Introduction

Introduction

Finance apps have become essential to the way people interact with money. From trading platforms to digital wallets and buy now, pay later (BNPL) services, apps have transformed how consumers manage their financial lives. Within this landscape, banking apps stand out as one of the largest and most critical subcategories. Unlike newer fintech players, banking apps are digital extensions of traditional institutions, built to bring core banking into the mobile age.

These apps differ from other finance tools in two key ways. First, they must comply with strict regulations. Second, they play a central role in everyday life. They aren’t occasional-use platforms, but the primary gateway to core banking. Customers depend on them to check balances and transactions, transfer money (to themselves, others, or abroad), pay bills, deposit checks, and manage cards. Over time, expanded service offerings and broader mobile access have raised the bar: customers now expect complete financial management at their fingertips, anytime and anywhere.

And those expectations go far beyond basic functionality. Customers demand smooth, personalized service that flows seamlessly across app, browser, and branch. They want to authenticate, move money, and resolve issues as easily as paying a bill. Most importantly, they expect uncompromised privacy and security – standards that are non-negotiable under the strict regulatory frameworks banks must follow.

Usage trends highlight this dependence. Banks generally keep users engaged for longer than other finance apps, with many customers engaging with their bank app several times a week – sometimes daily – for quick checks and routine tasks that once required a branch visit. That’s an edge that banks have over other finance services, but they still suffer the effects of churn like any other category of app. Retention, then, remains a priority alongside acquisition.

For traditional banks, most customers are already on mobile. Growth means deeper activation, migration to digital servicing, and cross-sell opportunities.

For banks, however, meeting these expectations brings new challenges. Marketing efforts such as email campaigns, QR-led activations, and cross-channel journeys only deliver value if measured effectively. With customer journeys sprawling across digital and physical touchpoints, capturing, analyzing, and acting on the full picture is no longer optional – it’s essential to protect ROI and grow customer lifetime value (LTV).

“Mobile app adoption across top subgenres like Mobile Banking and Digital Wallets & Payment continued to climb as consumers continue to turn to their mobile devices more than ever for their finance needs.”

SensorTower

Overcome 7 Critical Banking App Challenges

While banking apps play a key role in deepening customer loyalty, driving account registrations, and improving product sales, there are also multiple challenges to overcome:

1 – Privacy and security compliance

Banking apps process highly-sensitive user data – and compliance is non-negotiable. A customer’s identity, accounts and finances are all tied to their banking app. Banks must balance the visibility of that data – to offer personalized services and offers, for example – with rock-solid governance and risk control.

In general, the data collected and maintained by banking apps is largely more sensitive than for other verticals.

Consequently, the most severe security regulations are faced by banking institutions, who are governed by the strictest regulatory bodies and must naturally hold on to user data for longer periods of time.

Since we entered the 2020s, privacy has taken center stage in mobile app marketing. Both Apple and Google have introduced new privacy measures in recent years, which have meant that user-level data has become much less readily available than before.

These privacy-centered changes have a direct effect on marketers’ ability to measure LTV, conduct remarketing campaigns, and segment audiences. Luckily, innovation from mobile measurement partners (MMPs) has helped to clear these hurdles.

Today, AppsFlyer provides ISO 27001 and ISO 27701-certified infrastructure with server-to-server and SDK-based deployment options. Built with data sovereignty, privacy and auditability at its core, AppsFlyer allows banking apps to measure mobile engagement while staying fully compliant with GDPR, LGPD, ISO standards and internal governance.

2 – Measuring business-critical conversions

The emergence of banking apps has completely transformed the way many consumers handle their finances. The challenge for banks is measuring key conversion events like card activation and KYC completion, all while maintaining security and privacy compliance.

Measurement of the customer journey is at the heart of understanding app and marketing performance. Without an ability to measure the touchpoints that drive business-critical conversions, banks are left with unoptimized budgets and weak ROI justification for leadership.

3 – Seamless, measureable journeys for complex flows

Consumers expect their banking apps to have extensive functionality as they manage every aspect of their finances. That means a network of processes behind the scenes that need to provide a seamless, effortless user experience.

The complexity of those processes, and the ways they need to interact, can open up the possibility for blind spots and drop-offs – particularly as customers switch between channels (for example, from email to app).

Onboarding, authentication, and transactions themselves all need cohesive, measurable customer flows. Instead of adding more touchpoints, it’s important for marketers and apps to optimize existing customer journeys with data.

4 – Enterprise-level ad fraud risk

Finance apps were the vertical hardest-hit by fraud in recent years, with more than half of all install fraud exposure globally coming in the category. For banking apps, fraud isn’t an inconvenience: it’s a risk that runs into the billions of dollars every year.

Fraud is a huge challenge among Android banking apps, with Latin America a region that suffers more than most. While some app verticals can pour resources into suppressing install fraud, banking is at risk of fraud throughout the funnel – for example, onboarding and transactions.

To overcome fraudulent activity and maintain data integrity, post-install validation is absolutely critical for banking apps.

5 – Mapping cross-channel journeys across teams

The journey of a banking app user often spans multiple devices, platforms and channels, mixing together online and offline touchpoints. That creates the potential pitfalls of siloed data that can be difficult to stitch together into a cohesive picture.

Banking apps need robust measurement systems in place to cover the cross-channel journeys that a customer will typically undertake. Working with a measurement provider like AppsFlyer can help bridge the gaps of an omnichannel journey and inform strategies to optimise them.

6 – Reactivating high-value users securely

Banking is a vertical where users are – ideally – in for the long haul. But just because banks enjoy stronger engagement than other finance apps, doesn’t mean that user churn is low. Reactivation still has a significant role to play – providing it’s privacy-safe and anchored in meaningful intent on the user’s part.

Whether it’s dormant depositors or inactive cardholders, banks need to be able to re-engage users further down the line to boost LTV. As always, this needs to take place via secure, measurable paths to not only give accurate insights on the business impacts of reactivations, but to do so in a compliant fashion.

