Introduction

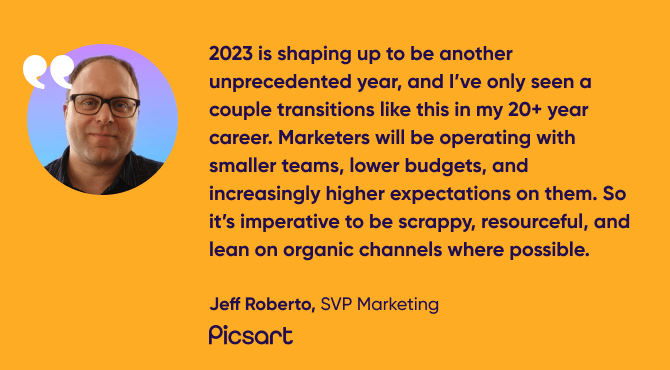

From the lows of the pandemic to the euphoria of rocketing valuations, we’re now facing the uncertainty of a global economic slowdown, a negative trend in consumer sentiment, and a shift in focus from growth to profitability.

This whiplash means heightened scrutiny around marketing budgets and more accountability on ROI.

To help you drive stability and profitability through this perfect storm, we’ve chatted with some of the top leaders in mobile marketing — from companies such as AccuWeather, Miniclip, Picsart, Plarium, Liftoff, Braze, and M&C Saatchi Performance— to get insight into some tough questions like:

- How do they foresee the current economic climate and digital slowdown, and how are their orgs planning to adapt?

- How will they be able to measure effectively in the face of the privacy tidal wave?

- How and why should brands position customer experience at the forefront of their competitive growth strategy?

- And how can brands leverage channel diversification in their efforts to drive better user acquisition, retention, and monetization?

Last but not least, we’ll dive deep into the data to share with you the most industry-sweeping trends, and paint an insights-driven picture of the current state of ad spend, consumer spend, iOS marketing, and more.

Let’s dive in!

The economic downturn & post-COVID digital cooldown

As made exceedingly clear in 2022, relying on old playbooks or hiding behind the “that’s the way we’ve always done it” just won’t cut it.

With tightening budgets, if your team isn’t focusing on careful planning and spending strategies, investing in retention just as much as UA, creative ways to drive ROI, and diversifying channel mix to expand reach in more effective ways then it’s time to get them going in the right direction.

Efficiency and improving both internal and external interfaces is another piece of the success in the bear market puzzle.

Asif Rahman, VP of Digital Analytics & Audience at AccuWeather mirrors this sentiment noting “2023 is going to be yet another year of trying to do more with less. Cross-org alignment is key here, with vendors and brands needing to work closely together to solve challenges.”

When viewing performance measurement from an efficiency perspective, Asif says: “With the cost of acquisition rising over the last few years, orgs have to come to terms with the fact that the ROI and LTV math has changed, and should now be measured over six months to a year.”

Reflecting this sentiment, our data shows that apps spent a total of $80 billion on UA in 2022, and a 20% YoY downward trend over the past several months. 2021, in comparison, saw a 40% surge in UA spending (read more about it in the “Top 5 data trends of 2022” chapter).

Clearly, the 2020 COVID-driven digital surge — which saw a 35% YoY growth in 2020 — didn’t become the new normal post-COVID as many expected or hoped for (more on that in the “Top 5 data trends of 2022” chapter) and we’ll have to update or even rewrite our playbooks accordingly.

The hunger games – And where the app gaming industry is heading

In an impending recession, discretionary spending is most often one of the first things users tend to scale back on. However, all data indicators up until now have proven this sentiment false — and the experts agree.

