Bring joy to your CFO: practical ways to shorten campaign payback periods

In my previous post “Show me the money”, we’ve demonstrated the strategic importance of monitoring your payback periods.

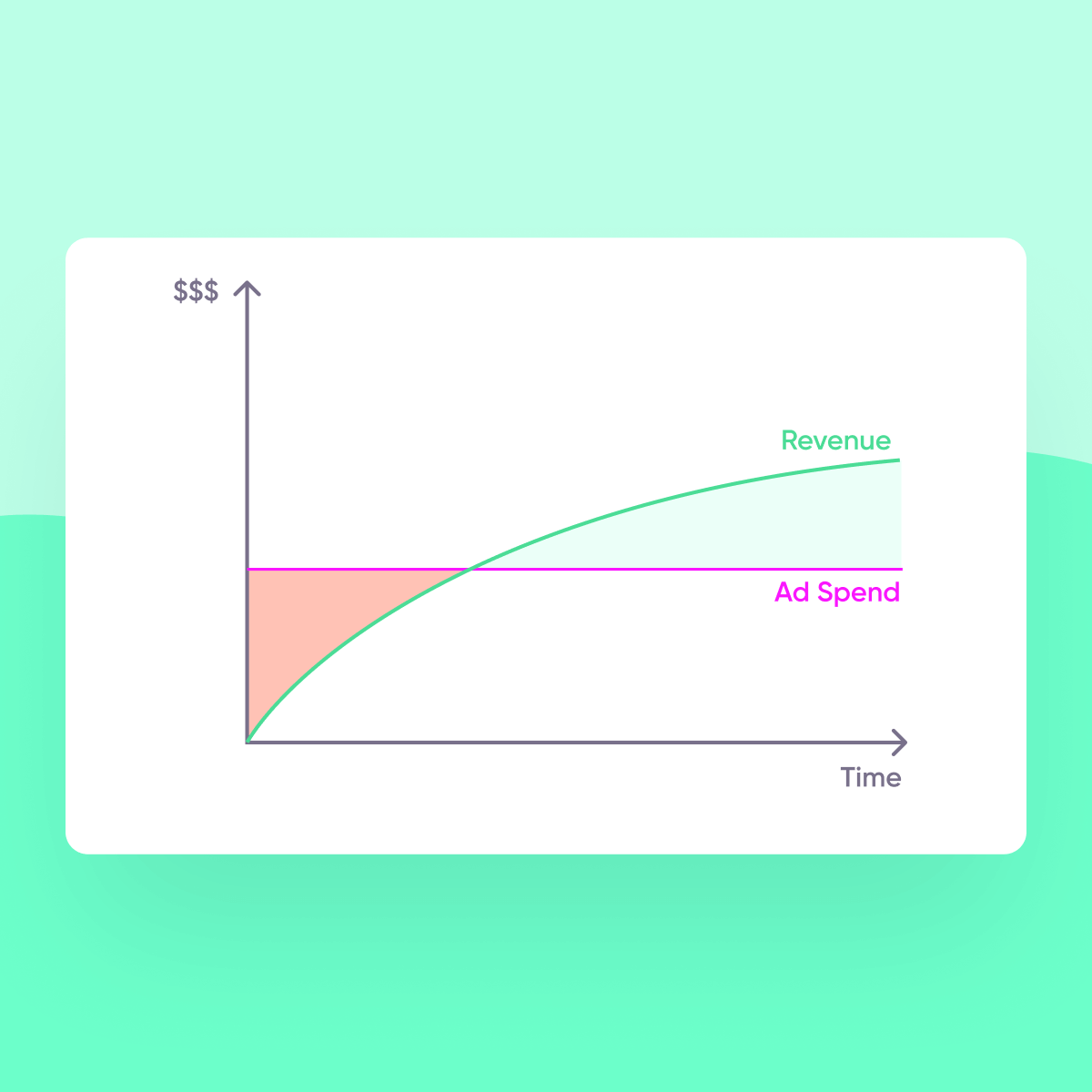

In a nutshell, when inflation was low and money was “cheap”, most companies aimed to drive growth, with an eye on long-term profitability via lifetime value (LTV) metrics.

But when the tide turned, economic uncertainty, high inflation, and “expensive” money shifted the priority to positive cash flow. As a result, the leading metric for marketers became payback period — the time it takes to recoup investment in marketing & advertising. And the shorter the time, the better.

So now the question is how? Let’s dive into ways to reduce the time to break even on marketing campaigns.

1. Improve your ROAS

Ideally, the period to break-even should be as short as possible — as early as after the 1st purchase or up to 30 days. But what levers can be pulled to make it happen?