For traditional banks, accurate attribution enables visibility into whether mobile is actually delivering customer outcomes – not just installs.

7 – Personalization and preserving privacy

Delivering a personalized user experience is key for driving customers to engage with specific functions within a banking app. However, personalization cannot come at the cost of privacy.

Banks can deliver a personalized mobile experience while remaining fully compliant with regulatory frameworks like GDPR, LGPD, and internal risk policies.

By combining deep linking, event-based triggers, and targeted push notifications, banks can tailor messaging and app flows based on real user behavior — such as resuming a loan application, reminding a user to complete KYC, or surfacing relevant services post-login.

Unlike generic personalization tools, these techniques operate without relying on PII or user-level tracking. Instead, they rely on consented, first-party signals that respect privacy requirements while still enabling banks to deliver timely, contextual, and high-value interactions.

This approach empowers banks to meet customer expectations for digital relevance — without compromising internal compliance, legal, or security controls.

The solution: Granular measurement as the foundation for… everything

In these challenges, we’ve looked at how banking apps have an edge when it comes to retention and engagement. But it’s a mistake to think that this is a battle that’s already won. Banking apps do lead the way for retention but still face the challenge of meaningful churn.

It’s why uninstall insights, optimized user journeys and intelligent re-engagement have such value. Measurement is at the heart of this solution: not only of basic KPIs, but also granular metrics that map every stage of the conversion funnel to inform both user acquisition and re-engagement.

Registration, onboarding and in-app engagement can all be measured to help banks optimize customer journeys in real-time. In turn, marketers are able to hone in on the audiences they’re looking for and uplift their overall marketing performance.If you’re just getting started with mobile attribution and marketing analytics, we recommend reading mobile attribution in the age of privacy first.

Mobile banking user acquisition – Key metrics and set up

Mobile banking user acquisition – Key metrics and set up

Before you even get started in setting up your UA campaigns, you must first have a few capabilities in place to guide your setup in the right direction. Let’s take a look at the essentials:

#1 – Event Mapping

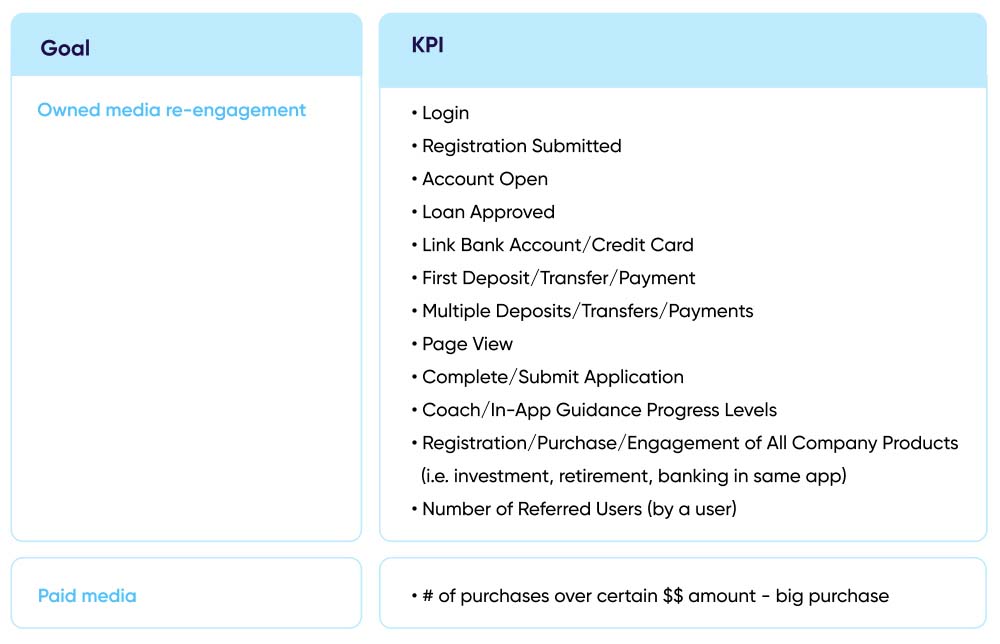

To begin discussing the importance of granular measurement for successful UA, let’s take a deeper look at what that actually means in practice.

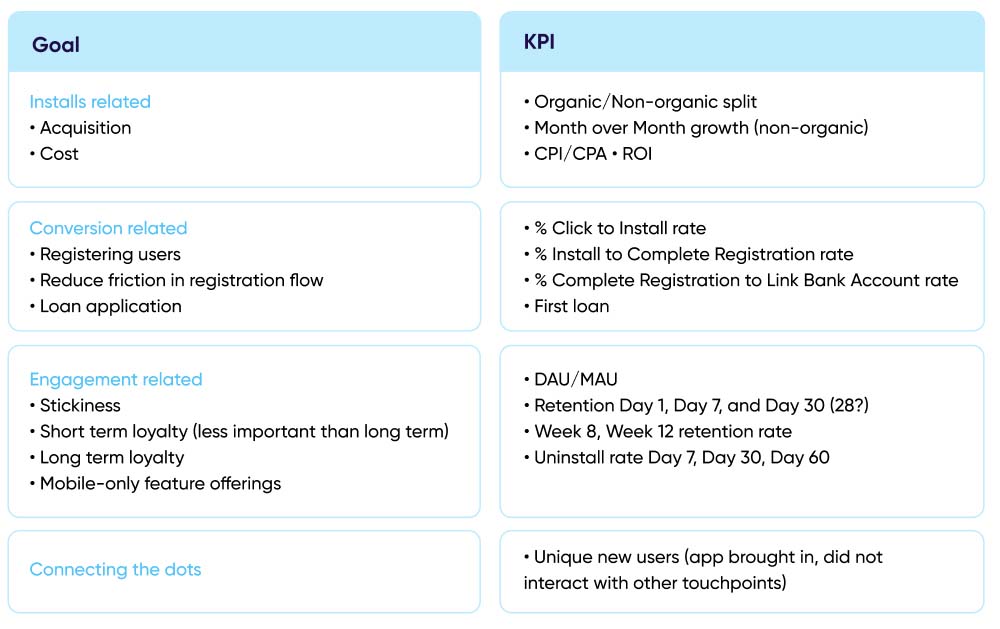

The chart below explores some of the main metrics banking apps can employ to optimize their efforts and deliver the highest-value users to their apps. The left column contains vertical-specific goals, while the right column contains the metrics through which these goals can be met.