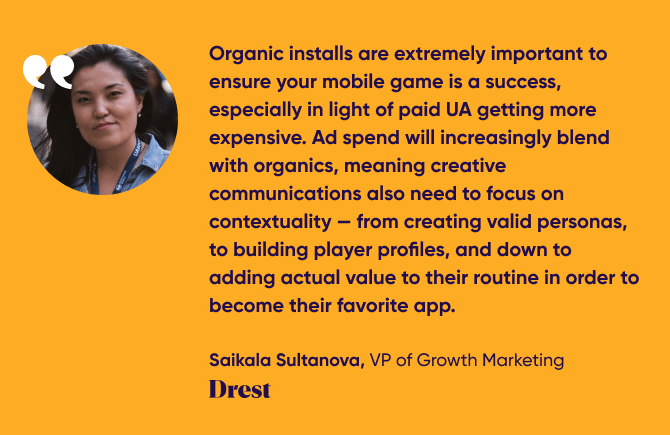

Saikala Sultanova, VP of Growth Marketing at Drest, stated that “the global pandemic resulted in a surge of demand for escapism and entertainment which in turn, resulted in the mobile gaming market surpassing $136 billion in consumer spend in 2022, growing 1.7x faster than the gaming market overall.”

This growth spurt in digital services consumption during 2021 is well-reflected in our data, which witnessed brands spending 40% more on UA compared to 2020.

In contrast to the digital festivities of 2021, “a series of macroeconomic challenges will continue to affect the gaming industry throughout 2023. Platform privacy changes, globally rising inflation, economic slowdown, and return to real-life experiences — are all due to reshape how we market games next year.”

Because of that, brands are expecting their marketing teams to be more selective in their activities and prioritize them based on the highest impact to their bottom lines, “leading with an ‘automation first’ mindset when it comes to future planning”, explains Saikala.

With COVID’s digital upsurge behind us and consumers slowly heading back to more real-world interactions, the numbers indicate that users are not spending time on their apps as extensively as they did last year.

Aviagames Inc’s CEO, Vickie Chen, believes that in the face of current government measures such as increasing interest rates, “users‘ average time spent on playing games may grow while average spend in games may shrink.”

Jeremy Bondy, CEO at Liftoff, points to the fact that during COVID, app downloads and consumer spend were artificially inflated due to lockdowns. “Now that we are returning to a sense of post-COVID normalcy, many are socializing more in person and spending less time in apps.”

What does this mean for gaming apps?

Jeremy states that for some genres, hypercasual in particular, this would imply a negative growth rate compared to previously inflated times. That said, he believes the downward trend is slowing down.

“On a positive note”, he says: “the CAGR from 2019 to present times still shows strong growth, which indicates YoY comparisons will return to normal from 2023 onwards. Despite a slowdown in mobile engagement relative to growth seen during the pandemic, we expect the share of mobile media hours to increase versus that of other channels moving forward.”

Evidently, marketers need to remain resilient, efficient, and creative to be able to see these uncertain times through.

It’s all about adaptability

Industry leaders are unanimous when stating that the key for being able to successfully adapt to our new reality and navigate 2023 is flexibility and agility.

“We’re seeing a trend that is both encouraging and exciting”, explains Ikkjin Ahn, co-founder & CEO at Moloco.

“Rather than eliminating marketing budgets entirely, marketers understand that performance advertising can be the economic engine that drives their business. Time and money are being invested into developing a clear understanding of customer LTV, tying that LTV measurement to media campaigns. In other words, right now, everyone is a performance marketer.”

It’s important for app marketing teams in general, and gaming app marketers in specific, to view recent events in the right light, taking into account all contributing factors.

“If one only looked at consumer spend on apps vs last year, one might think the app economy is headed for decline”, says Jeremy from Liftoff. “However, 2021 growth was elevated by COVID lockdowns, creating an artificial annual comparison. The four-year CAGR for gaming and apps overall — is still strong. Furthermore, if you compare it to two years ago (pre-COVID), gaming is still showing growth.”

Adding a much-needed holistic perspective to the conversation is Kevin McGuire, Chief Product Officer at Digital Turbine, when he says:

“Marketers need to bear in mind that everything is cyclical, and during down times we tend to return to fundamentals, which in this industry is about creating value for your partners and ensuring that supply and demand is still efficiently connected in the marketplace.”

Going back to basics is a solid piece of advice in times of economic turmoil. Combined with increased flexibility and agility, this should help you weather the storm.

Now, let’s explore the experts’ predictions on the ever-evolving privacy front, and what they consider to be the best solutions in place to help you do your job in the post-ATT, post-cookies age.