Payback time is a deep output KPI that includes a number of intermediary metrics dancing together. Just like “improving retention rate” can include a broad set of actions — from onboarding to customer support to CRM and more — shortening the payback period also involves multiple metrics and areas, primarily related to acquisition and monetization.

Easier said than done for sure! While ROAS & payback time don’t fully correlate since additional factors are at play, without changes on the monetization side, improving one is highly likely to improve the other, which is why acquisition actions largely overlap:

Reducing buying price (CPI, CPA).

This can improve both ROAS & payback, but only if the traffic composition remains similar and the quality of acquisition doesn’t drop in parallel.

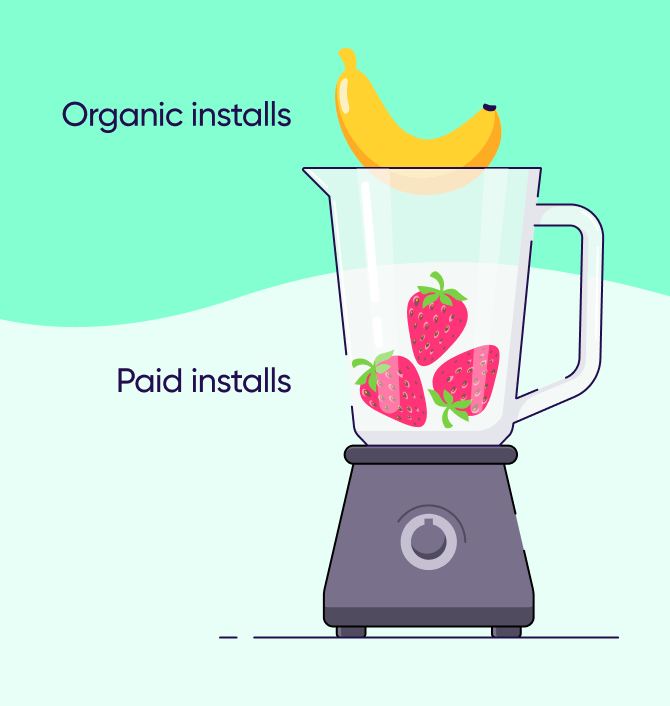

It’s one of the most tricky levers: isolated efforts to decrease CPIs can be counter-productive if they result in a drop in post-install conversion & traffic quality. Intermediary metrics should not be examined in isolation. It’s not all about reducing CPI on paid networks: improving your “organic” visibility (for instance by iterating on referrals and the shareability of your app) can add more users without spending on media, resulting in a lower blended CPI which in turn is likely to reduce payback time.

Improving down-funnel conversions

Both ROAS & payback time are likely to benefit from higher conversions: driving more revenue per user should shorten the payback time. This is more often than not the responsibility of product, iterating on paywall triggers and layout for instance. Yet, marketers can also play a significant role, for instance by:

- Analyzing which cohorts monetize the best. They may not just move more ad spend to these cohorts, but also understand which sources, messaging, creatives, and user journeys are best and apply those learnings.

- Improving the journey consistency, creating smooth transition from creative to AppStore (using dedicated CPPs and aligning messaging) and even onboarding and beyond (through deep linking & personalization)

2. Shift your acquisition North Star metric from LTV to cash return time

By switching around their leading metrics, marketers can better optimize their marketing mix with cash flow in mind. Analyze which sources of traffic bring the shortest payback periods and double down on those.

In some cases, these cohorts may not be the same as those that maximize LTV:CAC. You can also find cohorts with comparable ROAS that show shorter or longer payback periods, for instance if users convert earlier (bringing revenue back faster) or to plans & offers with higher early value.

This decision is certainly not made any simpler on iOS as SKAdnetwork doesn’t provide much detail about each cohort and only focuses on first day(s) activity (in versions 2 and 3). Fully utilizing the value of the consented cohort can also inform where to double down. More about this in the recent How to leverage IDFA data blog.

3. Design monetization & pricing for shorter payback

While monetization may sit in product or a dedicated team’s core responsibility in some companies, “Price” is one of the infamous four “P” of marketing and is a big part of the equation for payback. There are various ways to optimize for shorter returns working through monetization schemes.

Some apps show surprisingly inelastic behaviors with pricing, and can try to increase price points without losing as much on conversion rates. This obviously has a ceiling and raising prices can also be counterproductive, but I was surprised to see the % of A/B tests where a higher price point was helping with both ROAS & payback periods.