While the frequency of logins in banking apps may be lower than in other verticals, engagement metrics are no less important — they just look different.

AppsFlyer’s reports measure retention as the share of users who remain active over time. Here, we’re focusing on depth – the value of what those users do (transfers, card activity, bill-payments). Fewer logins can still coincide with stronger, business-ready engagement.

These signals enable better personalization, audience segmentation, CRM performance, and ultimately — help prove whether mobile is driving real servicing outcomes.

What to measure – SKAdNetwork

One of the most complicated aspects in Apple’s iOS 14+ measures to safeguard user privacy is SKAdNetwork’s conversion value and timer extension mechanisms. Since post-install data is what matters most in the freemium-driven app ecosystem — this poses somewhat of a problem.

Before iOS 14, marketers could measure in-depth and at length to determine customer or campaign value. But in Apple’s SKAdNetwork, the data is far less in-depth. You get 64 combinations from 6 bits to map post-install activity and a few days at best of activity data. In other words, conversion values are SKAN’s alternative to [limited] LTV.

With limited options, it’s imperative that advertisers make the most of what is possible. To be clear, what is possible can be plenty — if done right. But what does ‘right’ look like? How should marketers map their conversion value schemes?

To answer this question, we looked at data from our recently released Conversion Studio and analyzed the configurations of 600+ apps to help advertisers learn the bits and bytes — about the bits and bytes.

The data shows that for many marketers, conversion values are tough to master. While some have learned to squeeze the data lemon (unsurprisingly, mainly from the gaming crowd), others are not even close to utilizing the full potential of this new mechanism.

For more SKAN Insights, visit the Inside SKAN series. And for a recap of what conversion values are all about — here’s a quick video.

The why and how of rich in-app events

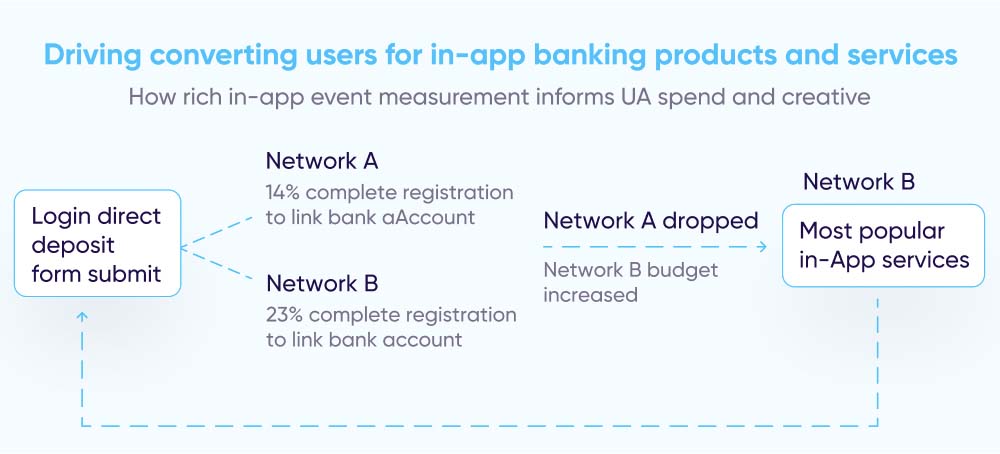

The depth to which banks can gather the right data in order to optimize campaigns towards high quality users, and boost engagement and revenue along the way, is significant.

That also means the amount of data we need to handle and analyze is massive, though with the right tech stack, setup, and measurement platform, marketing analytics can be made much easier.

But still… Why do I need to measure rich in-app events and other granular data?

Highly effective new customer acquisition, engagement, remarketing are all driven by building audiences and optimizing media sources, channels, campaigns, and creatives based on rich in-app events.

These events add layers of both available and measured parameters that map out ideal customer behavior.

With the raw data you receive from a measurement and attribution provider, you’ll be able to actually see user trends and patterns you might otherwise miss. It will help you to get a complete picture of user activity and behavior, no matter the platform, channel, device, and the time at which they perform actions.

Many traditional banks are focused on ensuring their apps support successful onboarding, servicing, and long-term customer retention. As digital maturity grows, the ability to guide users toward additional products or services — tailored by need and behavior — becomes a critical lever for cross-sell and customer value expansion. However, this must be done within strict regulatory boundaries and based on measurable engagement signals.

The top events banking marketers typically measure include:

