Welcome to the new normal: Black Friday 2021 on track to be the biggest ever for mobile apps

Mobile marketers saw explosive growth in the past year. COVID-19 and social distancing led consumers across the globe to adopt mobile eCommerce sites and apps at record levels.

According to eMarketer, 2020’s total mobile commerce sales rose 28%, reaching $2.7 trillion dollars and accounting for nearly 65% of the world’s retail eCommerce sales.

As digital transformation accelerated throughout the year, surges in eCommerce culminated in a Black Friday unlike any other, resulting in massive app install growth rates and in-app revenue gains.

The growth we witnessed last year across the app economy has yet to subside. According to our new State of eCommerce app marketing report, between January and July of this year, eCommerce app installs increased more than 48% over the same time last year, with consumers generating 55% more revenue than they did in 2020.

Meanwhile, mobile marketers spent $5.4 billion on app install ads for the six months between October 2020 and March of this year ($1.8B in the US), scrambling to capture consumer attention in an already saturated market.

2020 ushered in a whole new world of mobile-first consumers. In fact, the entire pre-holiday season baseline in app installs and revenue has elevated to match or even surpass the 2020 holiday season!

Despite the challenges marketers are facing with diminishing data brought about by significant changes in iOS 14+, the stage has been set for another record-breaking Black Friday, as we’ll demonstrate in this blog.

App activity on a global scale: A look at what’s happening around the world

Industry analysts forecast this year’s mobile commerce sales will reach $3.2 trillion, with Black Friday through Cyber Monday, and the remaining holiday shopping season, driving much of the mobile commerce activity.

The following app trends for the US, UK, and Brazil highlight just how much growth we’re seeing across the globe.

US: Black Friday sees massive surge in consumer spend

Key findings:

- Overall app installs increased 40% year-over-year, while non-organic installs dropped 6% (Nov. 2020 vs. Nov 2019).

- Black Friday 2020 saw non-organic app installs up 43%, while consumer spend surged 143% (compared to activity from the three previous Fridays).

- Between January 2020 and April 2021, CPIs increased 122%, climbing from $13.81 to $30.74.

UK: Overall app installs soar

Key findings:

- Overall app installs increased 153% year-over-year, while non-organic installs increased 82% (Nov. 2020 vs. Nov 2019).

- Black Friday 2020 saw non-organic app installs up 23%, while consumer spend surged 35% (compared to activity from the three previous Fridays).

- Between January 2020 and April 2021, CPIs increased 275%, climbing from $3.74 to $18.09.

Brazil: Black Friday installs and spend skyrocket

Key findings:

- Overall app installs increased 63% year-over-year, while non-organic installs increased 66% (Nov. 2020 vs Nov 2019).

- Black Friday 2020 saw non-organic app installs up 229%, while consumer spend surged 793% (compared to activity from the three previous Fridays).

- Between January 2020 and April 2021, CPI increased 170%, climbing from $1.01 to $3.12.

2021 Black Friday outlook: What mobile marketers can expect this holiday season

Based on the trends we’ve seen over the last 18 months, the economic outlook for Black Friday and the following holiday shopping season is extremely promising. Not only are app install rates expected to climb, but the amount of money consumers are spending in eCommerce apps will also increase.

Deloitte estimates overall eCommerce sales to be up by as much as 15% over last year’s holiday results.

“We anticipate strong consumer spending for the upcoming holiday season,” said Deloitte US economic Forecaster Daniel Bachman, “Further, eCommerce sales will continue to grow as consumers demonstrate an ongoing and steady movement toward buying online across all categories.”

Although most social distancing restrictions had been lifted in 2021 and people have been adapting to living alongside the virus and its variants (as much as possible), shopping will never be the same again. It has gone digital and there’s no turning back.

There’s plenty of data to back up this claim. A Deloitte survey of 2,000 US teen and adult smartphone users found that 70% stated they would continue their new smartphone behaviors even in post-pandemic times.

While the overall economic climate for mobile marketers is good, one crucial component that needs consideration is the rising cost of media. Mobile marketers will need to adjust their ad budgets accordingly, as higher CPIs impact the ability to buy at scale. Marketers who fail to adjust their budgets for increased CPIs will be left with far fewer app installs.

This is the cost of so much growth: A highly competitive market, with countless online retailers fighting to win as many eCommerce dollars as they can.

Uncertainties ahead: The impact of diminishing iOS data

We know the pandemic drastically accelerated digital transformation efforts — by as many as three to seven years for some businesses, according to McKinsey’s findings — but there are still many uncertainties ahead, especially in dominant iOS markets like the US and the UK.

Despite the growth we’re seeing across the app landscape, mobile marketers responsible for increasing app installs and usage rates are facing a major obstacle this holiday season: diminishing user data on iOS.