Privacy – The march will continue

Our industry is on a steady march away from individual-based marketing (user level) and toward a world of cohort-focused marketing (aggregate).

“The real challenge for marketers is to be able to learn, implement, and iterate quickly enough to adapt to fast-paced changes, which has proven to be a constant in our industry”, explains Gabi Castellan of Miniclip.

Creating a new measurement framework should be a fast-moving goal in early 2023. As we dive deeper into this privacy-driven landscape — led by Apple’s ATT and Google’s upcoming depreciation of cookies & Privacy Sandbox initiative — having this foundation in place will help your team see these rough times through.

As to the challenges of measurement on iOS, the experts issue a word of careful optimism.

The name of the new game is: living with certain levels of uncertainty, and making the most of what you have. User level attribution used to offer granular data to optimize on, which brought with it a sense of certitude that is partly gone now.

In other words, resistance to the fact that our ecosystem is being swept by constant change is impractical, and the sooner marketers embrace this reality, the better they’ll be equipped to deal with it and find ways to make it work for them.

“Performance advertising can still be delivered efficiently, even without individual user addressability”, agrees Moloco’s Ahn. To get there, marketers need to funnel into a single source of truth all of their data sources — e.g. SKAN data, MMP’s attribution data, Apple Search Ads data, MMM & incrementality estimates, etc. — in order to assess their campaigns’ performance holistically.

From a creative standpoint, and as with the downturn’s narrative in chapter 1, embracing the fundamentals is also a common theme.

Digital Turbine’s SVP Global Sales, Michael Wong, articulates this perfectly when he says: “With cookie deprecation and all of the mythical targeting techniques and workarounds that the industry has created now going away, brands must go back to basics. Story-based creative, delivered in a way that demands and achieves attention, carries far more weight now than ever before.”

Whichever OS basket you prefer placing your eggs in — iOS, Android, or both — agility is a frequently recurring theme across the board. And here’s how you put it into action:

Bringing measurement & privacy together

Leaders agree that measuring ROI is still possible, just not in the same instantaneous way as before. “Incrementality testing, geo holdouts, MMM — when executed and modeled correctly for your business — can truly help marketers assess the right media mix for their needs”, states Amir Shoval, Senior Director of Product at Plarium.

Some marketing leaders talked about attentive LTV measurement and close-knit collaboration with partners as a way to cement their strategy:

LTV measurement, however, needs to change its scope in order to reflect brands’ interest in user engagement and retention for longer periods of time.

And when it comes to predicting LTV based on limited data, leaders talk about predictive modeling as a highly efficient way to get there.

When it comes to ROI measurement, some of the leaders we spoke to focused on the importance of a tight ROI watch on all fronts, followed by spend optimization:

Shifting the narrative but staying in the realms of privacy-driven measurement, some welcomed recent changes — such as the release of SKAN 4.0:

“SKAN 4.0’s multiple postbacks, source identifier enhancements, and coarse/fine grain conversion value changes — are useful functionality upgrades”, says Jeremy Bondy from Liftoff. “Marketers need to actively seek to collaborate with partners and advertisers to unlock that increased value as iOS 16.1 and SKAN 4.0 adoption reaches critical mass in the iOS ecosystem during 2023”.

Bondy also applauded Google’s collaborative approach to the development and communication of their set of privacy-driven changes:

“Google has proactively engaged and sought feedback from ecosystem stakeholders during design stages, while communicating timelines and milestones well in advance. This not only allows everyone more time to plan and incorporate necessary changes, but also provides an opportunity to shape how these products should be developed.”

By shifting focus to longer term plays and understanding the balance between the implicit limitations on measurement and the added value for your end users, your team can move to a new paradigm where measurement and privacy happily coexist.

Looking ahead on the privacy front

There’s no doubt that the future of measurement will be different from what we were all used to, but clearly — the solutions that enable marketers to gain a healthy amount of their confidence back are already in place.

“When we look to the future of mobile marketing privacy, cookie deprecation is top of mind”, says Ben Dutter, SVP Strategy at Power Digital. “Fortunately, most of the market is moving beyond cookies, so the perceived impact is less doom and gloom and more of an inevitable nuisance. Clever marketers should shift to modern measurement and best practices around data integrity.”