- First Log in / Login

- Direct deposit / Transfer

- Page view

- Application / Form submit and completion

- Balance checked

- Offer clicked

- Statement viewed

- Loan calculator viewed

#2 – Deep linking

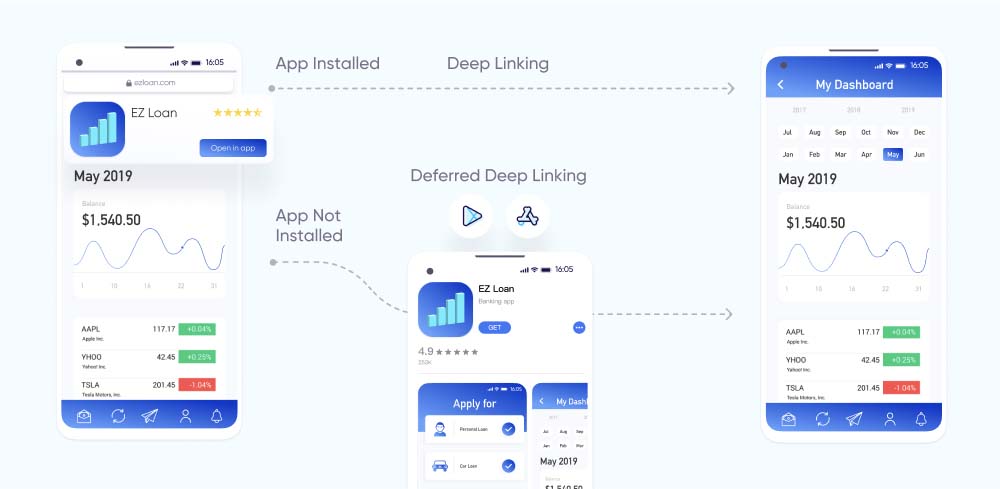

One of the most powerful tools in the app marketing tech stack is deep linking, creating a contextually-relevant user experience across channels, platforms, and devices. How is this done?

Using the information contained in the deep link, users are brought directly to a specific product or campaign landing page within an app, seamlessly moving from promotion to the app landing page with greater likelihood for conversion.

AppsFlyer’s OneLink infrastructure supports dynamic routing based on user type and context, allowing banks to drive onboarding completion, credit activation and upsell flows. Teams can easily personalize journeys via SMS, email, QR and web without engineering effort – and attribute every step of the funnel for accurate measurement.

To get started, you must first configure deep linking. Luckily, this can be done easily by implementing code in your app, or through enabling associated domains, depending on the method used.

Also pay attention to the fact that deep linking is needed for both specific product, service, application, registration, or other account pages.

The destination to which a user is brought is primarily dependent on:

- The deep linking campaign goals

- The consenting user information previously gathered (i.e. content viewed, account history, location, etc.), which must be decided and understood ahead of time.

For more information, read our guide on Deep linking 101: The why, what, and how of today’s most trending customer experience technology.

Advanced deep linking strategy

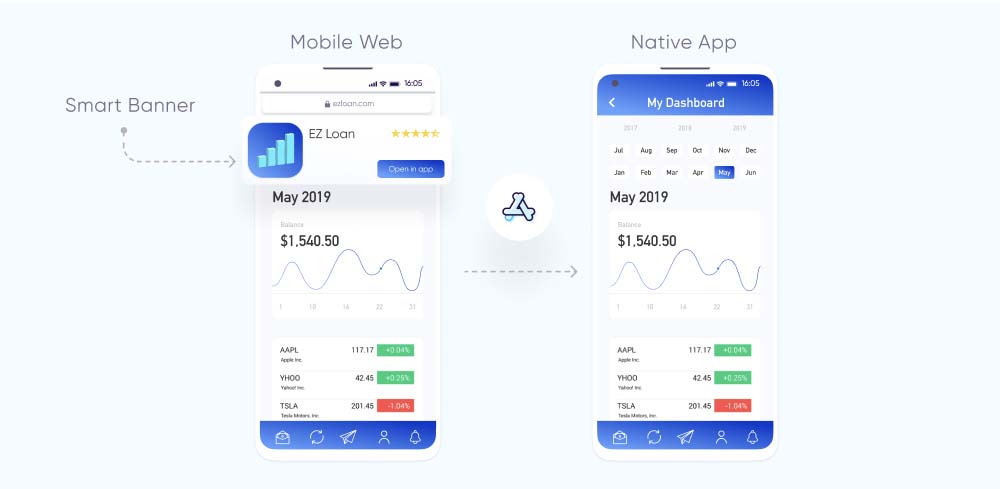

Banking app marketers can also use deep links to bring existing and converting users specifically from mobile web to their apps, via an ‘Open in App’ call-to-action smart banner.

These call-to-actions often go hand-in-hand with campaigns offering special offers or benefits for in-app users, or service suggestions based on previous web engagement history.

Through the deep links placed in these banners, marketers can bring new users to install their bank’s app, get smoothly routed to the same product or service page previously viewed, and later to a form page for signup.

But why would marketers want to reroute users to their app from mobile web in the first place? Simply put, the app is the ultimate destination because of its unmatched native user experience, data insights, and massive brand impact it can provide by placing a logo on prime real estate — a user’s mobile home screen.

When a user clicks on a smart banner popup and follows it to a page in the app, you can receive data on the user’s subsequent in-app activities, the IDs of product and category pages visited, and even, retroactively, the attribution data from the user’s journey to your mobile website.

Beyond the valuable data gathered, however, smart banners also contribute to an improved user experience, increasing the potential of greater brand loyalty and engagement overall.

When choosing a deep linking solution, make sure that it not only supports your growth needs, but is also in sync with the latest privacy and security guidelines, and your campaigns comply with the most up-to-date user privacy and security regulations.

#3 – Uninstall measurement

It’s not enough to bring users smoothly to your app, and personalize their experience within it to optimize conversion rates and reduce churn.

Marketers must also address the inevitable segment of users who will uninstall their app completely, and either build a strategy to bring those users back to active engagement, or exclude these users from future campaigns — if they believe a re-install is unlikely to occur.

To do so first requires understanding why, when, and which users uninstall, especially given the rising scale of competition and higher user expectations.

So what are some of the things that can make users uninstall your banking app?

- Poor in-app functionality and experience. Optimize your campaigns all you want, but it’s nothing short of critical to ensure you have a great infrastructure to support your app’s functionality, and ensure a flawless user experience.

- Excessive and/or impersonal onboarding process. Ensuring that your customers move as quickly and smoothly as possible to active engagement means building an onboarding process that is short, simple, and intuitive.

- Irrelevant or overwhelming notifications. While banking apps can use push notifications to update users on account changes or activity, offer incentives, share general news, or simply bring inactive ones back to a potential conversion — it’s also possible to overdo it.