With the loss of most of the user-level data driven by Apple’s App Tracking Transrepcey (ATT) framework in iOS 14.5+, mobile marketers must now rely on aggregate data to inform their app campaigns and strategies.

It’s difficult to say exactly how Apple’s latest iOS updates will impact the holiday shopping season.

Industry reports, including our own, make clear that eCommerce activity is likely to skyrocket during the fourth quarter of this year. But the loss of user-level data may result in marketers tightening their budgets until the industry as a whole is able to adapt to the new aggregate level data environment.

Besides limited LTV data and limited targeting capabilities, the loss of user-level data (or IDFA, Apple’s identifier) will have a major impact on paid remarketing in iOS , which is dependent on IDFA. As a result, remarketing efforts will be difficult to scale. Instead, it will be more effective for mobile marketers to focus on owned properties and media channels, leveraging in-app messages, push notifications, and email to re-engage consumers during peak periods.

In order to increase the number of consenting iOS users with full data granularity and increase iOS remarketing audiences, app marketers need to maximize ATT opt-in rates by evaluating when and how to display the ATT prompt to optimize the overall UX and build trust with the user.

In fact, we’ve found that when singling out users who saw the prompt, 40% accept tracking. Furthermore, higher ATT adoption rates among eCommerce apps would mean higher IDFA collection rates, which in turn would enable better, more accurate measurement and optimization, as we demonstrate in this analysis.

The new world of ecommerce is here and it’s mobile-first

The ease and convenience of mobile commerce is much too alluring for consumers ever to return to their pre-2020 shopping behaviors. As our data demonstrates, mobile marketing has seen an increase in adoption rates on the app-side of things, with app installs and in-app spending experiencing substantial growth this year.

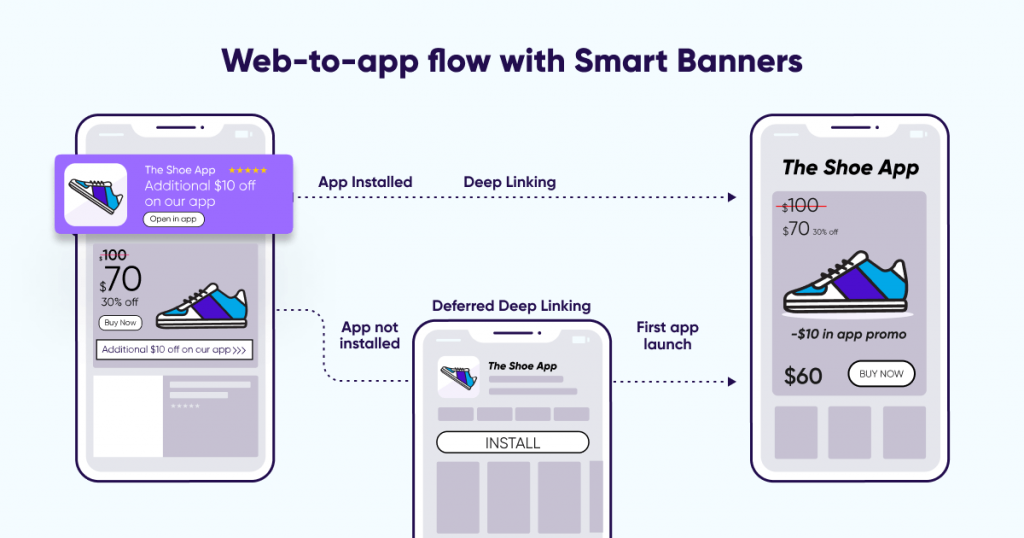

As app activity continues to increase, so do business outcomes. Google found a 31% increase in average transactional values when users used both the web and an app to interact with a brand, versus only relying on the brand’s website.

One retailer confirmed to Google that its app users had a higher average order value (AOV) and higher customer lifetime value (CLV) than customers who used the website: “The more customers we can move to the app experience, the more revenue we generate.”

The key is to build a world class mobile-first experience with consumers to drive engagement and ultimately sales. For marketers, this means ensuring a smooth transition from mobile web to app.

The bottom line

The steady climbs we’ve measured across the app landscape can mean only one thing: Mobile marketers are poised to enter 2022 on tailwinds stronger than ever before.

To maximize on this growth, mobile marketers need to understand how we got here and the challenges that lie ahead. Our newly released State of eCommerce app marketing report offers a deep dive into the critical factors playing out across the app economy, breaking down the numbers for North America, Latin America, APAC, and EMEA regions. The report includes insights on how we got to where we are now, along with action items marketers can take to prepare for the 2021 holiday season.

There’s no question online retailers are going to see a staggering amount of mobile app activity during the holidays. The marketers most likely to capitalize on their holiday gains will be the ones most prepared as we near Black Friday.

Download AppsFlyer’s 2021 State of eCommerce app marketing report today!