All indicators point in the direction of modeled solutions and impact measurement that are slated to become more embedded within marketers’ strategies.

According to Barak Witkowski, Executive VP of Product at AppsFlyer: “We’re going to see more and more privacy enhancing innovations like crypto and data clean rooms that will enable two parties or more — such as advertisers and networks — to collaborate without actually sharing user-level data between them.”

As to the importance of top-down measurement methods in marketers’ arsenal, the experts are whistling the same tune:

Amir even takes this a step further to predict an alternative future, in which marketers create their own market spaces where they can make up their own rules:

“Advertisers will seek out ways to get out of Google’s and Apple’s grip on mobile IAPs. If not by means of regulation (MSA in the EU) or court ruling (Epic vs Apple), then by leveraging alternative stores and marketplaces that support publishing apps with alternative billing systems”, according to Plarium’s Shoval.

Whether these prophecies materialize or not, as long as marketing leaders venture into 2023 with adaptability and a resourceful mindset, there’s certainly a lot to look forward to.

Chapter 3

Putting the customer first & prioritizing CX

Offering exceptional CX is becoming a top priority for brands that are after fortifying their existing user base and mitigating churn.

According to Raviteja Dodda, CEO & co-founder at MoEngage: “While obtaining new customers is still important, many brands have shifted gears and aim to achieve sustainable growth by fostering customer loyalty, using personalization as a key lever to offer enriching customer experiences.”

Engage, retain, repeat

As to the significance of offering customers undeniable added value in order to solidify retention, Jeff Mason, President at Power Digital believes that “during times of economic uncertainty, obsess about driving efficiency for your clients. Your team should aim to serve as a strategic partner to help your clients navigate headwinds.”

And when you think about it, this makes perfect sense from a business standpoint. Acquiring a new user is 5-25x more expensive than retaining an existing one. What’s the point in neglecting the very users you’ve spent countless marketing dollars on acquiring?

Investing in your CX and raising your app’s retention rates – even by a small amount – can have a major impact on your bottom line, not to mention your user loyalty and brand perception.

The privacy angle of CX

Tackling CX from a slightly different yet super relevant perspective, Jonathan Yantz, Managing Partner at M&C Saatchi Performance, is tying privacy with the need to adopt a lifecycle marketing approach:

“It’s more important now than ever before for marketers to fully understand and optimize their user journey, especially on mobile. Uncover obstacles or pain points causing consumers to drop off, and optimize ways to improve their mobile experience using additional touchpoints or reminders where necessary.”

“This is particularly important now when privacy restrictions make some of the data points more difficult to interpret in real-time, and when consumers place higher value on a seamless and cost-efficient UX over brand loyalty”, says Yantz.

“Offering the easiest, most seamless and cost-efficient UX can offer real value for the weary, cost-conscious consumer.”

Linking privacy with customer loyalty

There’s a direct correlation between respecting users’ privacy and creating a highly sought after brand trust. Raviteja believes that brands should allow their consumers to choose the information they’re willing to share and follow all opt-in and opt-out preferences religiously in order to help foster user trust and retention.

Garcia goes on to link CX with brands’ ability to uphold a competitive edge: “Businesses think twice before throwing money away on expensive ads that will end up annoying their consumers. Investing in partnerships with the publishers, influencers, and communities your consumers trust — is key to creating and maintaining a competitive advantage, both in 2023 and in the future.”

The leaders all hold a firm belief that especially as the economy continues to tighten, businesses must prioritize customer relationships, which are the backbone of any consumer-focused strategy.

And what helps happy customers stay happy other than great CX and value for money? Well, happy employees, believe it or not. The importance of a positive and supportive company culture, which used to be considered a nice-to-have, is now taking center stage in employee advocacy strategies — that extend far beyond the walls of your office:

And now that we covered 2023’s spotlight on phenomenal CX and the contributing factors that support it, let’s explore the strategic value behind a multi-channel battle plan.

