources.

- Leverage predictive analytics to make quick decisions (you can save a massive amount of money – see our analysis right here).

Then, there’s the top-down approach, which is an important complement to bottom up measurement, as it provides a valuable secondary perspective to confirm your findings.

Look at the big picture with media mix modeling (MMM) and conversion lift studies.

Be cautious of seemingly efficient spends, they might be ad fraud in disguise. Consider using ad fraud tools for protection.

In a nutshell, measure what works and make data-driven decisions to reallocate your ad spend wisely.

5. Prioritize cash flow/payback periods over LTV — spend on ads smartly

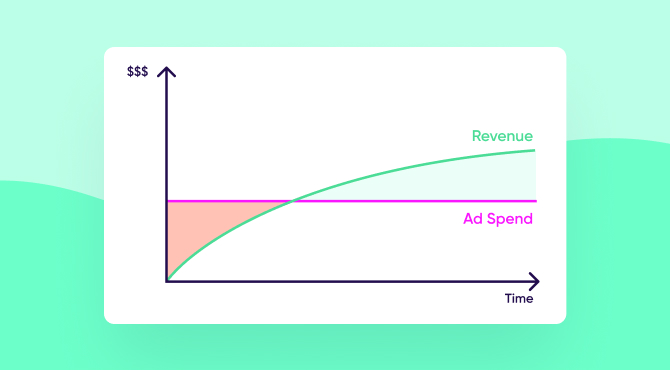

As a marketer, you’re probably familiar with using ROAS (Return on Ad Spend) to measure profitability. While it’s an important metric, relying solely on the LTV (Lifetime Value) can be a risky move during business uncertainty.

Sure, the money comes eventually, but what you need right now is cash flow that hits your pocket fast. In other words, shift your focus to where the money comes in fast — cash flow and payback periods.

We’ve seen it happen before — companies with seemingly profitable unit economics, go bankrupt because they overlooked their cash flow. Luckily, we’ve got a game plan to help you avoid that pitfall.

To start, analyze your sources of traffic and identify those that give you the shortest payback periods. These are the gems you want to double down on. Now, sometimes, these cohorts might not be the same as those maximizing LTV:CAC but don’t hesitate to go after the low-hanging fruit with shorter payback periods and comparable ROAS.

Trust us, you’ll thank your lucky stars for users who convert earlier and bring in revenue faster, as well as those who opt for plans and offers with higher early value. They’re the ones who’ll keep the cash flowing and extend your runway.

Note: For a deeper dive into payback periods and cash flow, check out our two previous articles here and here. You’ll find valuable insights and strategies to effectively navigate through these crucial aspects of your business.

Turning crisis into opportunity: The case for spending MORE, not less

Suppose you’ve already done the groundwork and reallocated resources to maximize your ROAS, but the latter is still tight. Think: getting $1.20 for every dollar spent instead of, say, a sweet $3 back.

That’s when we recommend making the bold moves — doubling down your efforts while your competitors play it safe.

Note: Pay attention to the next part only if your ROAS is slightly positive. If you’re already super profitable or struggling to make ends meet, this might not apply to you.

But if your company is still burning some cash (ad spend is profitable, but the overall company isn’t), listen up: Spending less might not be your best bet. In fact, it could decrease the profit that covers non-ad spend costs.

So, what’s the solution? Spend MORE!

We know, it sounds counterintuitive, so let us break it down.

Say you spend $1 million at a 1.2x return, that’s $200k to cover your essential expenses like salaries, office costs, tools, and everything in between. Now, try spending $100k at the same 1.2x return. Guess what? You’ll only get $20k to cover those costs.

Even if your return increases to 1.5 times, you’d still only have $50,000 to cover everything — a whopping four times less than the first scenario!

When you spend more, you get more. So, don’t shy away from making bold but strategic moves in tough times. But before you go all in, crunch those numbers and check your cash flow. It’s key to make calculated power moves, turning every crisis into a game-changing opportunity.

Key takeaways

- Gauge your financial situation to determine how long your business can operate with current cash reserves. Less than six months requires quick action.

- Eliminate redundancy and unused tools. Prioritize must-have tools and be ready to cut or reduce nice-to-have tools if necessary.

- Assess all projects, prioritize core activities, and eliminate distractions that don’t contribute to immediate profitability.

- Keep your team informed about the strategy, align them with company goals, and maintain transparency. Ensure everyone understands the importance of working smarter, not harder.

- Trim inefficient ad spend and reallocate resources to what’s driving real results. Employ both bottom-up and top-down measurement approaches for a comprehensive view of your ad spend.