Be intentional about sending only key notifications, at appropriate times, to customers who display strong intent and relevant characteristics for each message.

Given that users can uninstall your app for a combination of many reasons, understanding your app’s uninstall rate is extremely important. But what exactly are the main benefits of uninstall measurement for marketers? There are a couple:

- Compare the overall quality of your media sources by exploring the performance and retention of users from different media sources, campaigns, single ads, countries, etc.

Protect user privacy by removing uninstalled users from retargeting segments and discontinuing re-engagement messaging.

#4 – Fraud protection

As mentioned in the introduction, fraud is a massive problem, particularly for banking apps because of their scale and high payout.

Despite significant improvements in anti-fraud solutions and growing awareness of the dangers of app install fraud, banking apps and the finance vertical generally are still hard-hit by fraudsters.

Unlike other verticals, however, fraud in banking is most often focused on registrations or other down-funnel conversions, rather than installs. That’s because marketers are looking for active users that are regularly using their banking services, rather than simply a high scale of installs.

Increased fraud has led to much stronger protection, which in turn led fraudsters to up their game with increasingly more sophisticated fraud tactics.

This is especially evident in the use of bots that mimic in-app user behavior in an attempt to bypass protection, or from device farms — that include either thousands of actual devices on racks or virtual, emulated devices.

Powered by Protect360 technology, our fraud protection covers every stage and is battle-tested across over 60% of mobile installs globally.

Advanced protection

One challenge facing effective app install fraud prevention in banking is awareness of the issue and a more sophisticated understanding of the threat it poses.

Given the nature of data in this vertical, “fraud” is more often associated with functionality and content-related deception. That is, companies and users alike might think about facing money-related loss from accounts and other theft, rather than also consider the inevitable risk and financial exposure of their app and devices.

Another common myth is that cost-per-acquisition (CPA)-modeled banking app campaigns experience little to no fraud — due to the lack of install-focused incentive or the difficulty of generating an in-app event (i.e. credit card verification, linking bank account, adding a valid address, etc.) for fraudsters.

That simply is not true. For this reason, the following factors contribute to detecting and preventing fraud:

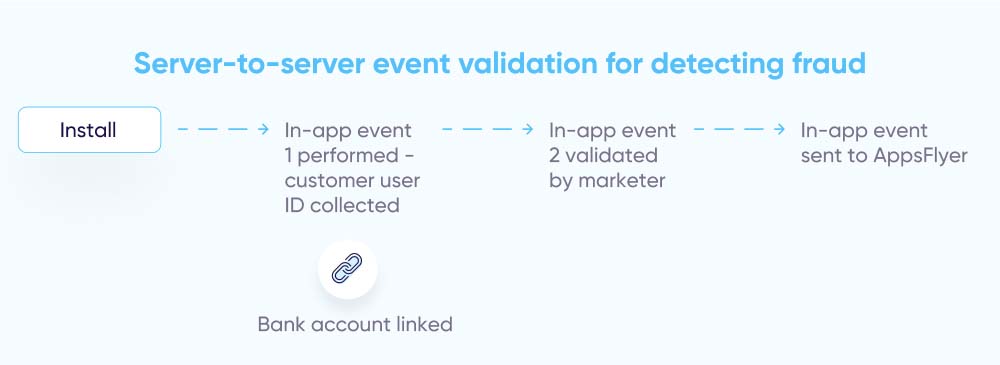

Server-to-server in-app event validation

For many banking apps, when an in-app event is recorded, only the fact that it happened (the counter) is sent to a mobile measurement partner (MMP) — without including any further details about the event (the values).

Savvy app marketers, however, will often send any event that is recorded to their own server to verify that it actually happened, or to collect more specific information about a user before sending the MMP that event.

For example, if a bank account link is recorded, checking this event server-side can tell the marketer which bank the user linked to or whether the link was successful, instead of simply relying on the record of the event and leaving a greater possibility for fraud.

Personally Identifiable Information (PII)

As mentioned above, the level of data sensitivity for banking apps is higher than in other verticals. While PII is not shared outside of the bank’s own servers, it does play an important role in fraud detection and prevention, since account activity is always validated by name, address, social security number, etc.

Incremental lift

The measurement for any conversion consists of an organic and non-organic baseline, which is important to include in regular analyses — not only for determining media source performance, but also for preventative fraud detection.

If the non-organic total is “increasing” at the expense of organic without raising the budget, it’s possible that the network isn’t adding actual value, and instead is using one or more methods of attribution fraud (i.e. click flooding and install hijacking).

#5 – Mapping a holistic customer journey

The reality is that a significant divide between user behavior and marketing measurement still exists in our day and age.

On one hand, bank customers have increasingly more complex conversion journeys involving multiple devices and touchpoints — desktop web, mobile web, apps, and offline, traditional banking.

On the other hand, marketers are measuring user actions across different channels and devices, but primarily doing so in silo from one another. Their data remains disparate and is analyzed by different teams. Their goals, strategy, and subsequent action are formulated and executed in parallel lines that rarely meet.

However, the good news is that customers are increasingly turning to mobile as the data-driven heart of the personalized digital banking experience, and more often staying exclusively there once adopted.

Still, marketing efforts and measurement technology can and should be built around the needs of omni-channel banking customers. The data capabilities of mobile, which has become the most easily measured ecosystem, allow marketers to bridge the gap between on and offline touchpoints, and unite each user across platforms with a single customer ID as part of the overall brand.

AppsFlyer offers 12,000+ pre-built integrations and a robust Partner Marketplace to piece together a holistic customer journey. It also enables streamlined connections to Adobe Experience Cloud, Snowflake, Firebase, CDPs and internal Business Intelligence tools, removing the burden of managing fragile custom integrations.For more information about holistic app measurement, read our complete guide, From mobile attribution to holistic people-based innovation.