Another way to optimize for payback, in the case of subscriptions, is to show users a yearly instead of monthly or even weekly option by default. This may or may not increase overall ARPPU, and requires subtle design.

But unless you severely harm conversion, yearly plans will bring more revenue forward as the first invoice includes the entire first year of revenue, which would have taken several months to compound otherwise.

To be even more extreme, payback could be shortened further by pushing users into a lifetime subscription at a higher price point. Lifetime may be used as a way to make the yearly plan look better, but it can also be used to increase early cash collection. I’ve seen consumer apps with $300-$400 one-time plans!

Each app should analyze the full consequences of switching pricing in depth, which is not as trivial as it may appear first. I’ve seen both successful monthly or yearly LTV experiments, but if and when the cash constraint is tough, driving more revenue earlier, rather than distributed over time, is likely to help with cash flow.

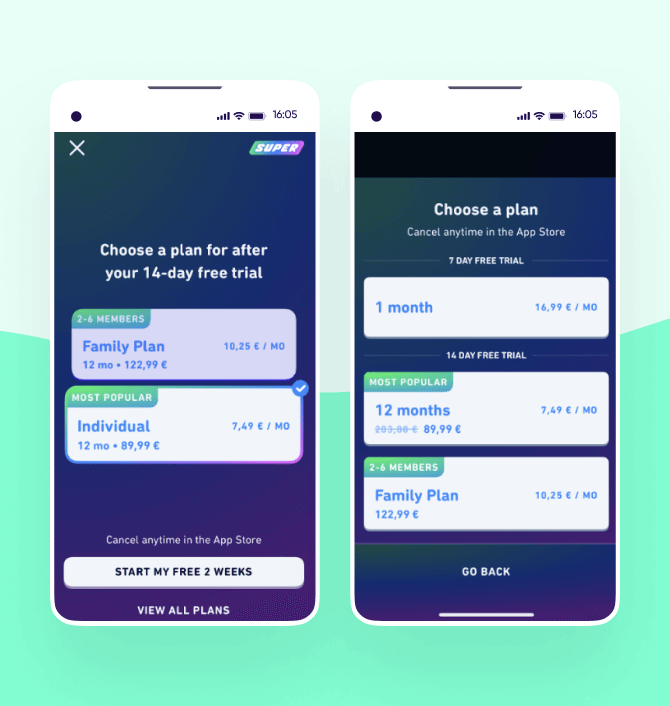

Some apps only offer yearly plans. Others may show a monthly plan only to users who discard this option initially. A growing paywall layout example is to start with the plan(s) that are most important to the developer, and then offer other options in a second screen hidden behind a more discrete “view all plans” call to action.

For instance Duolingo offers two yearly plans at 89.99 and 122.99 on the default screen, while the monthly option for 16.99 is only visible in another screen many may not see:

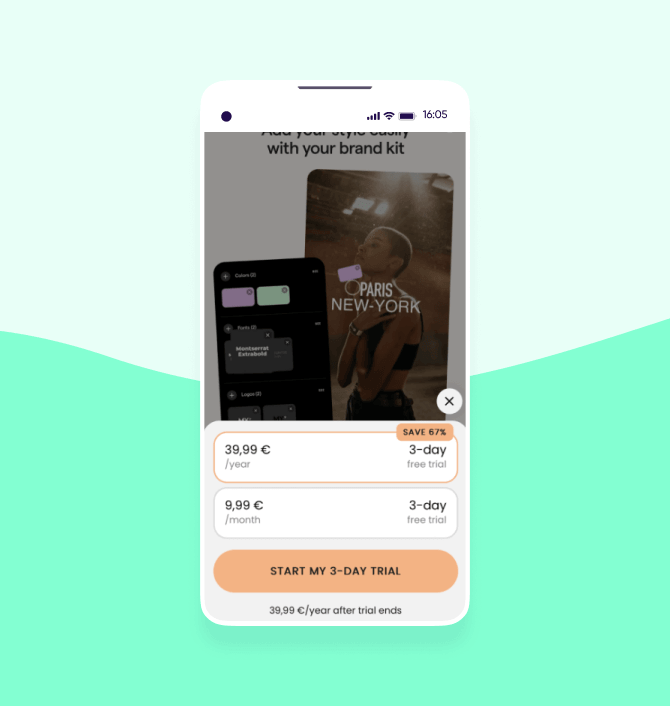

Another way to shift more users to a plan that brings money earlier is in the design of the pricing screen. One can direct users to pick the plan that fulfills their cash return objective by making it more attractive or simple: selection by default, highlighting total savings, or even increasing the price of other plans to maximize the decoy effect and make yearly (or even lifetime!) plans appear more enticing.