Channel diversification – Expanding reach & meeting consumers where they are

The experts are aligned when identifying these times as the perfect opportunity to embrace a cross-channel approach. Brands who take a diversified channel approach that blends both in-product and out-of-product communication – are also the ones that see more installs, more purchases per user, higher retention rates, and better LTV.

Liz Emery, VP of Mobile & Ad Tech Solutions at Tinuiti, states that “consumers are omnichannel, so if app marketers aren’t utilizing omnichannel tactics, like branding efforts, web inventory, and hitting the full funnel, they’re already behind the curve”.

Emery also ties channel diversification with the previously discussed CX and retention strategies:

For some experts, expanding the channel mix is also about experimenting with meteorically-successful social media platforms such as TikTok.

According to Saikala Sultanova, VP of Growth Marketing at Drest, “2023 will see a continuous shift in the channel split for marketeers. TikTok ads will keep on eating Meta’s share of the wallet, which means that companies will need to get comfortable with this channel, and learn how to make the most of it.”

Three worthy tactics – web-to-app, loyalty programs, and AI-driven marketing

1. Web-to-app

On the web front, Jeremy Bondy from Liftoff believes that app-to-web, is in fact, a vector for growth. “App developers should be looking to leverage the mobile web conversion funnel as a complement to their app-to-app strategy.”

Here’s why that’s important according to Jeremy:

- Mobile browser-based landing pages allow developers to capture registration details and expand on their value proposition and promotional offers, increasing first-touch engagement with users while avoiding the app store ‘tax’.

- The mobile web browser still provides DSPs and ad networks with useful, privacy-centric optimization signals on iOS, leveraging first party cookies and local storage via web SDKs or pixels, and linking registrations and events back to ad engagements.

2. Loyalty programs

When it comes to promoting in loyalty programs and VIP customers membership clubs, Simon Lejeune, VP Growth at Wealthsimple, believes there’s a considerable amount of business sense in opting for such strategies — primarily in the sense of fueling LTV for a very small investment:

“A good chunk of UA budgets will go towards incentives, promos & loyalty programs. These campaigns give you the most bang for your buck when it comes to upselling, cross-selling, and generally growing your ARPU and LTV. The incrementality and payback of those budgets are also way more measurable and accurate.”

3. AI-driven marketing

Lastly, how can we ignore AI-driven marketing?

Wealthsimple’s Lejeune predicts that “AI-generated content will supplant UGC and influencer ads. The next step will be hyper-personalization, with the ability for Facebook and Google to create not hundreds, but millions of ad variations from a few images and prompts. Most ads & email copywriting will be gone in a couple of years, and new cool jobs and skills will exist around prompts.”

Although content-supporting AI tools such as ChatGPT have been received with mixed reviews and a heated debate around their pros and cons, most experts tend to agree that putting such tools to use as a supportive tactic for quick and simple tasks — is both cost-effective and time-efficient.

And now that we’ve covered mobile, multi-channels, growth & efficiency tactics (and everything in between) — let’s give CTV advertisement and measurement its well-deserved spotlight as one of the most profitable strategies in 2023 and beyond.

Connecting the dots with connected TV

According to the IAB, CTV ad spend is projected to grow globally by 14.4% in 2023 and will be the fastest-growing channel, beating out paid search and social media.

Given this projection, it’s no surprise that according to 98% of brands, CTV advertising will one day be bigger in terms of ad spend than mobile advertising, with 25% saying this will happen in the next 2-3 years, and 62% claiming it will take 5 more years (see Bonus trend #2 for more).

Jonathan Yantz from M&C Saatchi Performance goes on to stress the huge role of CTV measurement in enabling the acceleration of this extremely strategic medium:

“While streaming TV isn’t exactly new, there’s a lot that’s possible these days through a mobile marketing lens that can unlock actual performance goals. And since you can’t typically or easily purchase, subscribe, or install a mobile app directly from a CTV ad, measurement in CTV will become more crucial to justify further advertising budgets.”

Whether this will come in the form of cross-device measurement, incrementality testing and MMM, or overall ad server and MMP modeling — CTV measurement will inevitably be a massive 2023 focus.

Influencer marketing – Harnessing the clout

With so much time already spent on mobile and social media in particular, it can be challenging for brands to keep up with creating fresh, authentic content for each channel, let alone cutting through the clutter and actually getting in front of people in a meaningful way.