Banking app user acquisition: 7 Best practices

Banking app user acquisition: 7 Best practices

1 – Personalize personalize personalize

Personalization of your banking app users’experience, when possible under privacy regulations, should be a priority, both in and out of your app. Emphasize a contextually relevant onboarding process that encourages users to register for an account and set their own preferences.

You can also use granular in-app event data to guide customers to specific functions within the app, or suggest related products or services for greater upsell.

2 – Keep messaging simple

While personalization keeps ongoing mobile financial management relevant, it’s also important not to overcomplicate the messaging.

Given the diverse range of functions available within a single banking app, be intentional about using targeted and engaging messages for maximum effect.

3 – The web-mobile combination

Despite the continued growth of mobile banking, some users still rely on desktop websites for their digital banking needs.

Therefore, it’s important to maintain a sustainable web presence to use as a strategic touchpoint, driving users down your funnel to relevant, specific functionality in which they’re most likely to convert.

4 – Segmentation sweet spots: Scale vs specific

Keep audiences broad enough to have sufficient scale for machine learning, but specific enough to find the unique users you’re looking for. Bear in mind that this cap will change per platform (Facebook, Google, etc.) and can also change over time.

5 – Follow the funnel

As a general rule, almost all marketing efforts, especially audience segmentation, follow the specific conversion funnel of the app, or suite of apps, given the diverse functionality offerings of mobile finance.

However, beyond keeping the app experience relevant for existing web or offline users, following your funnel also improves the collaboration and communication across departments, leaving less room for confusion and duplication.

6 – Increase ATT opt-in rates

Since launch, the overall trend for ATT rates have been gradually increasing.

Based on our most recent data, here are 2 ways to increase your ATT opt-in rates, and reap the rewards of greater quantities of user level data and attribution:

Timing is everything – Show the prompt to installers on 1st launch

You have control over when to show the ATT prompt (or if to show it at all) — and your decision can have a significant impact on opt-in rates.

According to our data, opt-in rates are at their highest when users launch your app for the 1st time — likely among other in-app notifications which may pop up during this time.

So, when attribution occurs using IDFA, it’s important to send it during the 1st launch. The MMP’s SDK can “wait”, which allows marketers to configure how long the SDK should defer for the ATT status, before the data is sent to the MMP’s servers.

Offer a post-ATT in-app notification to your engaged, non-consenting users

For users who decline to give permission when shown the ATT prompt, it doesn’t need to be the end of the road. They can still enable permissions at any time (and disable it again, if they wish) in their device’s Settings.

That said, your users might not know this, so this is your chance to give them a reminder. As with the pre-ATT prompt, show engaged users a post-ATT notification that includes the user benefits of opting in, which will take them directly to their Settings for app opt-in.

7 – Make the most of your SKAdNetwork Conversion Values

Having 64 options in your SKAN campaigns might sound limiting, but it still offers plenty of value if the bits are properly allocated and utilized.

Make the most of ranges and combinations and focus on the post-install actions that matter most. Test, test, and test again until you find the right mapping (having a UI certainly makes it easier).

Also, take advantage of Funnel measurement, which can be a more efficient way to allocate your bits. Instead of dedicating 3 bits to measure 3 separate events, a funnel configuration can measure sequential behavior using only 1 bit.

Mobile measurement solutions in the era of user privacy

Banking app owners can turn to a host of solutions to gain granular, actionable insights. These include:

- SKAdNetwork – Apple’s deterministic aggregated attribution solution. Within this framework, SKAN conversion values allow marketers to grade user value after the install.

- User-level deterministic attribution – ATT opt-in rates surpass 50% for many finance apps (among users who saw the prompt). Not only is full data granularity enabled for these users, but also the ability to segment towards non-consenting audiences.

- Aggregated probabilistic modeling – a statistical technique that leverages machine learning to estimate campaign performance with a high level of accuracy.

- Predictive analytics – allows marketers to make data driven decisions about users’ future value with a high level of confidence, while relying on very limited data points early in the funnel.

- Top-down measurement – holistic methodologies such as Incrementality (identifying incremental revenue drivers in order to optimize budget allocation), and media mix modeling or MMM (measuring the impact of campaigns to help determine how various elements contribute to the bottom line).

- Data Clean Rooms – enabling privacy-compliant measurement and optimization in a highly secure, permission-only environment where advertisers can leverage user level data insights without access to user level data.

Banking app re-engagement – Key metrics and attribution set up

Banking app re-engagement – Key metrics and attribution set up

Having a successful banking app is about much more than acquiring new users.. It’s also about making sure those who arrive remain engaged over time, interacting with all the banking functions of your app.

Re-engagement is a primary driver of late-funnel outcomes among banking apps. It’s important to treat the whole user journey as just that: a journey. It’s a lifecycle that progresses from understanding your audiences, to deep-linking them to the next-best action, and optimizing for maximum value. It’s about much more than clicks or app sessions.

Many users download banking apps but don’t regularly engage with or understand their full capabilities. Because of that, re-engaging this vertical is largely about bringing lapsed users back to the app to drive account activity and long-term engagement.

Measuring that activity is critical: banks need full visibility on which campaigns drive key outcomes like product usage and re-engagement. At AppsFlyer, we provide full-funnel marketing analytics to give banks customizable reporting, cohort analysis and data exports – all to make sure you’re measuring retention performance accurately and in a way that you can easily turn into actionable insights.