In this example from Mojo, a video editor to enhance your Stories, Reels & Tiktoks, this yearly plan is pre-selected, and with a ratio of 1:4 between monthly and yearly, they are able to showcase that the yearly plan is 67% “cheaper” while collecting 4 times more from the first invoice:

This isn’t relevant just for subscriptions but any IAP or even credit card payment monetization model. For instance, the popular F1 Clash game offers both a highlight (“most popular”, “best value”) and huge discounts (“110% FEE!”) to attract more users to the expensive options:

Bring future conversions earlier

Monetization timing. Some products monetize early on. In the case of subscriptions apps, it’s not uncommon to see most subscriptions start during onboarding before users even experimented with the product. Others allow users to understand the value before presenting monetization to increase intent or “hook” on a habit. It’s possible that the “late monetization” tactic is more effective from an LTV point of view, but it may delay revenue and payback longer.

In some cases, bringing revenue earlier may matter more than bringing more revenue, and apps may present monetization options early in the experience to optimize for fast cash returns.

In Overlooked, Alexandre Dewez showcase 3 examples of apps monetizing either:

- Very early: almost right after the app opens, like Splice. This is also the case for Curio (the paywall is the first screen after the download!) or Photoroom (where a 5-tap flow brings to the A-ha moment, followed by a paywall)

- Early on, at the end of onboarding, like Fitness Coach (very common in health & fitness apps like Noom, 8fit, and many more)

- Later on, after an initial product experience, like Duolingo

An interesting case of switching is Blinkist. A few years ago, Blinkist offered a “reverse trial”, granting all users 3 days of premium features before showing the paywall. After many iterations, it currently engages into a trial from the get go.

Promotions. Another way to accelerate future revenue is to offer promotions earlier. For instance, you might offer a half-price pack of IAP to users who retain on their second month or didn’t purchase on the first 10 paywalls they face.

By lowering these numbers (ex: offer a discount in the second week instead of second month, or after the 5th paywall instead of the 10th), it may be possible to bring future revenue forward. That’s particularly true for products that struggle with retention, to convert before users churn entirely and are harder to reach again and convince.

Optimize terms of payment

When looking at cash flow, your CFO might be less interested in when users convert than when the cash actually enters the bank account.

Platforms. There is much discussion on the level of platform fees (typically 15% to 30% on the 2 main app stores), and various developers are looking at ways to convert their users off the app to reduce commissions, hence improve margins, which in turn can also improve ROAS and payback.

One factor that is often not taken into account is that payment processors on the web may offer shorter terms of payment. Apple & Google have complex payment schedules so to simplify, let’s assume that the average time from transaction to payout is 45 days. In contrast, Stripe for instance offers payout speed of 2 to 7 days (depending on countries and other factors).

These intricacies in terms may not be top of mind for marketers, and are not particularly negotiable, but when money is “expensive” and cash positions are stretched, they can make a huge difference. I’ve had one case myself where had we not switched most of our conversions off the store (which was less profitable in the long term, by the way), we wouldn’t have been able to pay salaries! Instead, it went on to grow 4x in the following 2 years.

Negotiate terms. shortening the time that user transactions materialize into cash in the bank without any change in scale, UA tactics or monetization changes, a CFO might not just have a margin to operate but even in some cases make small interests on the difference.

That said, it’s very hard to pull: it seems highly unlikely that developers can have enough leverage to obtain special rates from Google & Apple.

It’s not all about money in, but also money out. It’s common to see larger companies negotiate terms with business partners. As an independent myself, a client offered me a bonus if I was willing to be paid on day 115!

User acquisition media sources are often one of the biggest sources of cost alongside salary & structure, and they may offer more flexible terms. That would require some serious negotiation skills, and is not always doable, but moving from net30 to net90 can make a CFO much happier. From past experiences, committing a future level of ad spend with networks can help in this tricky conversation.

Closing word: Be careful what you aim for

We’ve seen that there are many ways to shorten payback periods, whether by improving acquisition performance, changing your monetization tactics & strategy, or working with payment terms.

Be very cautious that several of the levers mentioned above can be double-edge swords. In particular for monetization schemes and promotions, such tactics can lead to cannibalizing future and higher revenue. Discounting too much too early in particular may hide the fact that this revenue would have taken longer to materialize, but at a higher level.

Measure precisely the effects of each change, model the long term impact, and decide alongside your C-level where to place the cursor on the scale of “making revenue earlier” (payback) vs. “making more revenue” (LTV).