According to Yantz from M&C Saatchi Performance, “influencer marketing is much more than just paying a celebrity to post about your product. Micro influencers and content creators can help performance marketers tap into an engaged community and help tell their story.”

And since effective distribution and granular measurement are at the heart of every well-planned marketing strategy, Yantz adds that “these posts can then be boosted using paid media (Spark Ads on TikTok, for example), shared with a wider audience, and enable you to track app installs and post-install events pretty seamlessly.”

Gabriela Carmo, CEO at Infleux views influencer marketing is a new UA channel well worth investing in given its generous payouts.

“Influencer marketing should be better explored by brands, as it combines performance and branding into a single medium. With influencer content — that’s paid according to performance — a company can increase brand awareness and reinforce its message in a smooth and non-invasive way.”

Being aware of the fact that influencer marketing involves a certain degree of creative freedom dictated by the actual influencer, Carmo stresses the importance of finding a delicate balance between the brand’s guidelines and the influencer’s style.

This concludes our predictions for 2023, but if you’re all about the data points, insightful trends, and dramatic numbers-led stories, the next section is a must-read.

Top 5 data trends of 2022

1. Total app installs grew 10% in 2022 despite a post-COVID digital cooldown, privacy changes, and economic downturn

15 years after the first iPhone was released, it seems smartphones have been embedded into our lives. The mobile app space is showing signs of maturation, which is why it’s no surprise to see mobile growth naturally declining over time.

Despite a relative slowdown, 2022 still delivered a 10% YoY rise in overall installs despite headwinds from Apple’s privacy changes, somewhat unexpected user behaviors post-COVID, and a looming economic recession affecting marketing budgets (more on that later).

The COVID digital surge did not stick

Clearly, the 2020 COVID-driven digital surge (35% YoY growth in 2020) was an anomaly, and did not become the new normal post-COVID as many have expected or at least hoped for, as stated by many in chapter 1. We see this “COVID bump” prominently in Android gaming, notching 52% growth in 2020.

Android installs grew 9% YoY

This was driven primarily by the geographic dimension, with an impressive 18% surge in the largest Android market — India.

On the other hand, we see the effects of the war in Ukraine as the Russian market witnessed an 18% drop in overall Android installs compared to last year. The 9% growth might have been higher too if not for reduced budgets in non-gaming apps amidst the economic downturn.

iOS installs grew 16% after last year’s ATT low

Apple’s release of its ATT framework had a massive impact — mainly driven by non-gaming apps. Many fully digital products and experiences exist only on iOS, such as health & fitness, photo editors, kids, and lifestyle apps.

Additionally, non-gaming is not as marketing-driven as gaming, so when it comes to overall installs — ATT’s impact was not as pronounced as it was in gaming during 2021. Although gaming apps have since recovered and have shown some growth during 2022 (from -10% to +4%), gaming apps on iOS are clearly still challenged by the post-ATT data reality.

2. Ad spend down 5% YoY but downturn felt towards end of year with a 20% drop

Overall we see a 5% drop YoY in UA spend for the entire year, but when looking at the last three months, when the economic slowdown really hit, the difference between 2021 and 2022 is made clear.

2021 saw an 8% budget rise between start and end of year, while 2022 saw a 20% decline.

| Cost YoY | NOI YoY | CPI YoY | |

| Android gaming | 3% | 12% | -8% |

| Android non-gaming | -22% | -2% | -20% |

| iOS gaming | 23% | -9% | 33% |

| iOS non-gaming | -23% | -24% | -2% |

Stark differences between platforms and verticals:

- Android gaming apps showcased their efficiency, with 8% reduced CPIs and yet 12% higher NOIs driving a small 3% increase in overall UA ad spend. Marketers acquired more users for the same budget and re-invested their efficiency to scale further.

- iOS gaming apps took in the 33% rise in CPI, raising budgets by 23%. Unfortunately, this still drove 9% fewer NOIs.

- Android non-gaming saw a much larger drop in CPI at 20%, leading to a 22% decrease in budgets. Android marketers prioritized efficiency again, and used savings to mitigate a small 2% drop in NOIs.