1 – Essential re-engagement metrics for banking apps

Below are the main metrics top banking apps include in effective re-engagement campaigns:

2 – ROX, deep linking, and great CX

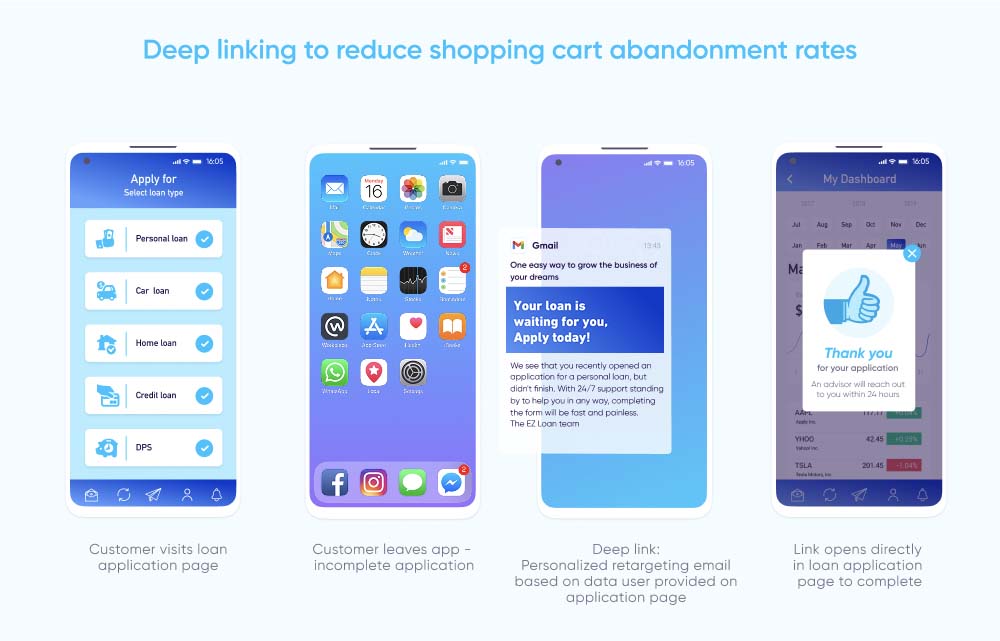

We addressed earlier the why and how of deep linking in acquisition, but in the banking vertical, deep linking is just as vital for re-engagement and remarketing.

For banking apps that tend to have longer and higher-value conversion cycles, it’s easy for users to become inactive or even uninstall the app.

Marketers must be especially proactive and keep users steadily engaged after install, rather than face the more difficult task of bringing them back after they’ve already jumped ship.

Deep linking is often used in conjunction with email and push notifications, given the critical level of personalization this messaging requires. The success of these cross-channel campaigns is your return on experience – or ROX – and it’s through a strong customer experience (CX) that you’ll see an uplift in performance.

That said, deep linking also enables personalization of paid campaigns , which is how you’re served an ad with the new account offer you looked at instead of a generic creative.

For example, emails with deep links embedded in CTAs leading to product X’s registration or application page might be sent to users who visited product X information page in the app, but didn’t register.

Likewise, for users who did register for product X, an email containing deep links might bring this segment to related product or service pages that pair well with product X.

So, by offering great CX, marketers are able to take more users to their desired destination and widen the bottom of their funnel. Product managers, on the other hand, can leverage deep linking to better engage and retain their users.

Great CX leads to business results, and the business impact resulting from investment in customer experience is known as return on experience (ROX).To learn more about ROX and how it can propel your app engagement forward, have a look at our ROX guide.

3 – Owned Media

Owned media is any marketing asset directly controlled by a company and which requires little to no additional cost to access and use. Most relevant to mobile re-engagement are push notifications, emails, and SMS messages, but also webinars and social media posts.

Owned media is your way of creating free, contextual content designed to increase engagement on your active, idle or lapsed users’ side — and create a more personal, long-lasting connection. In the age of user privacy, where user-level data is harder to come by, this connection is nothing short of critical.

Let’s explore this process. Usually, marketers have a CRM which enables the use of such campaigns. These CRMs receive data in two ways: either through their own SDK, or through an attribution and measurement provider.

The latter typically has pre-built integrations with the most popular tools worldwide, allowing marketers to export their data directly.

Imagine that a customer began the onboarding process of setting up their online banking in the app, but abandoned the process before completion. Based on these in-app events (which the CRM receives), the marketer first runs a push and then an email campaign, but the customer still doesn’t finish setting up their online banking.

At this point, the marketer might either start remarketing via paid sources to drive conversion, or add this customer to an audience segment for future remarketing exclusion.

If the marketer is savvy, they will use different parameters to run diverse campaigns on push, email, and paid channels. For lower value products, leveraging owned media makes complete sense because it’s practically free.

For high value products, however, marketers can also re-engage using paid media. Interestingly, despite their widespread use, many marketers are still not fully aware of the long term value these channels inevitably provide.

Why leverage owned media?

- Utilize the marketing “hierarchy.” Given the little to no cost of owned media channels, especially compared to paid campaigns, re-engaging users via these channels should be the focus and priority as much as is possible and appropriate.

- Performance anomalies. In the event of sudden growth in the number of installs, registrations or other metrics, you might not always understand why. Measuring your owned media alongside paid allows you to pinpoint if a particular growth anomaly came from a specific channel or partner, and subsequently decide where to further allocate budget.

- Creative optimization. Particularly relevant for campaign managers, if a creative or ad is connected via deep link to an email or push notification, measuring these campaigns will specifically identify which creatives are delivering the best results.

4 – Remarketing via paid media

Because banking apps typically face longer and higher value conversion cycles, re-engaging lapsed or uninstalled users (or alternatively excluding uninstallers from your campaigns) is necessary for ensuring long-term retention and lifetime value.

Additionally, given the challenge of increasing UA costs, it’s cheaper to proactively re-engage your existing users, driving them from desktop and mobile web to app, rather than acquire new or lapsed ones.

One of the most common remarketing segments, and often the start of full funnel remarketing campaigns, is the group of users who install but don’t proceed to complete account registration.

Setting up mobile banking in the app is the base for most of the subsequent activities users can complete in-app, so it’s especially important that they complete this action before further engagement.

Given the amount of information banks can receive from the customer onboarding process, these campaigns can start with owned media campaigns, primarily email and push, in order to maximize conversions while minimizing spend.