- iOS non-gaming saw a 23% reduction in spend despite a small 2% drop in cost of installs, as marketers moved away from paid UA to other forms of activation and engagement.

Gaming is more recession proof than non-gaming

As noted by Saikala Sultanova in chapter 1, this seems to have allowed the former to raise budgets compared to non-gaming apps, which have cut budgets.

Most gaming IAPs involve micro payments (which are easier when facing an economic downturn), while more costly non-gaming’s IAPs in eCommerce, travel, transportation, etc. — might be bringing consumers to think twice.

Non-gaming drop in finance and food delivery

Non-gaming budget reductions were largely driven by fintech in general and crypto in particular.

The highest non-gaming CPIs can be found in finance, so in case financial apps drop budgets — that would have a big impact. On the food delivery front, despite having so much money to spend during the lockdowns of 2020/21, this year food delivery apps will no longer be able to spend like before.

SSOT can turn things around

The use of a Single Source of Truth (SSOT) to de-duplicate non-organic installs on iOS can have a dramatic impact on budgets allocation and accurate ROAS measurement.

A recent AppsFlyer study uncovered an average of 29% uplift in attributions and 40% reduction of eCPI (See chapter 2 for more insights on the SSOT front).

Owned media continues to surge

With the challenges of remarketing in iOS, it’s no surprise that the use of owned media to re-engage existing users through push notifications, email, and in-app messages — has jumped almost 45% since April (compared to a more modest 17% lift in Android).

Marketers are catching on, as evident by the experts’ ample calls to action around channel diversification (see chapter 4). 2022 has seen tremendous demand for owned media remarketing campaigns that align with tight budgets and are not affected by privacy shifts. Not to mention that owned media — whether for acquisition or re-engagement — is practically free.

Many companies are doubling down on building a strong brand image, and owned media allows a bespoke channel of communication to both loyal and new users.

3. Apps spent $80 billion on UA in 2022, a slight YoY drop after the 40% surge in 2021

We’ve seen the trends and reasons, but as far as actual dollar figures go, global app install acquisition budgets in 2022 reached an estimated $80 billion in total — including China (see below for notes on how we reached this figure).

This figure represents a slight decrease from 2021 after a 40% surge compared to 2020. Remember, it’s a whole new post-COVID ball game out there, and we can see the economic slowdown hit even harder when looking at the last several months (see trend #2 for more).

On the vertical front, gaming was the largest category with $27 billion, followed by finance with $8.5 billion, casino real money with $5.2 billion and shopping with $3.4 billion (excluding China).

Methodology

*Total industry UA spend methodology – the formula combines three buckets:

- Budgets measured by one of the major mobile measurement partners (industry wide extrapolation was made based on 3rd party estimates).

- The non-attributed market or marketing driven installs that were not measured by one of the major MMPs (about 10% according to estimates).

- Spend in China where measurement is a far greater challenge due to its fragmented app store space. We used App Annie’s total of 98 billion installs in 2021 and AppsFlyer’s share of NOI and CPI.

4. ID matching rates up 10% to reach 26% of iOS NOIs – prompt optimization can deliver a better ad experience

IDFA is not dead

2022 saw a 10% rise in ID matching rates, reaching 26% of all NOIs in 2022 (including SKAN). It seems that apps are optimizing their ATT prompt experience and more users are coming around to the idea of providing consent given it delivers a better ad experience (see below).

Clearly, the presence of IDFA is not negligible, although it has obviously experienced a massive drop since pre-ATT days when ID matching rates were above 80%. Capturing the behavior of consented users is highly beneficial for modeling, optimization, and benchmarking of marketers’ entire user base.

Apps that have not yet implemented an ATT prompt are highly encouraged to consider changing their tune!

Ad load increasing post-ATT

Another shocker is that there are more ads now than before ATT. Instagram, YouTube, TikTok and Apple have all introduced new ad units across more inventory to counteract existing ad formats that are worse off post ATT.

As a result of this ad overload, users are served more irrelevant ads that create a negative user experience. That is why showing and optimizing the ATT prompt for consent is so important when heading into 2023.