Timing remarketing campaigns

Deciding when to start running remarketing campaigns depends on multiple factors, such as the type of audience segment, your budget, level of engagement, and whether you’re seeking to recover users or simply re-engage.

Remarketing campaigns may be launched as early as immediately or 24 hours after install, within the first week, or later. There’s no one-size-fits-all formula.

Stopping your campaign also depends on several factors, not the least of which are your expected marketing goals and the limits of your campaign budget.

Because of that, it’s important to ensure that however long you run your campaigns for, be sure to stop them within a reasonable amount of time to avoid putting your budget to waste.

5 Best practices for effective remarketing

5 Best practices for effective remarketing

1 – Re-engagement audience segmentation

As in acquisition, your granular in-app event user data can be directly applied to create audience segmentations for re-engaging users. Push notifications, emails, and other owned media are most often used first in re-engagement campaigns given their low costs and ability to reach users more easily than paid methods.

Below are some examples of audience segments for re-engagement:

- Retarget and re-engage. Improve your re-engagement by targeting high-value users who took actions you value in the app, but were inactive this month.

- Recover or deprioritize uninstalled users. Target users who completed a certain number of lower funnel actions but who recently uninstalled your app with custom creative to drive re-installs. Conversely, you might choose to lower the priority of retargeting campaigns focused on these users and invest in audiences who are more likely to guarantee a higher value.

- Remarketing exclusion. An audience who has engaged with a specific owned media source (push, email, SMS, other), or has met some other exclusion requirement (i.e. rejected for a loan more than twice), is excluded from paid retargeting.

- Funnel completion. As users move through the conversion funnel, it is inevitable that they will drop off at various stages along this journey. Create segments for each of the actions users should complete in order to find those that aren’t progressing and drive them along your funnel to conversion.

Another important use of audience segmentation is the creation of split audiences for determining the incremental performance and growth of each media source, as well as performing A/B testing and pushing product features.

For the purposes of incremental and A/B testing, these split audiences can be based on the following factors, among others:

With incrementality and A/B testing, you can create two groups of users (test and control) across different networks and see which network, campaign, ad, or creative results in a more positive business impact.

Likewise, incrementality testing informs whether or not adding a new network to your existing portfolio has a true incremental impact:

1 – Product-specific assets

These should be created for each action for which you’re re-engaging users. Be sure to design a separate landing page with action-specific creatives and messaging that will serve as the homepage for each campaign.

For example, the messaging for a segment driving users to sign up for marketing push notifications should be different from that of a regular homepage.

2 – Ad and audience refreshes

Since click-through rates are difficult to maintain in the banking vertical but are also the key for niche segmentation, periodic ad and audience refreshes are mandatory.

You should also always A/B test your creatives to understand their true impact. For high language affinity segments, be sure to use communication in the relevant local languages.

3 – Simultaneous creative testing

When it comes to optimizing ad and creative performance, testing 3-5 different creative sets simultaneously will provide the most profound performance analysis within a reasonable and efficient time period.

However, as a general rule, it’s better to test several different creatives more frequently than to perform tests on large amounts of creative sets at the same time.

4 – Personalization – not just for UA

With the sophistication of marketing tech and the number of available apps increasing, app users, especially in mobile banking, expect customized experiences from start to finish.

Use data on user engagement to cross-sell and re-engage lapsed users. Pair deep links with other in-app event data to reduce incomplete registration, or conversion rates. Choose ad partners that offer behavior or intent personalization and make this process part of your marketing routine.

5 – Early funnel optimization

For traditional banks, early funnel optimization is all about ensuring users reach meaningful milestones after the install. These milestones depend on whether the app is being used to acquire new customers or to migrate existing ones into digital servicing.

When the goal is onboarding existing customers, the early funnel should focus on removing friction between install, first login, and usage of core features like balance checks, transfers, or bill payments. Measuring install-to-login conversion, time to first action, and session frequency in the first 7 days can reveal where users abandon the journey.

In banks that offer full mobile account creation, the early funnel is more complex. Key events to measure include registration completion, KYC submission and approval, account funding, and first product activation (like a debit card or savings goal). Each step requires optimization to reduce drop-off and shorten time to verified activation.

Regardless of the funnel type, the priority is to optimize for verified, business-ready engagement, not just session volume. Identify bottlenecks using event-based measurement, use deep linking to recover drop-offs mid-journey, and consider server-to-server integration for secure, compliant data collection where SDK use is restricted.

By focusing on these early conversion signals, banks can improve onboarding performance, reduce wasted spend, and build stronger digital relationships from the very first session.

How measurement helps banks build long-term customer value

Banking apps are at the forefront of traditional banks’ digital transformation, as they modernize the customer experience while still driving measurable impact for the bank.

A pandemic-accelerated mobile explosion and a growing demand from consumers to save both time and money has driven a rise in technologies which have greatly enhanced the mobile banking experience across platforms, without compromising users’ privacy.

It’s now easier than ever to conduct all facets of modern banking directly from a mobile device and, combined with promises of increasingly faster connectivity, mobile banking is well-positioned to advance over the coming years.

But leading the finance category is a head start for banks, not the finish line. Banks must turn this advantage into durable, long-term value with granular measurement. With uninstall analysis, intent-based reactivation and seamless, privacy-first user journeys, banks will build the foundation for future profitability and success.

The mobile finance vertical continues to expand, while traditional banks win by deepening value per customer. Both things can be true, and banks don’t need to rely on a fresh wave of first-time mobile users in order to receive value for their digital efforts.

AppsFlyer provides a secure, compliant and enterprise-ready infrastructure partner for banks who are either looking to optimize their app offering, or are at the very start of their own digital transformation. It’s not an either/or – you can measure both sustained activity over time and also the depth of usage that moves your business forward.

To find out more about how AppsFlyer can help you, book a demo or speak to a member of our team now.