Pressure to deliver short term revenue

It’s possible that management pressures to deliver amidst the economic slowdown has forced the display of more ads for CPM revenue (from the publisher’s side). This yields easier short term revenue at the expense of potential long term damage such as churn, ad fatigue, and lack of effectiveness.

5. Non-gaming apps enjoy a 20% jump in IAP revenue while games are dealing with a 16% drop

We can clearly see the difference in gaming app IAP revenue between iOS and Android. Games are much more affected by ATT and the drop in data signals for optimization, which is why gaming apps haven’t grown in revenue as much as non-gaming since ATT launched.

Beyond privacy, it’s also important to note that the drop in iAP revenue is a known phenomenon in the gaming vertical. Some gaming brands own cash cow apps or lucrative franchises or are able to consistently create new hits — but many gaming brands manage to come up with one hit wonders and are struggling to compete with the uber successful ones.

So a negative trend in gaming IAP per brand within the entire measured time frame does make sense.

Non-gaming apps can drive confidence by this IAP jump, as they might stay clear from having to reduce ad spend budgets like we saw in trend #2 (although we need to remember that this is based on overall revenue across all consumers, not just marketing-driven users who are a minority in this vertical).

In-app advertising revenue rising

Contrary to IAP, we see continuous ad revenue growth driven primarily by games across both platforms, with Android notching a sizable 48% YoY increase in IAA, and iOS not too far behind with a 38% YoY growth.

This is likely because of hybrid monetization models that are gaining traction within gaming, and imminent pressure from management to deliver results, despite the economic slowdown leading companies to display more ads for easy short term gain through CPM.

Bonus trends

1. iOS gaining ground in Android markets this year

After looking at the growth of installs this year (trend #1), it’s quite peculiar that typically Android-dominant markets are showcasing spectacular growth in iOS installs. In particular, we see Vietnam at 56%, India at 49% and Indonesia at 26% YoY growth in 2022 — despite having entrenched Android user bases.

Even developed countries put up healthy iOS growth numbers, with the UK at 28% and Germany at 20% YoY growth. On the other hand, we see Brazil with a drastic 32% drop in overall installs this year, driven by the recent suspension of iPhone sales in the country.

2. The time has come to connect to connected TV

As quite a few of our experts have pointed out in chapter 4, the cord cutting has ended and the age of CTV is here. Advertisers are searching for new ways to reach their target audiences, and CTV provides a consistent, streamlined way to reach large, casual audiences.

Total cross-platform CTV clicks measured by AppsFlyer grew 20.6% in just 3 months from July 2022 to October 2022.

Now is the right time to start advertising on CTV before it becomes a heavily crowded and saturated space. The earlier you get into a new channel, the more you get out of it.

Key takeaways

- Top trends for 2022 included:

- Total app installs growing 10% despite a post-COVID digital cooldown and economic downturn

- Ad spend going down 5% YoY, apps spending $80 billion on UA in 2022 (which is a slight YoY drop)

- ID matching rates going up 10% to reach 26% of iOS NOIs

- Non-gaming apps enjoying a 20% jump in IAP revenue while games are dealing with a 16% drop

- 2022 has been a year of adjustments and reckoning, and starting in 2023 we’ll see more and more marketing leaders driven into creative problem-solving that might take them out of their comfort zone. But out of necessity stems innovation.

- Macroeconomic challenges will continue to affect the gaming industry in 2023. Platform privacy changes, globally rising inflation, economic slowdown, and return to real-life experiences, are all due to reshape how games are marketed next year.

- Creating a new measurement framework that combines top down and bottom up methods while ensuring there is a single source of truth that can connect multiple data realities should be a key goal for your team in early 2023.

- Offering exceptional CX is becoming a top priority for brands that are after fortifying their existing user base and mitigating churn. This is the time to obsess about driving efficiency, prioritize client and employee retention, and provide strong customer value.

- Lifecycle efforts that span across email, SMS, and push notifications, will grow in importance. Making sure your teams are fully leveraging personalized messages combined with audience segmentation will help them drive stronger engagement, loyalty, and ultimately, more value for your customers.